Top Industry Leaders in the Bakery Filling Toppings Market

The bakery filling toppings market is a dynamic sector within the broader food industry, driven by consumer preferences for indulgent and innovative bakery products. Examining the competitive landscape reveals key players, strategies adopted, market share dynamics, emerging companies, industry news, investment trends, and recent developments in 2023.

The bakery filling toppings market is a dynamic sector within the broader food industry, driven by consumer preferences for indulgent and innovative bakery products. Examining the competitive landscape reveals key players, strategies adopted, market share dynamics, emerging companies, industry news, investment trends, and recent developments in 2023.

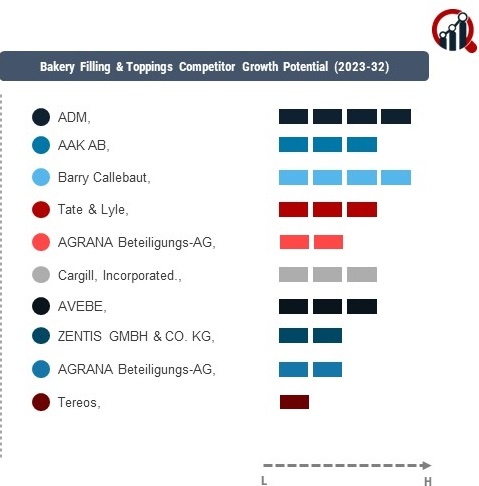

List of Key Players

- ADM

- AAK AB

- Barry Callebaut

- Tate & Lyle

- AGRANA Beteiligungs-AG

- Cargill, Incorporated.

- AVEBE

- ZENTIS GMBH & CO. KG

- AGRANA Beteiligungs-AG

- Tereos

- Rice & Company Inc.

- PURATOS

Strategies Adopted

Key players in the bakery filling toppings market deploy various strategies to stay competitive. Product innovation is a central focus, with companies introducing new flavors, textures, and formulations to meet evolving consumer preferences. Strategic partnerships with bakery chains and manufacturers help in expanding distribution networks and ensuring a consistent market presence. Additionally, investments in research and development are common, aiming to enhance the quality and versatility of bakery filling toppings.

Factors for Market Share Analysis

Market share in the bakery filling toppings sector is influenced by factors such as brand recognition, product quality, pricing strategies, and distribution efficiency. Companies that can offer a diverse range of high-quality products at competitive prices and maintain strong relationships with key bakery manufacturers tend to secure a larger market share. Continuous innovation and responsiveness to changing consumer trends also play a crucial role in determining market share.

New and Emerging Companies

The bakery filling toppings market has witnessed the emergence of new and innovative companies aiming to capture niche segments or introduce unique product offerings. Startups like Sweet Innovations have gained traction by specializing in premium and artisanal filling toppings, appealing to consumers seeking upscale and distinctive bakery products. These emerging players inject dynamism into the market, challenging established norms and driving innovation.

Industry News and Current Company Updates

Recent industry news highlights a growing demand for clean-label and natural bakery filling toppings. Consumers are increasingly scrutinizing ingredient lists, prompting companies to reformulate products with simpler and recognizable components. Major players like Barry Callebaut have responded to this trend by announcing plans to enhance the sustainability and traceability of their cocoa supply chains, aligning with consumer expectations for transparent and ethical sourcing practices.

Investment Trends

Investment trends in the bakery filling toppings market indicate a focus on technological advancements, sustainable sourcing, and market expansion. Companies are investing in state-of-the-art manufacturing technologies to improve production efficiency and enhance product quality. Sustainability initiatives, such as sourcing responsibly produced ingredients, resonate with environmentally conscious consumers and attract investment interest. Additionally, investments in marketing and distribution channels are crucial for reaching a wider audience and gaining a competitive edge.

Overall Competitive Scenario

The competitive scenario in the bakery filling toppings market is characterized by a mix of large multinational corporations and smaller, specialized players. While established companies leverage economies of scale and extensive distribution networks, newer entrants often focus on niche markets or unique product attributes. The market is competitive, with players vying for shelf space in both retail and commercial bakery establishments.

Recent Development

The bakery filling toppings market experienced noteworthy developments. One significant trend was the increasing consumer demand for plant-based and allergen-free options. Major players responded by introducing a range of plant-based and allergen-free filling toppings to cater to a growing segment of health-conscious and allergy-sensitive consumers. This shift aligns with broader consumer preferences for clean-label and inclusive bakery products.

Another notable development was the integration of digital technologies in the supply chain. Companies embraced data analytics and automation to optimize production processes, reduce lead times, and enhance overall operational efficiency. This technological integration not only improves cost-effectiveness but also ensures consistent product quality, meeting the stringent requirements of bakery manufacturers.

Furthermore, there was a surge in strategic collaborations between bakery filling topping manufacturers and leading pastry chefs. These partnerships aimed to co-create unique and trend-setting flavors, giving companies a competitive advantage in offering exclusive products that resonate with evolving consumer tastes. The collaboration trend signifies a strategic approach to stay ahead in a market where differentiation is crucial.

In terms of market expansion, several key players announced plans to enter untapped regional markets, particularly in Asia and Latin America. This expansion aligns with the increasing global demand for premium bakery products and offers companies an opportunity to tap into emerging consumer markets with a rising appetite for Western-style baked goods.