Benzalkonium Chloride Size

Benzalkonium Chloride Market Growth Projections and Opportunities

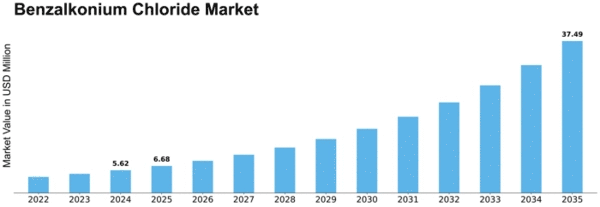

Many market factors influence the dynamics of the Benzalkonium Chloride Market. The growing demand for disinfectants in various industries is one of the market drivers. A frequently employed quaternary ammonium compound as well as an antimicrobial one, benzalkonium chloride is an essential ingredient in antiseptics, disinfectants, and sanitizers. The report "Benzalkonium Chloride Market Size, Share & Trends Analysis Report By Application (Biocides & Disinfectants, Pest Control), By End Use (Pharmaceuticals & Cosmetics, Oilfields), And Segment Forecasts, 2018 – 2024". In 2027, at a CAGR slightly above 8.1% over the forecast period from 2020 to 2027, it is predicted that the size of the global benzalkonium chloride market revenue will be USD 650 Million by the end of this period, up from USD 521 million in 2020. Benzalkonium chloride's market share stands at about $65 billion as per Global Market Insights estimates, where biocides' industry growth is estimated at over $10 billion, with a total valuation surpassing $20 billion during the forecast period till 2022. Moreover, according to a recent study conducted by GMI on the benzalkonium chloride market, it has been found that more than half a percent of the population will be affected by diseases due to hygiene issues, among which the respiratory disease prevalence rate is significantly high. This market also considers regulatory forces. Governments and regulatory bodies formulating rules and standards regarding its use largely determine the structure of the Benzalkonium Chloride market landscape globally. Strict product safety and efficacy regulations affect the production, distribution, and use of Benzalkonium Chloride (BAC). Economic factors are also important for this industry worldwide. Customer buying power behavior may vary depending on international economic fluctuations or exchange rates and disposable income. The overall market demand levels may be defined by purchasing power, as it can be seen among final customers, such as industries that are intensive users of Benzalkonium Chloride. In times of industrial recessions, cost-cutting measures result in low consumption of products containing Benzalkonium Chloride. It also affects technological changes linked with innovation. The growing adoption of more efficient or versatile forms by manufacturers through research aimed at improving efficiency diversity has been instrumental in the industry's current growth. Competition dynamics within the industry have also affected the market. Some of these factors include key players, product portfolios, pricing strategies, and their respective market share, among others, that determine overall competitiveness within the Benzalkonium Chloride Marketplace. However, environmental issues also play a part in the Benzalkonium Chloride Marketability. In addition to this, the rising consumers' concerns regarding eco-friendly products will propel them to prefer those that have insignificant influence on the environment since they are becoming more ecologically aware than before, which could affect consumer preferences and industry practices, thereby driving the formulation and production processes friendlier to Mother Nature.

Leave a Comment