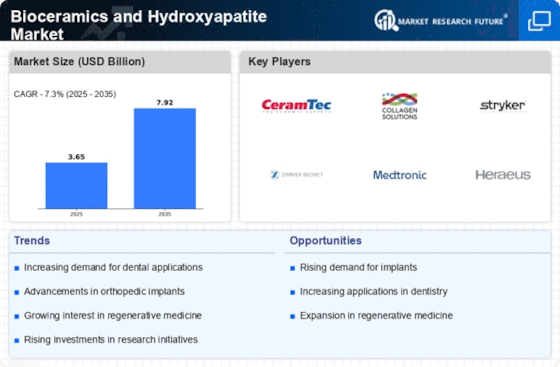

Top Industry Leaders in the Bioceramics and Hydroxyapatite Market

Latest Bioceramics and Hydroxyapatite Companies Updates:

Zimmer Biomet: Developed a new bioceramic material, ZB5X, for use in spinal implants. This material boasts enhanced osseointegration (bone growth) and mechanical properties.

Ossian: Partnered with the University of Cambridge to develop bioresorbable ceramic bone plates for craniofacial surgery. These plates dissolve over time, eliminating the need for removal surgery.

Stryker Corporation: Collaborated with researchers at MIT to explore the use of hydroxyapatite in 3D-printed cartilage implants for joint repair. This could revolutionize regenerative medicine applications.

Ossum Healcare: Received CE approval for its magnesium-based biodegradable stents in Europe, paving the way for wider market access.

Shanghai Richen Medical Supplies: Launched its hydroxyapatite coating technology for dental implants in China, targeting the growing demand for dental prosthetics.

Stryker received FDA approval for its Tantalum Acetabular Component System with HA3D for revision hip surgery, expanding its portfolio of bioceramic-based orthopedic solutions in the US.

List of Bioceramics and Hydroxyapatite Key companies in the market:

-

GE Healthcare

-

Bio-Rad

-

SofSera

-

ALB Technology Limited

-

Cam Bioceramics

-

Bonesupport AB

-

Fluidinova