Regulatory Support and Compliance

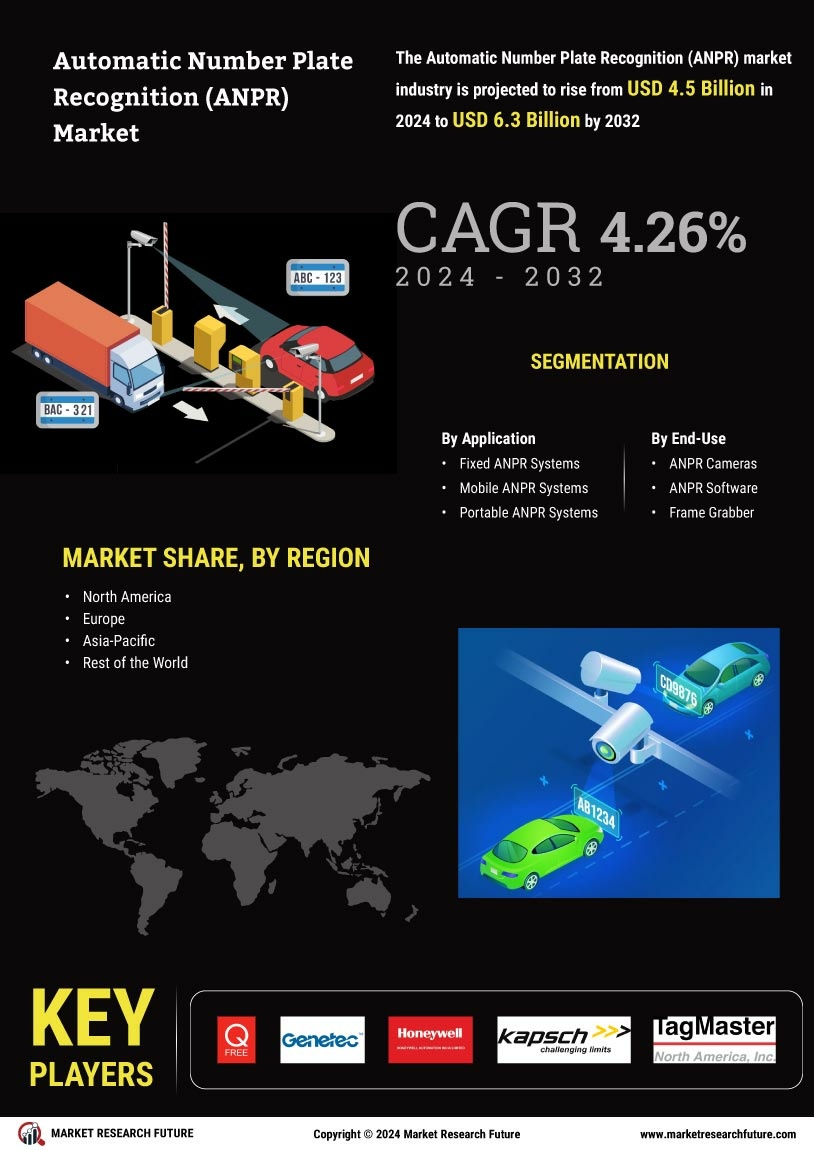

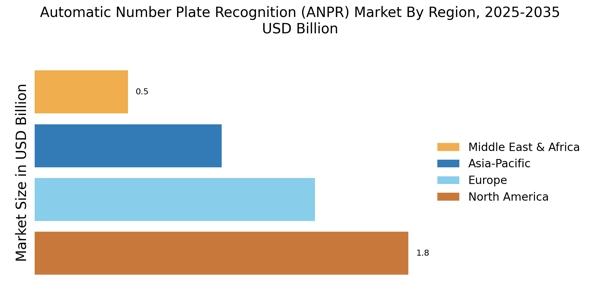

The Automatic Number Plate Recognition Market (ANPR) Market is benefiting from increasing regulatory support and compliance requirements. Governments and regulatory bodies are recognizing the potential of ANPR technology in enhancing public safety and law enforcement capabilities. As a result, there is a growing emphasis on the implementation of ANPR systems in various applications, including traffic monitoring and crime prevention. This regulatory push is likely to create a favorable environment for market growth, as organizations seek to comply with legal standards while leveraging the advantages of ANPR technology. Market data suggests that regions with stringent regulatory frameworks are witnessing accelerated adoption of ANPR solutions, indicating a strong correlation between regulatory support and market expansion.

Growing Adoption in Parking Management

The Automatic Number Plate Recognition Market (ANPR) Market is experiencing a notable increase in adoption within parking management systems. As urban areas face challenges related to parking space availability and traffic congestion, ANPR technology offers a viable solution for efficient parking operations. By automating the process of vehicle identification and payment collection, ANPR systems streamline parking management, reduce operational costs, and enhance user experience. Recent statistics indicate that the parking management segment is projected to grow significantly, with ANPR solutions playing a pivotal role in optimizing parking resources. This trend reflects a broader movement towards automation and efficiency in urban infrastructure, further propelling the ANPR market.

Increased Demand for Security Solutions

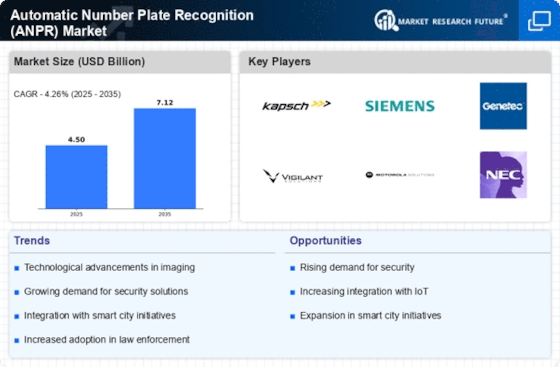

The Automatic Number Plate Recognition Market (ANPR) Market is witnessing heightened demand for security solutions across various sectors. As urbanization continues to rise, the need for effective surveillance and monitoring systems becomes increasingly critical. ANPR technology is being adopted by law enforcement agencies, parking management systems, and toll collection services to enhance security measures. The ability to quickly identify vehicles of interest and monitor traffic patterns is driving the adoption of ANPR systems. Market data suggests that the security segment is expected to account for a substantial share of the ANPR market, as organizations prioritize safety and crime prevention. This trend indicates a growing recognition of the importance of integrating ANPR technology into broader security frameworks.

Integration with Smart City Initiatives

The Automatic Number Plate Recognition Market (ANPR) Market is closely linked to the development of smart city initiatives. As cities evolve to incorporate advanced technologies for improved urban management, ANPR systems are becoming integral components of these frameworks. The ability to collect and analyze vehicular data supports traffic management, congestion reduction, and enhanced public safety. Moreover, the integration of ANPR with other smart technologies, such as traffic lights and public transportation systems, is likely to create a more cohesive urban environment. Market analysis indicates that investments in smart city projects are expected to drive the demand for ANPR solutions, as municipalities seek to leverage data-driven insights for better decision-making and resource allocation.

Technological Advancements in ANPR Systems

The Automatic Number Plate Recognition Market (ANPR) Market is experiencing a surge in technological advancements that enhance the efficiency and accuracy of license plate recognition. Innovations such as artificial intelligence and machine learning algorithms are being integrated into ANPR systems, allowing for real-time data processing and improved image recognition capabilities. This evolution is likely to drive market growth, as organizations seek to adopt cutting-edge solutions that can handle diverse environmental conditions. Furthermore, the introduction of high-resolution cameras and advanced optical character recognition technologies is expected to bolster the performance of ANPR systems. According to recent data, the market for ANPR technology is projected to grow at a compound annual growth rate of over 10% in the coming years, indicating a robust demand for these advanced systems.