Expansion of Automotive Production

The Automotive Tappet Market is poised for growth due to the expansion of automotive production across various regions. As manufacturers ramp up production to meet increasing consumer demand, the need for reliable and efficient engine components, including tappets, becomes paramount. In recent years, production levels have surged, with estimates indicating a production increase of over 10 million vehicles annually. This surge is likely to create a corresponding demand for tappets, as each vehicle requires multiple tappets for optimal engine function. Consequently, the expansion of automotive production is expected to drive the tappet market, as manufacturers seek to ensure quality and performance in their engine designs.

Growth of Electric and Hybrid Vehicles

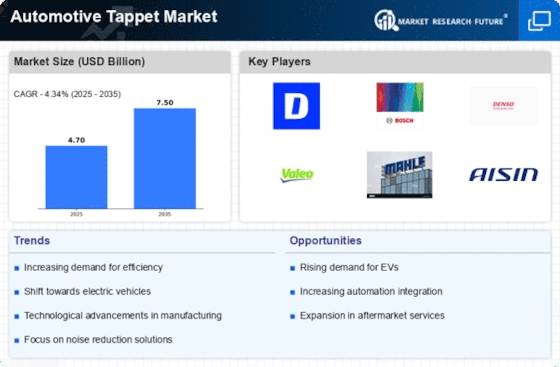

The Automotive Tappet Market is also influenced by the growth of electric and hybrid vehicles. While these vehicles utilize different engine technologies, the transition towards electrification is prompting manufacturers to innovate and adapt their tappet designs. Electric and hybrid vehicles often require components that can optimize performance and efficiency, leading to the development of new tappet technologies. The market for electric vehicles is expected to grow at a rate of approximately 20% annually, which may create opportunities for tappet manufacturers to diversify their product offerings. This shift towards electrification indicates a potential evolution in the tappet market, as manufacturers align their products with the future of automotive technology.

Rising Demand for High-Performance Vehicles

The Automotive Tappet Market is significantly influenced by the rising demand for high-performance vehicles. As consumers increasingly seek vehicles that offer superior speed, handling, and efficiency, manufacturers are compelled to invest in advanced engine components, including tappets. High-performance engines often require specialized tappets that can operate under extreme conditions, thereby driving innovation and production in this sector. The performance vehicle segment is expected to witness a growth rate of around 5% annually, which will likely bolster the tappet market as manufacturers adapt to meet these demands. This trend underscores the importance of high-quality tappets in achieving optimal engine performance and consumer satisfaction.

Technological Advancements in Engine Design

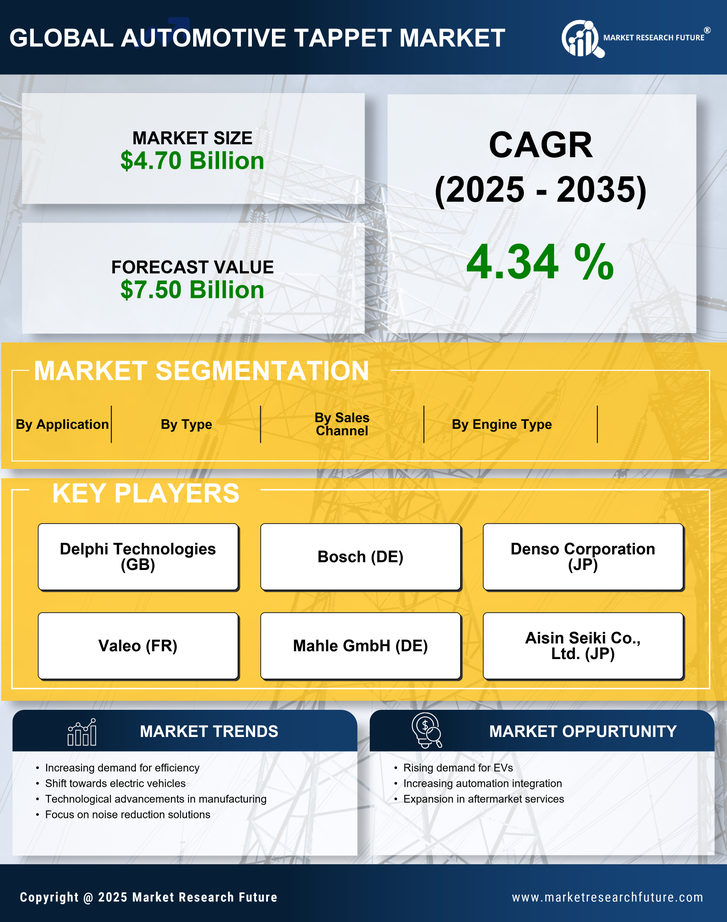

The Automotive Tappet Market is experiencing a notable shift due to technological advancements in engine design. Innovations such as variable valve timing and advanced fuel injection systems are becoming increasingly prevalent. These technologies necessitate the use of high-performance tappets that can withstand greater pressures and temperatures. As manufacturers strive to enhance engine efficiency and reduce emissions, the demand for specialized tappets is likely to rise. In fact, the market for tappets is projected to grow at a compound annual growth rate of approximately 4.5% over the next five years. This growth is indicative of the industry's response to evolving automotive technologies, which require more sophisticated components to meet stringent regulatory standards.

Regulatory Compliance and Emission Standards

The Automotive Tappet Market is significantly shaped by stringent regulatory compliance and emission standards. Governments worldwide are implementing increasingly rigorous regulations aimed at reducing vehicle emissions and enhancing fuel efficiency. These regulations compel manufacturers to adopt advanced technologies in engine design, which often necessitate the use of specialized tappets. As a result, the demand for tappets that can support these advanced engine technologies is likely to increase. The market is projected to grow as manufacturers invest in research and development to create tappets that meet these evolving standards. This trend highlights the critical role of tappets in achieving compliance with environmental regulations.