Research Methodology on Biosensor Market

The published research report “Biosensor Market: Global Industry Analysis, Size, Share, Growth, Trends, and Forecasts 2023-2030” is prepared by Market Research Future (MRFR) with a particular focus on the regional market and its associated dynamics over the forecast period 2023-2030. The published report gives a key to the readers to understand the current developments, current market trends and size of the global Biosensors market. To undertake a study of the Biosensors market, the targeted approach is implemented.

Primary Research

Primary research is the initial step in the research process that enables us to get information from an array of organized and unorganized sources. We at MRFR consider primary research as an important aspect of our study process. It includes full-scale interviews and surveys with industry experts and professionals. During the primary research process, various corporate survey approaches are taken with the help of industry experts and executives. Primary research includes interviews based on face-to-face, e-mail, and telephone.

Secondary Research

It is an important part of MRFR’s market report. In secondary research, the secondary sources that are referred to are excellent sources of data collection. It seems to be the conducted step of MRFR’s market study process in which different factors are taken into consideration such as company reports and press releases on financial services, international organizations’ databases, regional associations' databases, industry associations' journals and other sources.

Market Attractiveness Analysis

The market attractiveness of the industry is calculated in terms of market size and market trends and factors associated with the factors are considered to forecast the attractiveness of the market.

Market Size Estimation

The market size estimation is derived by calculating the market potential based on the current demand, trends and forecasts. Regulated data sets and information sources are used to estimate the current market size, market segmentation and market composition for the global Biosensor market.

Porter’s Five Forces Analysis

The specific analytic tool used in our study to analyze the market situation is Porter’s Five Forces Analysis. Porter’s Five Forces Analysis is used to analyze the market scenario based on the bargaining power of buyers, the bargaining power of suppliers, the threat of substitutes, the threat of new entrants and the level of competition in the industry.

Market Segmentation

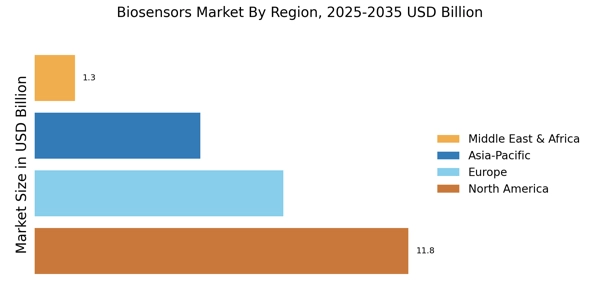

The global Biosensor market is segmented by product type, technology, application and end user. The segmentation is done on a regional basis as well, namely North America, Europe, Asia-Pacific and the Rest of the World.

Data Collection

The detailed data collected through the study is processed and then composed by experts in the industry. Primary and secondary data are collected from both organized and unorganized sources. The data is further filtered through analytical tools such as quantitative analysis, qualitative analysis, data triangulation and validation.

Data Mining

The present report is a result of detailed data mining and data collection by experienced analysts. The process of data mining involves studying the various dynamics of a business, such as market trends, competitors’ strategies, consumer trends, pricing structures and industry-specific trends and insights.

Data Validation

Data is validated using triangulation by making use of multiple data sources to gain an in-depth and comprehensive understanding of the market dynamics, market trends and their corresponding implications on the global Biosensor market.

Data Analysis Techniques

The present report is an outcome of the implementation of different analytical techniques such as SWOT analysis, DROI analysis and PESTEL analysis, which helps to understand the economics of the industry and helps to form the basis for curating strategic operational plans for various stakeholders.

Conclusion

The present report is mainly prepared to understand the current market scenario and growth prospects of the Biosensor market. The research study provides a deeper understanding of the market and its dynamics over the forecast period 2023-2030. With the help of analytical tools, the present report gives future projections for the various stakeholders.