- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

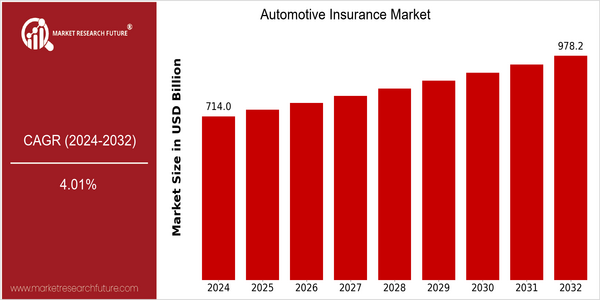

Automotive Insurance Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 713.99 Billion |

| 2032 | USD 978.2 Billion |

| CAGR (2024-2032) | 4.01 % |

Note – Market size depicts the revenue generated over the financial year

The worldwide automobile insurance market is expected to grow at a significant CAGR from 2024 to 2032, from a current market size of USD 713,993,913,500 to USD 1,087,193,200 by 2032. This CAGR of 4.01% is expected to be observed over the forecast period. This growth is mainly due to the increasing number of vehicles on the road and the rising awareness among consumers regarding the importance of automobile insurance. The integration of advanced telematics and artificial intelligence in insurance underwriting and claims processing is expected to improve the operational efficiencies of the industry and enhance the customer experience. The key players in the automobile insurance market, such as Allstate, State Farm, and Progressive, are investing in new products and strategic collaborations to increase their market share. The usage-based insurance model, which uses telematics data to calculate the premium, is gaining momentum among the automobile insurers. In addition, strategic alliances with technology companies for developing digital platforms to enhance customer experience are also gaining momentum. These strategic initiatives not only enhance the customer experience but also align with the changing customer preferences for more specialized and flexible insurance solutions.

Regional Deep Dive

Auto insurance is experiencing dynamic shifts in the various regions of the world, driven by technological advancements, changes in regulatory environment, and changes in customer preferences. In North America, the market is characterized by a high penetration of digital insurance platforms and a growing focus on usage-based insurance models. In Europe, the regulatory framework has been strengthened in recent years to improve the protection of consumers and to encourage sustainable practices. In the Asia-Pacific region, meanwhile, the growing vehicle ownership and urbanization are fostering the rapid uptake of new insurance solutions. The Middle East and Africa are experiencing increasing awareness of the insurance products, while Latin America is experiencing a decline in economic stability, which affects the availability and cost of insurance.

North America

- The telematics and usage-based insurance are changing the market. Progressive and Allstate are the pioneers in the field of individualized premiums based on driving behavior.

- Data security and privacy are being enhanced by regulatory changes, such as the implementation of the Model Insurance Data Security Act by the National Association of Insurance Commissioners.

- As the electric vehicle gains in popularity, insurance companies are developing special coverage for it. For example, State Farm and Geico have introduced specialized policies for EV drivers.

Europe

- The new General Data Protection Regulation (GDPR) has had a considerable impact on how insurers collect and process data on their customers, resulting in more transparency and greater customer rights.

- This is a good example of the evolution of digital insurance platforms, where Lemonade and Zego use artificial intelligence and machine learning to automate the process of submitting claims and enhancing the customer experience.

- Green insurance is gaining ground, with Allianz and AXA pledging to reduce their carbon footprint and to promote green business practices.

Asia-Pacific

- In China and India, where the middle classes are growing fast, there is a rapid increase in the ownership of vehicles, and with it a greater demand for automobile insurance.

- Insurtech companies like PolicyBazaar in India and ZhongAn in China are revolutionizing the insurance sector with their new and novel digital insurance solutions.

- Governmental efforts to improve road safety and vehicle standards have influenced insurance policies. In Japan, for example, the authorities have adopted stricter regulations to reduce the accident rate.

MEA

- The rising awareness of the importance of motor insurance is supported by government campaigns in the UAE and other countries, which have made it compulsory for all cars to be insured.

- AIG and AXA have launched mobile apps that make it easier for policyholders to make claims and access insurance services.

- In the light of the present economic situation, it is important for the insurance industry to develop insurance products that are more flexible and more affordable to cater to the diverse needs of the population.

Latin America

- The economic uncertainty in countries such as Brazil and Argentina has influenced the behavior of consumers, and the demand for flexible payment methods and micro-insurance products is growing.

- And the rise of the digital platforms has reorganized the market, with SURA and B3 launching insurance services on the Internet to reach a wider public.

- The Superintendence de Seguridad y Reaseguro of Colombia has increased its supervision of the insurance industry.

Did You Know?

“In the United States, about 80% of the drivers are unaware of the possibilities of saving up to 30 % of their premiums through the usage-based insurance, which reduces premiums according to the behavior of the drivers.” — Insurance Information Institute

Segmental Market Size

The automobile insurance market is currently experiencing stable growth, largely driven by the increasing number of vehicles and the evolving expectations of consumers. In addition, the growing use of connected vehicles, which require adapted insurance products, and the legal framework, which stipulates minimum coverage levels, are driving the market. The shift to electric vehicles is also requiring insurance companies to adapt their products to the specific risks associated with these new vehicles.

The market is now at a stage where the leading companies are progressive and geico, who are at the forefront of new insurance solutions, such as usage-based insurance. The main applications are for private car insurance, commercial car insurance and special policies for ev. The latter is based on a combination of the drive for sustainability and the government's support for evs. Telematics and artificial intelligence are driving the development of motor insurance and make it possible to calculate more individual premiums and risk profiles.

Future Outlook

The report projects that from 2024 to 2032, the global car insurance market will increase from $713.94 billion to $978.2 billion, at a compound annual growth rate (CAGR) of 4.01%. A number of factors are expected to drive this growth, including an increase in the number of vehicles on the road, a growing awareness of insurance, and the increasing complexity of automobiles. The number of consumers who opt for comprehensive coverage will also increase, with penetration of the market reaching over 85% of car owners by 2032, compared to 75% in 2024. The report also cites the growing use of digital platforms to simplify the process of buying and selling insurance.

A revolution is coming, a revolution based on the use of technology, in particular telematics and artificial intelligence. Data analysis is increasingly being used to develop individualised policies and dynamically priced products which are expected to attract a wider customer base. In addition, the development of electric vehicles and of driverless vehicles is expected to lead to the need for new products designed for these innovations, further increasing the opportunities for growth. In the meantime, regulatory changes aimed at promoting fairness in the market and greater protection for consumers are also having a significant effect on the market’s evolution. These changes will transform the motor insurance market and will, it is hoped, lead to a transformation of the customer experience which will lead to sustainable growth.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 652.6 Billion |

| Market Size Value In 2023 | USD 682.6 Billion |

| Growth Rate | 4.60% (2023-2032) |

Automotive Insurance Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.