Automotive Coolant Size

Market Size Snapshot

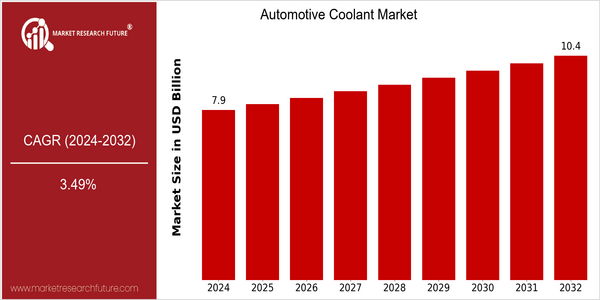

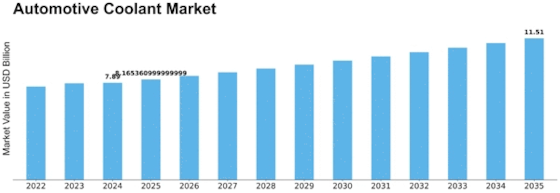

| Year | Value |

|---|---|

| 2024 | USD 7.89 Billion |

| 2032 | USD 10.39 Billion |

| CAGR (2024-2032) | 3.49 % |

Note – Market size depicts the revenue generated over the financial year

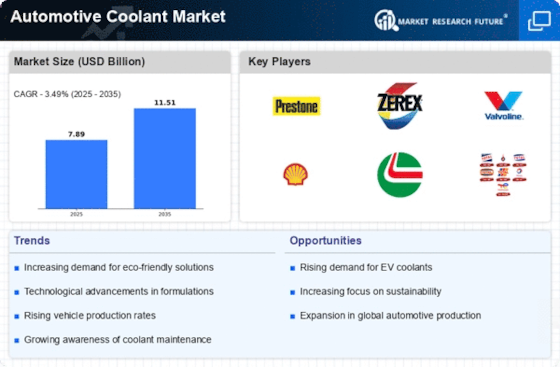

The market for automobile cooling liquids is expected to grow steadily, reaching a size of $ 7,897 million in 2024, and growing to $ 10,397 million in 2032. This growth is equivalent to a CAGR of 3.49 % for the forecast period. The rising demand for efficient cooling systems in vehicles, driven by technological developments in the automobile industry and rising vehicle production, is a major factor in this growth. The need for high-performance coolants that can withstand high temperatures and increase the efficiency of engines is also increasing. The development of new, environment-friendly coolants and the introduction of smart cooling systems will also contribute to growth. The market is dominated by large companies such as BASF, Prestone Products, and Valvoline, which are investing heavily in research and development in order to develop superior coolants. Strategic alliances and product launches are also influencing the market. Recent industry collaborations aimed at improving coolant performance and the environment, for example, are a clear indication of the commitment of the industry to meet changing customer demands and regulatory standards. The automobile cooling liquids market is expected to continue its upward trend, driven by the rising production of vehicles and technological developments.

Regional Market Size

Regional Deep Dive

Among the many regions where the Coolant Market is growing, it is being driven by the rising production of automobiles, the increasing awareness of automobile maintenance, and the stricter regulations on the environment. Each region has its own characteristics, depending on the local car industry, the preferences of the consumers, and the legal framework. North America is characterized by its mature car industry and by its focus on advanced coolant formulations. Europe is characterized by its emphasis on environment-friendly products. The Asia-Pacific region is characterized by its rapid growth, based on the growing incomes of the consumers and the expanding production of automobiles. The Middle East and Africa are slowly developing their car industries, and Latin America is experiencing a resurgence in automobile sales, which is affecting the demand for coolants.

Europe

- Europe is the world leader in the development of low-toxic, environment-friendly coolants. This is partly due to the stringent European Union regulations on chemical substances. Companies such as BASF and Total Energy are at the forefront in developing these coolants.

- In the European market the use of advanced cooling systems is becoming increasingly common. This includes the use of nanotechnology in coolants to improve their heat conductivity. This trend is supported by the Horizon 2020 programme of the European Commission.

Asia Pacific

- In the Asia-Pacific region, the production of motor vehicles is booming, particularly in China and India, and this has a direct effect on the demand for coolants. Major companies such as the China National Petroleum Company (CNPC) and Sinopec are expanding their product ranges to meet this growing demand.

- A notable trend is the increasing use of hybrid and electric vehicles in the Asia-Pacific region. This is expected to increase the demand for specialized coolants for these vehicles. The shift towards hybrid and electric vehicles is a result of government subsidies and the development of charging stations.

Latin America

- The growing motorization of Latin America, especially in Brazil and Mexico, has had a positive influence on the development of the antifreeze market. The local companies are increasing their production to meet the growing demand for both conventional and green coolants.

- Local manufacturers have also entered into associations with international firms, thus improving the quality and variety of the coolants produced in the region. The market competition is expected to be facilitated by this association, and coolant formulas are expected to become more sophisticated.

North America

- In the United States, the trend has been toward the use of biodegradable and organic coolants, owing to the increasing number of regulations and the demand for products which are regarded as economi-cal. In this field, the Prestone Products Corp. is making a name for itself with its formulations which meet the most stringent regulations.

- North America is a region where the development of electric vehicles (EVs) is influencing the formulation of coolants, because the cooling of batteries requires special coolants. The main automobile manufacturers, such as General Motors and Tesla, are investing in research to develop effective cooling solutions for their EV models.

Middle East And Africa

- The Middle East and Africa are experiencing a gradual increase in the use of automobile cooling systems, mainly due to the growth of the automotive industry and the rising rate of vehicle ownership. Local manufacturers are beginning to offer cooling systems adapted to the local climate.

- In the meantime, the regulatory framework in the region is gradually catching up with the global standards and encouraging the use of high-quality coolants. And initiatives such as those of the Gulf Cooperation Council (GCC) to improve vehicle maintenance are bound to boost the consumption of coolants.

Did You Know?

“Did you know that the automotive coolant market is increasingly shifting towards the use of propylene glycol-based coolants, which are considered safer for the environment and human health compared to traditional ethylene glycol-based coolants?” — Market Research Future

Segmental Market Size

The car coolant market is growing steadily. This is due to the rising demand for engine cooling solutions in cars. Also, the regulatory policies to reduce emissions and improve fuel economy are boosting the growth of this market. Advances in the coolant formulations, such as the development of long-lasting and environment-friendly coolants, are also driving the market. This market is currently in its mature adoption stage, with companies like Zerex and Prestone leading the way in the production of advanced coolants. The main application areas are cars, trucks, and heavy equipment, where temperature control is important for peak performance. The main trend driving the market is the focus on environment-friendly coolants, with many manufacturers producing bio-based coolants to meet the new standards. Nanotechnology and smart coolant systems are also shaping the evolution of this market, enhancing performance and life, and meeting the growing demand for reliability and efficiency.

Future Outlook

The global market for automotive coolant is expected to grow steadily from 2024 to 2032, with a CAGR of 3.49% from 2024 to 2032. This is mainly due to the growing demand for cooling systems in vehicles, resulting from the technological development of the automobile industry and the increase in the number of cars produced in the world. The popularity of electric vehicles will also increase the demand for specialized coolants that can operate in different temperature conditions. In 2032, the penetration of advanced coolants such as organic acid technology (OAT) and hybrid organic acid technology (HOAT) is expected to exceed 40% of the total market, indicating a shift towards more sustainable and high-performance solutions. The development of long-term coolants and the integration of smart coolant management systems will also help to improve the performance and life of vehicles, which will also increase the demand for coolants. In addition, the stricter regulations on fuel consumption and emissions will also force manufacturers to develop and adopt advanced coolants. The popularity of hybrid and electric vehicles will also require the development of specialized coolants to meet the special cooling needs of these vehicles. The automotive coolant market will therefore continue to develop and will become a major part of the automobile industry by 2032.

Leave a Comment