Increased Focus on Mental Health

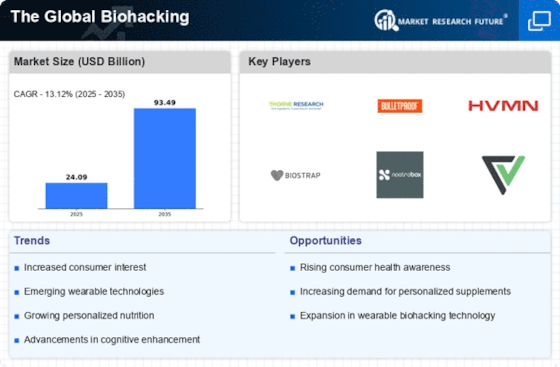

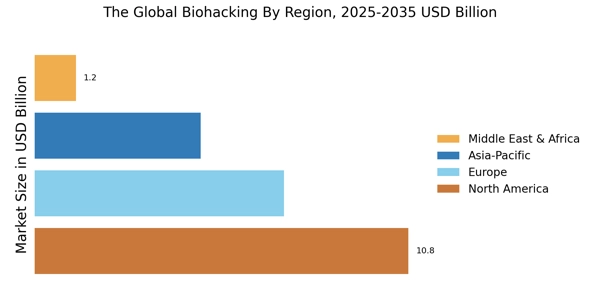

The growing emphasis on mental health and cognitive enhancement is a pivotal driver for The Global Biohacking Industry. As awareness of mental well-being rises, individuals are increasingly seeking methods to improve cognitive functions, reduce stress, and enhance overall mental clarity. This trend is reflected in the market for nootropics and cognitive enhancers, which has seen substantial growth, with projections indicating a market size exceeding 5 billion dollars by 2026. The integration of mental health solutions into biohacking practices is likely to attract a broader audience, thereby expanding the market's reach and fostering innovation in product development.

Advancements in Genetic Engineering

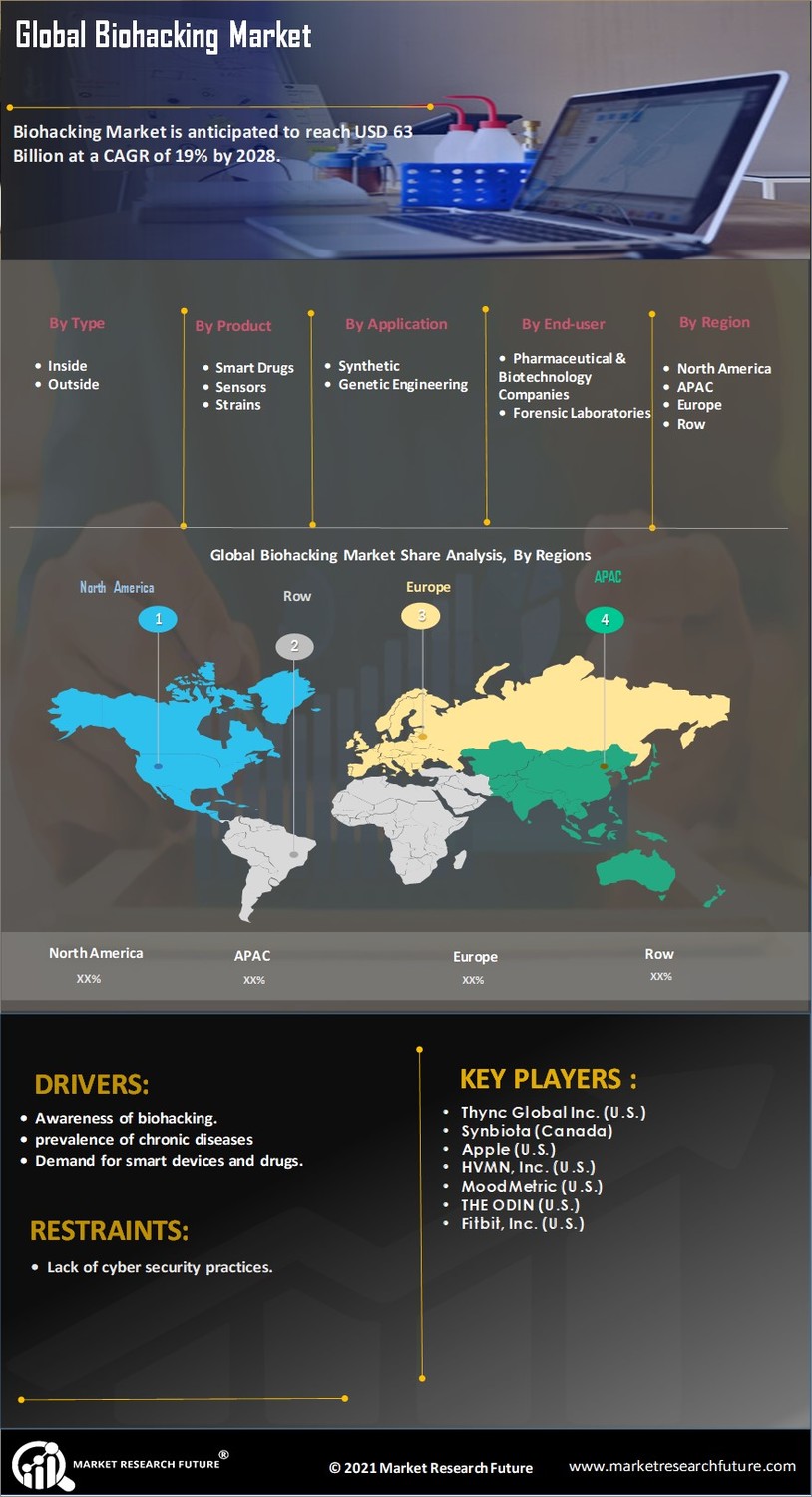

The advancements in genetic engineering are reshaping the landscape of the biohacking industry. Techniques such as CRISPR and gene editing are becoming more accessible, allowing individuals to modify their genetic makeup for enhanced health and performance. This trend is likely to drive The Global Biohacking Industry as consumers seek personalized solutions to optimize their biological functions. According to recent estimates, the genetic engineering sector is projected to grow at a compound annual growth rate of over 10% in the coming years. As more individuals become aware of the potential benefits of genetic modifications, the demand for biohacking products and services that incorporate these technologies is expected to surge, further propelling the market forward.

Growing Popularity of DIY Biohacking

The rise of do-it-yourself (DIY) biohacking is a notable trend influencing The Global Biohacking Industry. Individuals are increasingly taking health and wellness into their own hands, experimenting with various biohacking techniques at home. This movement is supported by the proliferation of online communities and resources that share knowledge and experiences related to biohacking. As a result, the market for DIY biohacking kits and supplements is likely to expand, catering to a growing demographic of health-conscious consumers. Reports indicate that the DIY health market is projected to grow significantly, potentially reaching a valuation of 10 billion dollars by 2027, underscoring the potential for innovation and product development in this segment.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into biohacking practices is emerging as a transformative force within the industry. AI technologies are being utilized to analyze vast amounts of health data, enabling personalized biohacking strategies tailored to individual needs. This trend is expected to enhance the efficacy of biohacking interventions, making them more appealing to consumers. The Global Biohacking Industry could witness a significant uptick in demand as AI-driven solutions become more prevalent. Market analysts suggest that the AI healthcare market is anticipated to reach approximately 36 billion dollars by 2025, indicating a robust potential for growth in biohacking applications that leverage AI capabilities.

Rising Interest in Personalized Nutrition

The increasing interest in personalized nutrition is driving significant changes within The Global Biohacking Industry. Consumers are becoming more aware of the impact of diet on health and performance, leading to a demand for tailored nutritional solutions. This trend is reflected in the growth of personalized meal plans, supplements, and dietary tracking technologies. The market for personalized nutrition is expected to reach approximately 11 billion dollars by 2025, indicating a robust opportunity for biohacking products that cater to individual dietary needs. As consumers seek to optimize their health through customized nutrition, the biohacking industry is likely to adapt and innovate, creating new avenues for growth.