Advancements in Vehicle Technology

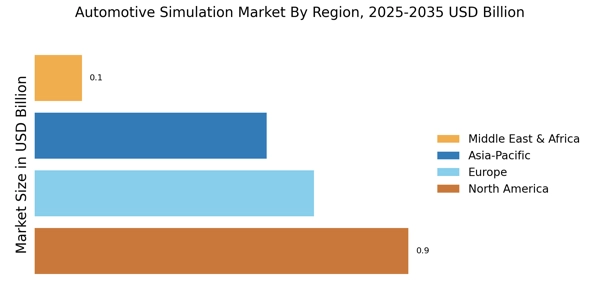

The Automotive Simulation Market is experiencing a surge due to rapid advancements in vehicle technology. Innovations such as electric vehicles (EVs) and autonomous driving systems necessitate sophisticated simulation tools for design and testing. In 2025, the demand for simulation software is projected to grow as manufacturers seek to optimize performance and safety. The integration of advanced materials and smart technologies into vehicles further complicates the design process, making simulation an essential component. As automakers strive to meet stringent regulatory standards, the Automotive Simulation Market provides the necessary tools to simulate various scenarios, ensuring compliance and enhancing vehicle reliability. This trend indicates a robust growth trajectory for simulation solutions, as they become integral to the development of next-generation vehicles.

Increased Focus on Safety Regulations

The Automotive Simulation Market is significantly influenced by the heightened focus on safety regulations. Governments worldwide are implementing stricter safety standards for vehicles, compelling manufacturers to invest in simulation technologies that can accurately predict vehicle behavior in various conditions. In 2025, the market is expected to expand as companies utilize simulation tools to conduct crash tests and evaluate safety features without the need for physical prototypes. This shift not only reduces costs but also accelerates the development process. Furthermore, the ability to simulate real-world scenarios allows manufacturers to identify potential safety issues early in the design phase, thereby enhancing overall vehicle safety. As regulatory bodies continue to evolve their requirements, the Automotive Simulation Market is likely to see sustained growth driven by the need for compliance and consumer safety.

Integration of Advanced Analytics and AI

The Automotive Simulation Market is increasingly integrating advanced analytics and artificial intelligence (AI) into simulation tools. This integration enhances the accuracy and efficiency of simulations, allowing manufacturers to analyze vast amounts of data generated during the design and testing phases. In 2025, the market is expected to benefit from AI-driven simulations that can predict vehicle performance under diverse conditions. This capability not only streamlines the development process but also provides insights that were previously unattainable through traditional methods. As the automotive industry embraces data-driven decision-making, the demand for sophisticated simulation tools that incorporate AI and analytics is likely to rise. This trend indicates a transformative shift in the Automotive Simulation Market, as companies leverage technology to gain a competitive edge.

Growing Demand for Cost-Effective Solutions

The Automotive Simulation Market is witnessing a growing demand for cost-effective solutions as manufacturers seek to optimize their development processes. Simulation tools enable companies to conduct extensive testing and validation without the high costs associated with physical prototypes. In 2025, the market is projected to expand as organizations recognize the financial benefits of utilizing simulation technologies. By reducing the number of physical tests required, companies can allocate resources more efficiently, ultimately leading to faster time-to-market for new vehicles. Additionally, the ability to simulate various scenarios allows for better decision-making and risk management during the design phase. This trend suggests that the Automotive Simulation Market will continue to thrive as manufacturers prioritize cost efficiency while maintaining high-quality standards in vehicle development.

Rising Adoption of Electric and Hybrid Vehicles

The Automotive Simulation Market is experiencing growth due to the rising adoption of electric and hybrid vehicles. As consumers increasingly demand environmentally friendly options, manufacturers are compelled to innovate and optimize their designs. Simulation tools play a crucial role in this transition, allowing for the testing of battery performance, energy efficiency, and overall vehicle dynamics. In 2025, the market is projected to expand as automakers utilize simulation technologies to enhance the development of electric drivetrains and associated systems. This trend not only supports the shift towards sustainable transportation but also enables manufacturers to address challenges related to range, charging infrastructure, and vehicle performance. The Automotive Simulation Market is thus positioned to thrive as it supports the automotive sector's evolution towards electrification.