Government Initiatives and Policies

Government initiatives aimed at promoting sustainable practices are likely to play a crucial role in shaping the Global Biopolymers & Bioplastics Market. Various countries have implemented regulations that encourage the use of bioplastics, such as bans on single-use plastics and incentives for companies adopting sustainable materials. For instance, the European Union has set ambitious targets for reducing plastic waste, which has led to increased investments in biopolymer technologies. These policies not only foster innovation but also create a favorable environment for market growth. The market is expected to benefit from these regulatory frameworks, as they provide a clear direction for companies to align their strategies with sustainability goals.

Increasing Focus on Circular Economy

The concept of a circular economy is gaining traction, influencing the dynamics of the Global Biopolymers & Bioplastics Market. This approach emphasizes the importance of sustainability and resource efficiency, encouraging the use of renewable materials and the recycling of bioplastics. Companies are increasingly adopting circular economy principles, which not only enhance their sustainability profiles but also create new business opportunities. The market is witnessing a rise in initiatives aimed at developing biodegradable products that can be composted or recycled, thereby reducing waste. As awareness of circular economy practices grows, it is likely that the demand for biopolymers will continue to rise, further propelling market growth.

Growing Investment in Research and Development

Investment in research and development is a pivotal driver for the Global Biopolymers & Bioplastics Market. Companies are increasingly allocating resources to explore new biopolymer formulations and applications, aiming to enhance performance characteristics and expand market reach. This trend is supported by collaborations between academia and industry, fostering innovation and knowledge transfer. Market data suggests that R&D spending in the bioplastics sector is expected to increase significantly, as stakeholders recognize the potential of biopolymers to replace conventional plastics. Such investments are likely to lead to the introduction of novel products that meet the evolving demands of consumers and industries alike.

Rising Consumer Demand for Eco-Friendly Products

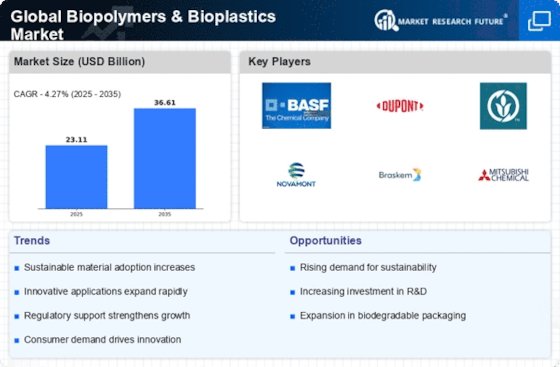

The increasing awareness among consumers regarding environmental issues appears to drive the demand for sustainable alternatives in various sectors. This trend is particularly evident in the packaging industry, where the shift towards biodegradable materials is notable. In the Global Biopolymers & Bioplastics Market, consumer preferences are evolving, with a significant portion of the population willing to pay a premium for eco-friendly products. Market data indicates that the bioplastics segment is projected to grow at a compound annual growth rate of over 20% in the coming years, reflecting this shift. As consumers become more environmentally conscious, manufacturers are compelled to innovate and incorporate biopolymers into their product lines, thereby enhancing their market presence.

Technological Innovations in Biopolymer Production

Technological advancements in the production of biopolymers are transforming the landscape of the Global Biopolymers & Bioplastics Market. Innovations such as improved fermentation processes and the development of new bio-based feedstocks are enhancing the efficiency and cost-effectiveness of biopolymer production. For example, recent breakthroughs in enzyme technology have enabled the conversion of agricultural waste into high-quality bioplastics. This not only reduces production costs but also minimizes environmental impact. As technology continues to evolve, it is anticipated that the market will witness a surge in the availability of diverse biopolymer products, catering to various applications across industries, including packaging, automotive, and textiles.