Market Analysis

In-depth Analysis of Batteries Market Industry Landscape

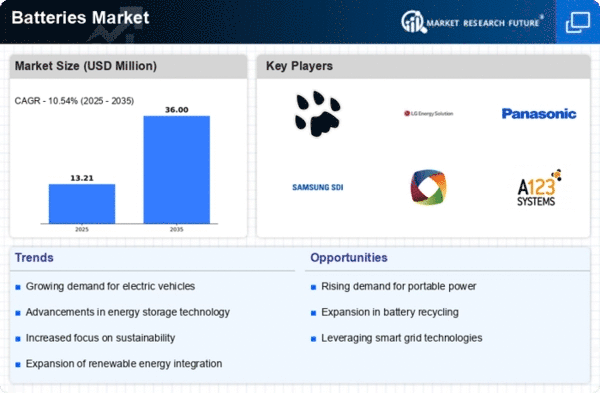

The battery market is experiencing dynamic shifts driven by evolving consumer needs, technological advancements, and global sustainability goals. In recent years, there has been a notable surge in demand for batteries, fueled by the growing prevalence of electric vehicles (EVs), renewable energy systems, and portable electronic devices. This increasing demand has given rise to a competitive landscape, with established players and emerging entrants vying for market share. A big factor in market movement is the fast improvement of battery tech. As scientists strive to find new ways, they are trying out different battery types. These offer better power storage space, live for longer and charge up quicker than before. Lithium-ion batteries are very popular, especially in electric vehicles. But now other options like solid-state and lithium sulfur ones are getting noticed because they might solve some of the problems with older lithium techs. The electric car market is really important for how the battery business changes. Governments worldwide are putting more and harder rules on emissions, pushing car makers to put a lot of money into electric cars. This way of living is causing more and more people to need batteries, which in turn makes them put their money into huge factories for making lots of these. Big car companies and tech firms are making deals or spending a lot of money on battery factories to get ahead in this quickly growing market. Moreover, worries about keeping things sustainable are changing what people want to buy and laws. This is pushing the market toward environmentally friendly answers. People want more clean energy, so they're asking for batteries to store extra power from sources like wind and sun. This app goes beyond single homes to cover big energy storage projects for the whole grid. It helps keep renewable sources like solar and wind reliable and steady. Along with improvements in technology and plans for keeping things sustainable, the way countries behave also affects how the market changes. The supply chain for important battery parts like lithium, cobalt and nickel often comes from just a few places. This makes some people worry about getting enough resources or the prices going up and down too much. People are working hard to get different things in the supply chain and find new, better materials. This is happening so we can avoid these problems and keep a good battery market that lasts for long time. As the battery market evolves, it is witnessing a shift in the competitive landscape. Traditional battery manufacturers face competition not only from each other but also from new entrants, including startups and companies from adjacent industries. The potential for breakthrough technologies and innovative business models keeps the market dynamic and fosters an environment of continuous improvement and adaptation.

Leave a Comment