Market Share

Automotive Throttle Cables Market Share Analysis

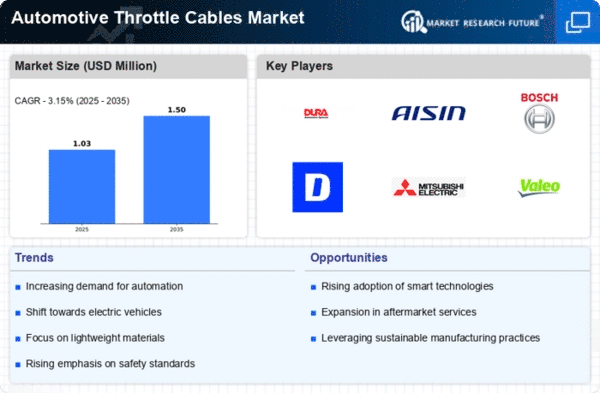

The automotive throttle cables market has been witnessing notable trends in recent times, reflecting the dynamic nature of the automotive industry. One prominent trend is the increasing shift towards electronic throttle control systems. Traditional mechanical throttle cables are being replaced by electronic throttle control (ETC) systems, which offer enhanced precision and responsiveness in vehicle acceleration. This shift is driven by the growing demand for improved fuel efficiency, smoother driving experiences, and the integration of advanced technologies in modern vehicles.

Another noteworthy trend is the emphasis on lightweight materials and design innovations in throttle cables. Manufacturers are exploring new materials that are not only durable but also lightweight, contributing to overall vehicle weight reduction. This focus aligns with the automotive industry's broader trend towards lightweighting to meet fuel efficiency and emission standards. Additionally, innovative design approaches are being adopted to enhance the flexibility and durability of throttle cables, ensuring optimal performance and longevity in diverse driving conditions.

The global automotive industry's push towards electrification and the rise of electric vehicles (EVs) are influencing the throttle cables market as well. As EVs become more prevalent, there is a shift from traditional throttle cables to electronic throttle-by-wire systems. These systems provide a seamless integration with electric powertrains, offering precise control over acceleration and deceleration. This transition underscores the evolving landscape of the automotive throttle cables market, adapting to the changing dynamics of powertrain technologies.

Furthermore, a growing focus on sustainability and environmental concerns is impacting the automotive throttle cables market. Manufacturers are increasingly incorporating eco-friendly materials and production processes in response to the industry's commitment to reducing its carbon footprint. This includes the use of recyclable materials in throttle cable construction and adopting manufacturing practices that minimize environmental impact. As sustainability becomes a key driver in automotive decision-making, these practices are likely to gain further prominence in the throttle cables market.

Regional variations in market trends are also evident, with emerging economies playing a pivotal role in shaping the landscape. In developing regions, the demand for affordable and fuel-efficient vehicles is driving innovations in throttle cable technologies. Simultaneously, established automotive markets are witnessing a surge in demand for high-performance vehicles, leading to advancements in throttle cable designs that cater to the needs of performance-oriented driving.

In conclusion, the automotive throttle cables market is undergoing significant transformations driven by technological advancements, lightweighting initiatives, electrification trends, and a heightened focus on sustainability. The shift from mechanical to electronic throttle control, the exploration of lightweight materials, the influence of electric vehicle adoption, and the industry's commitment to eco-friendly practices are shaping the market's trajectory. As the automotive landscape continues to evolve, the throttle cables market is poised to adapt and contribute to the overall efficiency, performance, and sustainability of vehicles worldwide.

Leave a Comment