Regulatory Mandates

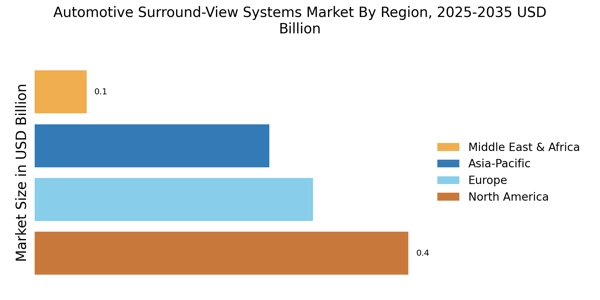

Regulatory influences play a crucial role in shaping the Automotive Surround-View Systems Market. Governments worldwide are implementing stringent safety regulations that mandate the inclusion of advanced driver-assistance systems (ADAS) in new vehicles. These regulations often require features such as surround-view systems to enhance visibility and reduce blind spots, thereby improving overall road safety. As of 2025, it is anticipated that more than 50 countries will have adopted regulations promoting the integration of such technologies in vehicles. This regulatory push is expected to significantly boost the Automotive Surround-View Systems Market, as manufacturers strive to comply with these evolving standards.

Consumer Safety Awareness

Growing consumer awareness regarding vehicle safety is a significant driver for the Automotive Surround-View Systems Market. As accidents and collisions remain a pressing concern, consumers are increasingly seeking vehicles equipped with advanced safety features. The presence of surround-view systems, which provide a comprehensive view of the vehicle's surroundings, is perceived as a crucial safety enhancement. In recent years, surveys indicate that over 70% of consumers prioritize safety features when purchasing a vehicle. This heightened focus on safety is likely to continue influencing purchasing decisions, thereby driving the demand for Automotive Surround-View Systems.

Rising Vehicle Production

The increasing production of vehicles is a fundamental driver for the Automotive Surround-View Systems Market. As automotive manufacturers ramp up production to meet consumer demand, the incorporation of advanced safety features, including surround-view systems, becomes essential. In 2025, global vehicle production is projected to reach approximately 100 million units, with a notable percentage expected to feature surround-view technology. This trend indicates a growing recognition of the importance of safety and convenience in modern vehicles, thereby propelling the Automotive Surround-View Systems Market forward.

Technological Integration

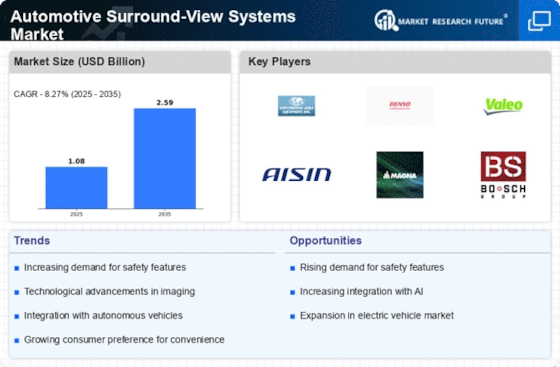

The integration of advanced technologies into the Automotive Surround-View Systems Market is a pivotal driver. Innovations such as high-definition cameras, artificial intelligence, and machine learning algorithms enhance the functionality and reliability of these systems. As vehicles become increasingly equipped with sophisticated electronic systems, the demand for surround-view technology rises. In 2025, the market is projected to witness a compound annual growth rate of approximately 15%, driven by the need for enhanced safety features and improved user experience. This technological evolution not only improves vehicle safety but also facilitates the development of autonomous driving capabilities, further propelling the Automotive Surround-View Systems Market.

Market Competition and Innovation

Intense competition among automotive manufacturers is fostering innovation within the Automotive Surround-View Systems Market. As companies strive to differentiate their offerings, there is a notable emphasis on enhancing the capabilities of surround-view systems. This competitive landscape encourages the development of new features, such as real-time object detection and integration with other vehicle systems. In 2025, it is expected that advancements in surround-view technology will lead to a more immersive user experience, further driving consumer interest. Consequently, this innovation-driven competition is likely to stimulate growth within the Automotive Surround-View Systems Market.