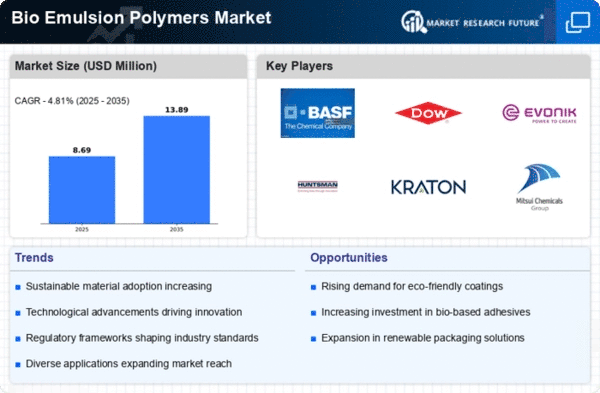

Market Share

Bio Emulsion Polymers Market Share Analysis

In the Bio-Emulsion Polymers Market, successful market share positioning strategies are crucial for companies to thrive in a competitive environment. This industry, characterized by a growing focus on eco-friendly solutions, demands a strategic combination of innovation, sustainability, and customer-centric approaches.

Green Product Development: Companies in the bio-emulsion polymers sector prioritize green product development to align with environmental concerns. Investing in research and development to create bio-based polymers with reduced environmental impact is a key strategy. This allows companies to differentiate themselves in the market by offering sustainable alternatives.

Application-Specific Formulations: Recognizing the diverse applications of bio-emulsion polymers across industries like paints and coatings, adhesives, and textiles, companies tailor formulations to meet specific application needs. This strategy ensures that the products cater to the unique requirements of different sectors, enhancing their market relevance.

Strategic Collaborations and Partnerships: Collaborative efforts with other industry players, research institutions, or sustainable suppliers are common strategies. Such partnerships enable the exchange of knowledge and resources, fostering innovation and contributing to a more robust market position.

Global Expansion and Market Diversification: Companies often explore opportunities for global expansion to tap into new markets and reduce dependence on specific regions. Diversifying the market presence not only broadens the customer base but also helps in mitigating risks associated with regional economic fluctuations.

Sustainability Certification and Transparency: Obtaining certifications for sustainable practices and transparent communication about these efforts are key strategies. Companies that showcase their commitment to sustainability through certifications and transparent reporting can build trust with environmentally conscious customers, influencing their purchasing decisions.

Brand Building and Marketing: Establishing a strong brand presence is vital for market positioning. Effective branding, marketing campaigns, and communication strategies help create awareness about bio-emulsion polymer products, build customer trust, and differentiate companies in a crowded market.

Customer Education and Awareness: Given the environmentally friendly nature of bio-emulsion polymers, educating customers about their benefits is crucial. Companies engage in customer education initiatives to raise awareness about the sustainable features of their products, creating a more informed customer base.

Technological Innovation: Staying at the forefront of technological advancements is imperative in the bio-emulsion polymers market. Companies that invest in innovative manufacturing processes, quality control, and application development can gain a competitive advantage, offering products with enhanced performance and sustainability.

Customer Relationship Management (CRM): Building and maintaining strong relationships with customers is paramount. Excellent customer service, after-sales support, and proactive engagement contribute to customer satisfaction, fostering loyalty and repeat business.

Regulatory Compliance: Adhering to stringent environmental regulations and safety standards is fundamental. Companies that demonstrate a commitment to compliance ensure product quality, safety, and environmental responsibility, building trust with customers and regulatory authorities.

Leave a Comment