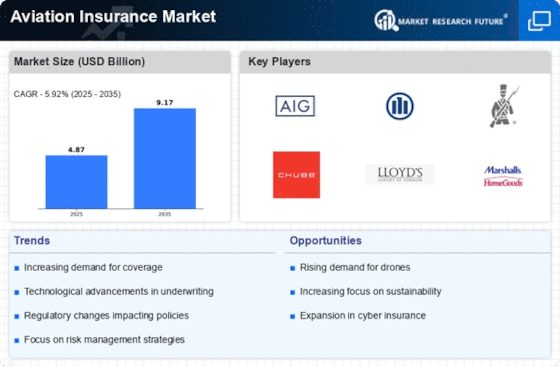

Rising Air Travel Demand

The Aviation Insurance Market is experiencing a notable surge in demand due to the increasing number of air travelers. As more individuals and businesses opt for air travel, the need for comprehensive insurance coverage becomes paramount. In 2025, the International Air Transport Association reported that passenger numbers are projected to reach 4.5 billion, indicating a robust growth trajectory. This rise in air travel not only necessitates enhanced safety measures but also drives the demand for aviation insurance products that cater to a diverse range of aircraft and operations. Consequently, insurers are adapting their offerings to meet the evolving needs of airlines and private operators, thereby fostering a competitive landscape within the Aviation Insurance Market.

Increased Regulatory Compliance

The Aviation Insurance Market is significantly influenced by the heightened regulatory compliance requirements imposed on airlines and aviation operators. Regulatory bodies are continuously updating safety standards and operational guidelines to mitigate risks associated with air travel. In 2025, it is anticipated that new regulations will emerge, focusing on areas such as cybersecurity and environmental sustainability. These evolving compliance mandates compel aviation operators to secure comprehensive insurance coverage that aligns with regulatory expectations. As a result, insurers must stay abreast of these changes to offer products that not only meet legal requirements but also address the unique risks faced by their clients. This dynamic creates opportunities for growth within the Aviation Insurance Market as operators seek to navigate the complexities of compliance.

Expansion of Commercial Aviation

The expansion of commercial aviation is a critical driver for the Aviation Insurance Market. With the proliferation of low-cost carriers and the introduction of new routes, the aviation sector is witnessing unprecedented growth. According to the latest data, the global commercial fleet is expected to grow by over 30% by 2030, necessitating a corresponding increase in insurance coverage. This expansion not only amplifies the risk exposure for insurers but also compels them to innovate and diversify their product offerings. As airlines invest in new aircraft and technologies, the Aviation Insurance Market must adapt to cover emerging risks associated with these advancements, ensuring that both operators and passengers are adequately protected.

Technological Innovations in Aviation

Technological innovations are reshaping the Aviation Insurance Market, as advancements in aircraft design, safety systems, and operational efficiency create new opportunities and challenges. The integration of artificial intelligence and data analytics into aviation operations enhances risk assessment and management, allowing insurers to tailor their products more effectively. For instance, the use of predictive analytics can help insurers better understand potential risks associated with specific aircraft models or flight routes. As these technologies continue to evolve, they are likely to influence underwriting practices and premium calculations, ultimately transforming the landscape of the Aviation Insurance Market. Insurers that embrace these innovations may gain a competitive edge in a rapidly changing environment.

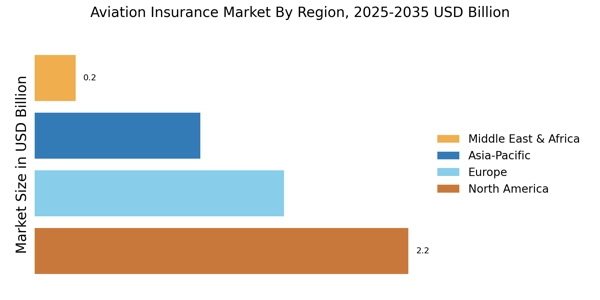

Emerging Markets and Investment Opportunities

Emerging markets present a wealth of investment opportunities for the Aviation Insurance Market. As countries in Asia, Africa, and Latin America continue to develop their aviation infrastructure, the demand for aviation insurance is expected to rise correspondingly. The International Civil Aviation Organization projects that air traffic in these regions will grow at a rate of 5.5% annually over the next decade. This growth is likely to attract new entrants into the aviation sector, further driving the need for tailored insurance solutions. Insurers that strategically position themselves to capitalize on these emerging markets may find lucrative opportunities to expand their portfolios and enhance their market presence within the Aviation Insurance Market.