Regulatory Compliance

The aircraft insurance Market is heavily influenced by regulatory compliance requirements imposed by aviation authorities. These regulations often dictate the minimum insurance coverage necessary for aircraft operators, which can vary by region and aircraft type. As safety standards evolve, insurers must adapt their policies to meet these new requirements. For instance, the Federal Aviation Administration (FAA) in the United States mandates specific insurance levels for commercial operators, which can drive demand for tailored insurance products. This regulatory landscape not only ensures safety but also creates a stable demand for insurance services, as operators seek to comply with legal obligations. Consequently, the Aircraft Insurance Market experiences growth as insurers develop innovative solutions to meet these regulatory challenges.

Emerging Markets Growth

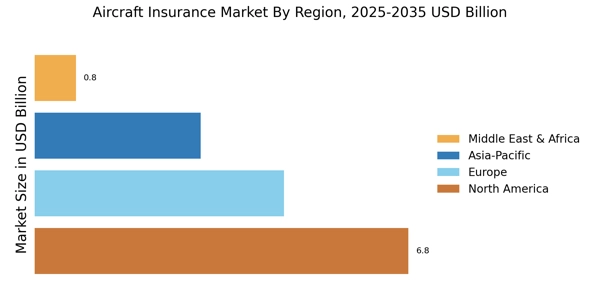

The Aircraft Insurance Market is witnessing growth in emerging markets, where the aviation sector is expanding rapidly. Countries in Asia, Africa, and Latin America are investing heavily in their aviation infrastructure, leading to an increase in the number of aircraft and air travel demand. This expansion creates a burgeoning market for aircraft insurance, as new operators seek coverage for their fleets. Additionally, as these markets develop, they often adopt international safety standards, which can further drive the need for insurance products that comply with these regulations. Insurers are recognizing the potential in these regions and are tailoring their offerings to meet the unique needs of emerging market operators. This trend suggests a promising future for the Aircraft Insurance Market as it capitalizes on the growth opportunities presented by these developing regions.

Rising Air Travel Demand

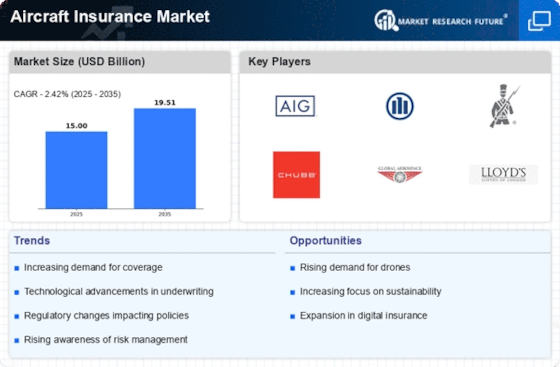

The Aircraft Insurance Market is experiencing growth due to the increasing demand for air travel. As more individuals and businesses opt for air transportation, the number of aircraft in operation rises, subsequently increasing the need for insurance coverage. According to industry reports, air travel is projected to grow at a compound annual growth rate of approximately 4.5% over the next decade. This surge in air travel not only boosts the number of commercial flights but also enhances the demand for private and charter services. Consequently, insurers are compelled to expand their offerings to accommodate a broader range of aircraft types and operational needs. This trend indicates a robust future for the Aircraft Insurance Market, as more operators seek comprehensive insurance solutions to protect their assets and comply with regulatory requirements.

Increased Focus on Safety

The Aircraft Insurance Market is significantly impacted by the heightened focus on safety within the aviation sector. As incidents and accidents can lead to substantial financial losses, operators are increasingly prioritizing safety measures, which in turn drives demand for comprehensive insurance coverage. Insurers are responding by offering specialized policies that address specific safety concerns, such as coverage for pilot training and maintenance practices. This focus on safety not only protects operators but also enhances the overall reputation of the aviation industry. Furthermore, as safety standards continue to evolve, the Aircraft Insurance Market is likely to adapt, creating new opportunities for insurers to develop innovative products that align with these safety initiatives.

Technological Advancements

Technological advancements play a pivotal role in shaping the Aircraft Insurance Market. Innovations such as advanced avionics, satellite tracking, and data analytics enhance operational safety and efficiency, which in turn influences insurance underwriting processes. Insurers are increasingly utilizing data from these technologies to assess risk more accurately, leading to more tailored insurance products. For example, the integration of real-time data allows insurers to monitor aircraft performance and maintenance schedules, potentially reducing premiums for operators who demonstrate a commitment to safety. This trend not only benefits insurers by improving risk assessment but also provides operators with more competitive insurance options. As technology continues to evolve, the Aircraft Insurance Market is likely to see further innovations that enhance both safety and insurance offerings.