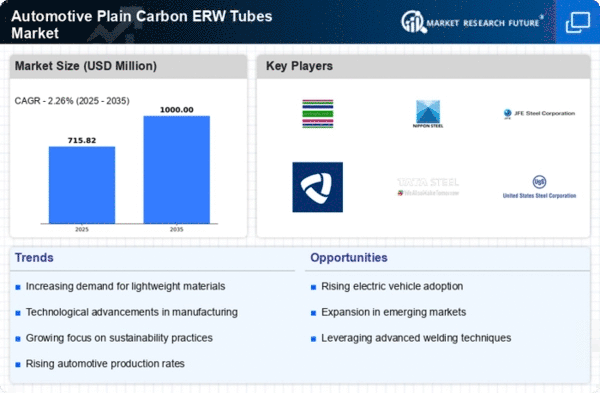

Market Growth Projections

The Global Automotive Plain Carbon ERW Tubes Market Industry is projected to grow from 5.82 USD Billion in 2024 to 9.16 USD Billion by 2035, reflecting a compound annual growth rate of 4.21% from 2025 to 2035. This growth trajectory highlights the increasing demand for automotive components that meet stringent performance and safety standards. The market dynamics are influenced by various factors, including technological advancements, rising automotive production rates, and the expansion of electric vehicles. These elements collectively contribute to a favorable environment for the growth of plain carbon ERW tubes in the automotive sector.

Rising Automotive Production Rates

The Global Automotive Plain Carbon ERW Tubes Market Industry is closely linked to the rising production rates of automobiles worldwide. As emerging economies expand their automotive manufacturing capabilities, the demand for ERW tubes is expected to surge. Countries such as India and China are ramping up production to meet both domestic and international market needs. This increase in automotive production is likely to drive the market value significantly, with projections indicating a compound annual growth rate of 4.21% from 2025 to 2035. Such growth reflects the industry's adaptability to changing consumer preferences and the need for efficient supply chains.

Expansion of Electric Vehicle Market

The expansion of the electric vehicle market is poised to significantly impact the Global Automotive Plain Carbon ERW Tubes Market Industry. As more manufacturers pivot towards electric vehicles, the demand for lightweight and durable materials is increasing. Plain carbon ERW tubes are well-suited for electric vehicle applications due to their structural integrity and weight advantages. This shift towards electrification is likely to create new opportunities for growth in the market, as manufacturers seek to optimize vehicle designs for efficiency. The anticipated growth trajectory suggests that the market will continue to evolve in response to the changing landscape of the automotive industry.

Growing Demand for Lightweight Materials

The Global Automotive Plain Carbon ERW Tubes Market Industry is experiencing an upsurge in demand for lightweight materials, driven by the automotive sector's focus on enhancing fuel efficiency and reducing emissions. Manufacturers are increasingly adopting plain carbon ERW tubes due to their favorable strength-to-weight ratio, which contributes to overall vehicle performance. As regulations tighten globally, the automotive industry is projected to prioritize materials that support sustainability goals. This trend is expected to bolster the market, with a projected value of 5.82 USD Billion in 2024, indicating a robust growth trajectory as manufacturers seek to innovate and comply with environmental standards.

Technological Advancements in Manufacturing

Technological advancements in manufacturing processes are significantly influencing the Global Automotive Plain Carbon ERW Tubes Market Industry. Innovations such as automated welding techniques and precision machining are enhancing the production efficiency and quality of ERW tubes. These advancements not only reduce production costs but also improve the overall performance of automotive components. As manufacturers adopt these technologies, they are likely to see increased competitiveness in the market. The anticipated growth to 9.16 USD Billion by 2035 suggests that these technological improvements will play a crucial role in meeting the rising demand for high-quality automotive components.

Increasing Focus on Vehicle Safety Standards

The Global Automotive Plain Carbon ERW Tubes Market Industry is also benefiting from the increasing focus on vehicle safety standards. Governments worldwide are implementing stricter regulations to enhance vehicle safety, which necessitates the use of high-quality materials in automotive manufacturing. Plain carbon ERW tubes, known for their durability and strength, are becoming essential components in the production of safer vehicles. This trend is likely to drive demand as manufacturers strive to comply with safety regulations, thereby contributing to the market's growth. The emphasis on safety is expected to sustain the industry's expansion in the coming years.

Leave a Comment