Market Share

Automotive Bushing Technologies Market Share Analysis

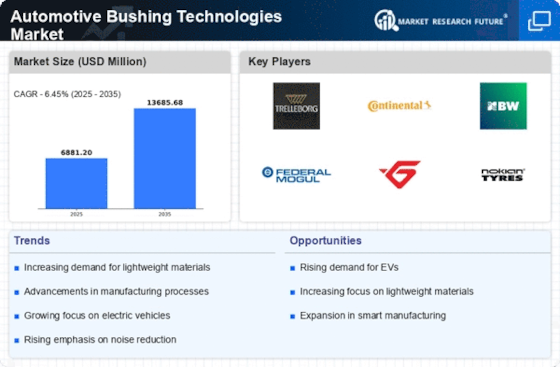

The Automotive Bushing Technologies Market has shown several significant trends affecting its general picture. Suspension bushings are essential in ensuring the efficient operation of a vehicle's suspension system. A main trend that is visible in the Automotive Bushing Technologies Market is an increase in the use of advanced materials. Manufacturers have continued to explore materials that provide better durability, resistance, and wear performance for improved performance characteristics of their products. Currently polyurethane stands out from other types because it may resist severe conditions and last much longer compared to typical rubber bushes. This move towards sophisticated materials is driven by the need for lightweight solutions and fuel efficiency, which were once crucial factors in the development of automobile manufacturing. Apart from that, the sudden upsurge in interest in electric and hybrid vehicles has become quite noticeable and influences the market for automotive bushing technologies. Since such cars are becoming more common, manufacturers have to revise their bushing designs to satisfy the special requirements of electromobiles. Apart from the shift towards electric mobility, there is also a tendency towards sustainability in car manufacturing, resulting in the choice of materials and methods of production for making bushings. Furthermore, smart technology integration into automotive bushings and sensors is gaining momentum at present. These smart bushings adjust road changes by giving real-time feedback to vehicle suspension systems. Manufacturers include sensors in order to improve ride quality and enhance vehicle stability and safety as well. The development of intelligent bushing technologies represents a step towards creating more responsive and adaptive suspension systems in modern vehicles. Globalization and expansion of automobile markets in developing countries are other major factors influencing trends within automotive bushing technology. As automakers venture into new markets, there is an increase in the demand for reliable and affordable suspension solutions. Therefore, the Automotive Bushing Technologies Market is going through significant changes driven by multiple factors, as stated above. These include the adoption of advanced materials riding on a wave of electric mobility integration of smart technologies leading to a focus on sustainability; these trends are changing how automotive bushes are designed, manufactured, and used today.

Leave a Comment