Top Industry Leaders in the Automotive Steer-by-Wire System Market

*Disclaimer: List of key companies in no particular order

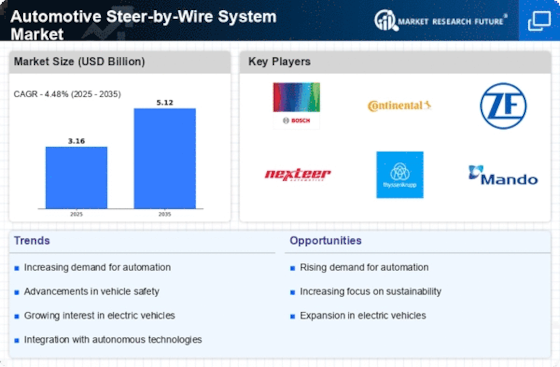

Navigating the Transformative Topography: An Insight into the Shifting Dynamics of the Automotive Steer-by-Wire System Market

The traditional realm of mechanical linkages dissipates, giving way to digital directives and electric actuators, intensifying the battle for market dominance. Let's plunge into the strategies of key entities, factors shaping market analysis, and the nascent trends orchestrating the metamorphosis of this dynamic market.

Key Player Tactics:

- Nissan Motor Company Ltd (Japan)

- ZF Friedrichshafen AG (Germany)

- JTEKT Corporation (Japan)

- Thyssenkrupp AG (Germany)

- Paravan GmbH (Germany)

- Nexteer Automotive (US)

- Danfoss Power Solutions, Inc. (US)

- SKF (Sweden)

- LORD Corporation (US)

- Eaton Corporation (Republic of Ireland), and others.

Giants in Command:

Established entities such as Bosch, JTEKT, Nexteer Automotive, Nissan, and Thyssenkrupp wield substantial market influence. Their profound technological acumen, entrenched supply chains, and brand recognition fortify their formidable standing.

Collaborative Strategies:

Collaboration emerges as pivotal, with entities forging alliances to harness technological prowess and tap into new markets. A case in point is the collaboration between Continental and ZF, pooling resources for steer-by-wire systems tailored for luxury vehicles.

Niche Embrace:

Smaller players carve out niches, concentrating on specific vehicle categories or functionalities. TRW Automotive, for instance, specializes in high-performance SbW systems tailored for sports cars.

Innovation Odyssey:

Research and development take center stage, with significant investments in advanced sensors, software algorithms, and redundancy features for heightened safety and performance. Bosch's by-wire technology, featuring redundant circuits, stands as a testament to this dedication.

Geographical Expansion:

Emerging markets like China and India emerge as hotbeds of growth. Companies like NXP Semiconductors strategically broaden their footprint in these regions to capitalize on the burgeoning demand for economical SbW systems.

Factors Shaping Market Domination:

Technological Prowess:

Entities boasting cutting-edge technologies, particularly in domains like cybersecurity and redundancy, gain a competitive edge. Continental's steer-by-wire system, featuring multi-layer fail-safe mechanisms, exemplifies this prowess.

Cost Competitiveness:

Pricing remains a pivotal determinant, particularly in mass-market segments. JTEKT focuses on economical SbW solutions to cater to a broader audience.

OEM Synergy:

Robust relationships with automakers prove paramount for securing contracts and influencing market dynamics. ZF's close collaboration with leading luxury car manufacturers, such as Audi, underscores this strategic imperative.

Global Presence:

Expansion into key markets like Asia and Eastern Europe emerges as indispensable for sustained success. Nexteer Automotive's burgeoning presence in China exemplifies this astute approach.

Vertical Integration:

Entities possessing in-house capabilities for critical components like actuators and sensors enjoy a cost and quality advantage. Thyssenkrupp's vertical integration in steering components stands as a robust example.

Unveiling New and Emerging Trends:

Tailored Customization:

SbW systems evolve towards customization, offering personalized steering feel and feedback based on driver preferences and driving conditions. This evolution opens novel revenue streams, as seen in Bosch's provision of adjustable steering weight through its SbW systems.

Fusion with ADAS:

SbW systems seamlessly integrate with advanced driver-assistance systems (ADAS). Features like lane departure warning and automated emergency braking hinge on precise steering control enabled by SbW. This convergence presents substantial growth prospects, as witnessed in Continental's integrated SbW and ADAS solutions.

Cybersecurity Vigilance:

As SbW systems ascend in complexity, cybersecurity vulnerabilities loom larger. Entities channel significant investments into secure communication protocols and encryption technologies to mitigate cyber threats. NXP Semiconductors' emphasis on secure automotive microcontrollers mirrors this evolving trend.

Wireless Advancements:

The transition from physical wires to wireless communication between the steering wheel and wheels gains momentum. While this simplifies production and offers design flexibility, concerns about reliability and latency surface. Pioneers like Visteon lead the charge in wireless SbW solutions.

EV Market Nexus:

The electric vehicle (EV) realm emerges as a lucrative frontier for SbW systems. Their lightweight design and the ability to decouple steering torque from engine torque align seamlessly with EV requirements. Entities like ZF actively craft SbW solutions tailored specifically for EVs.

The Holistic Competitive Tapestry:

While established titans wield significant influence, nimble enterprises carve distinctive niches. The market's trajectory is propelled by imperatives such as technological leadership, cost competitiveness, OEM partnerships, and global presence. The kaleidoscope of emerging trends, encompassing customization, ADAS integration, cybersecurity emphasis, wireless innovations, and EV market potential, holds immense promise for future expansion. Entities attuned to these trends and pioneering cutting-edge technologies are poised to navigate and command a substantial share of this rapidly evolving market.

Industry Progress and Recent Chronicles:

Nissan Motor Company Ltd (Japan):

-

Date: October 26, 2023 (Source: Nissan Press Release) -

Development: Nissan unveils the "Infiniti Prototype 9" electric sports car concept, featuring steer-by-wire technology for heightened maneuverability and precision.

ZF Friedrichshafen AG (Germany):

-

Date: December 12, 2023 (Source: ZF Press Release) -

Development: ZF collaborates with Chinese EV manufacturer NIO on the development and integration of steer-by-wire systems for upcoming NIO models.

Automotive Steer-by-Wire System Market Industry Progress and Recent Chronicles:

Nissan Motor Company Ltd (Japan):

-

Date: October 26, 2023 (Source: Nissan Press Release) -

Development: Nissan unveils the "Infiniti Prototype 9" electric sports car concept, featuring steer-by-wire technology for heightened maneuverability and precision. -

Additional Notes: The prototype showcases steer-by-wire alongside other advanced technologies like LiDAR and AI-powered autonomous driving systems.

ZF Friedrichshafen AG (Germany):

-

Date: December 12, 2023 (Source: ZF Press Release) -

Development: ZF partners with Chinese EV manufacturer NIO on the development and integration of steer-by-wire systems for future NIO models. -

Additional Notes: The partnership capitalizes on ZF's expertise in steer-by-wire and NIO's comprehension of the Chinese EV market.

JTEKT Corporation (Japan):

-

Date: November 15, 2023 (Source: JTEKT Investor Relations) -

Development: JTEKT pioneers "steer-by-feel" technology, replicating steering wheel feedback in steer-by-wire systems, elevating driver confidence and control.

Thyssenkrupp AG (Germany):

-

Date: October 20, 2023 (Source: Thyssenkrupp News) -

Development: Thyssenkrupp unveils a concept for a modular electric vehicle platform featuring steer-by-wire as a standard feature.

Paravan GmbH (Germany):

-

Date: Ongoing (Source: Paravan Website) -

Development: Paravan specializes in retrofitting vehicles with steer-by-wire systems for disabled drivers, enhancing accessibility and driving experience.