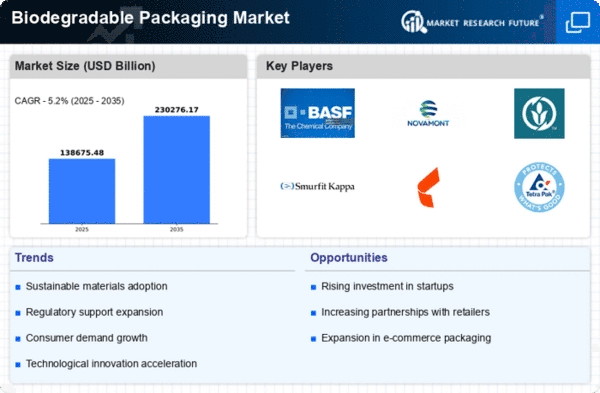

Market Analysis

In-depth Analysis of Biodegradable Packaging Market Industry Landscape

The biodegradable packaging market dynamics exhibit a robust and dynamic setup with the current surge in consciousness about ecological problems and the changeover to sustainable behaviors as main driving forces. Bio-based packaging demand is booming like never before as shoppers and businesses alike are more focused on swapping usual non-biodegradable packaging materials for green and bio-based packaging alternatives. It is mainly driven by two things: the plastic pollution issue, the overflow of landfill and expecting the greenhouse gas emissions to be low.

One of the most influential drivers in the market dynamics is the growing green consciousness, or how much impact packaging materials have on the environment. Consumers are becoming increasingly conscious about product choices they make, preferring packages that come from the recycling friendly materials. That is the new reality of consumer behavior which has forced businesses to change their approach to packaging to at least comply with the demand for sustainable products on the market. Subsequently, market is witnessing an innovation swing, where the companies are undertaking research and development extensive to create top-class biodegradable packaging materials with the due balance between functionality and environmental responsibility.

The role of government regulations and initiatives are of significant importance for enabling the market dynamics of biodegradable packaging. For most countries the regulations are severe and they restrict businesses from using non-biodegradable products, thus urging them to find sustainable alternatives. Therefore, this regulatory environment put forward a great background for the biodegradable packaging industry to flourish. Governments are giving boost to the companies that are adopting eco-friendly packaging through incentives and their policies which are promotion sustainable practices in such way that it help business in every industry to choose planet friendly packaging.

In addition to these factors is market dynamics which are affected by the growing inter-sector collaboration and partnerships. Organizations are beginning to see the value in using their resources and capabilities together so that the process of transitioning to sustainable packaging solutions can be done in a timely manner. By working together the packaging manufacturers, the raw material suppliers and the research institutions create the opportunity for a sharing process the information and an environment which stimulates innovation. The partnerships in this case not only add corporate strength but also improve the competitiveness of the market as a whole.

As the adoption of biodegradable packing has been history, the cost consideration has been a challenge for the widespread adoption of the biodegradable packaging. Nonetheless, because the technology keeps evolving and as the economies of scale prevail the cost differentiation between the conventional and the biodegradable packaging is becoming equal. As a result of this cost reduction, this factor has a tremendous impact upon the market dynamics, and is the one that makes sustainable packaging solutions affordable for the great majority of enterprises and customers.

Leave a Comment