Market Analysis

In-depth Analysis of Automotive Upholstery Market Industry Landscape

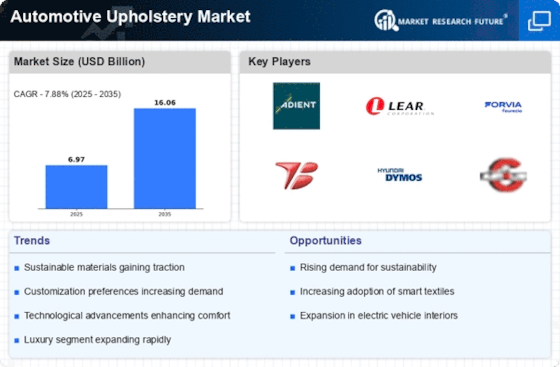

A primary motivator is the increasing consumer preferences and demands for enhanced comfort and elegant styling in their cars. Currently, buyers choose upholstery materials that convey a feeling of luxury while also being durable and low maintenance. In addition to consumer preferences, the global automobile industry's focus on development plays a crucial role in shaping market dynamics. Advancements in material innovation have led to the development of more creative upholstery arrangements, such as astute textures and cost-effective materials. Astute textures combine innovation to provide features like heating, cooling, and, in any case, recognizing critical signals, enhancing the whole driving experience. Conversely, maintainability is becoming more and more noticeable as more consumers choose sustainable and reused materials in automotive upholstery. Administrative rules and outflow requirements also have a fundamental impact on market factors. This has caused the center of gravity to shift in favor of lightweight materials while building automobiles, including upholstery. Manufacturers are increasingly combining eco-friendly and lightweight materials in upholstery to meet regulatory requirements and provide superior comfort for customers. Recent store network disruptions have brought attention to the importance of flexible supply chains for the automotive industry, which includes the upholstery market. The components of the industry are susceptible to shifts in the cost and availability of essential supplies like as calfskin, synthetic textures, and foam. Variations in the components of the store network can have an impact on market factors by influencing the production and valuation of automobile upholstery materials. Additionally, the market for upholstery is changing along with the automotive industry due to the rise of electric cars (EVs). The focus of EV manufacturers is creating interiors that complement the most advanced and practical vision of electric portability. Considering this demand for creative, lightweight, and environmentally friendly upholstery materials is growing, which is having an impact on market factors. Furthermore, the interior design of EVs often prioritizes creating a comfortable and technologically advanced environment, leading to significant requirements for upholstery materials. Manufacturers in this sector must adapt to these influential elements to stay competitive and satisfy evolving customer demands as well as the demands of the automotive market. Moving forward, development and manageability are expected to be the primary forces behind the automobile upholstery market's advancement.

Leave a Comment