Automated Test Equipment Size

Automated Test Equipment Market Growth Projections and Opportunities

The global automated test equipment market is poised for significant growth in the coming years, driven by substantial investments in research and development (R&D) and testing activities by companies. The escalating demand for electronic components like Integrated Circuits (ICs) and circuit boards, coupled with widespread integration of these components across diverse industries, is expected to fuel the expansion of the automated test equipment market. Automated test equipment, also known as automatic test equipment (ATE), refers to computer-controlled devices designed to test electronic devices for functionality and performance. It plays a crucial role in conducting stress tests with minimal human intervention, utilizing a combination of hardware, sensors, and software to collect and analyze test results.

Several factors contribute to the anticipated growth of the market, including the increasing adoption of consumer electronics devices and advancements in telecommunication and networking technologies. The deployment of 5G networks globally has notably boosted the adoption of automated test equipment.

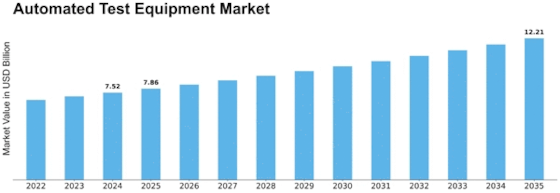

As of 2019, the global automated test equipment market was valued at USD 4,471.7 million, and it is projected to reach USD 11,711.7 million by 2026, demonstrating a Compound Annual Growth Rate (CAGR) of 15.16%. This comprehensive study delves into industry trends, market dynamics, competitive landscapes, and growth opportunities within the global automated test equipment market. The report categorizes the market based on components, types, applications, and regions/countries.

Components of the automated test equipment market include industrial PC, mass interconnect, prober, handler, and semiconductor. Types encompass non-memory ATE, memory ATE, and discrete ATE. Applications span consumer electronics, automotive, aerospace and defense, telecommunication, and others. The study covers regions such as North America, Europe, Asia-Pacific, and the rest of the world. North America is anticipated to maintain its market dominance, fueled by the rapid adoption of digital technology, increased investments in the aerospace and defense sector, and the growth of the semiconductor industry.

The automated test equipment market is characterized by high competitiveness, with numerous vendors offering feature-rich and innovative products. Key vendors in this market include Chroma ATE Inc, Cobham PLC, Astronics Test Systems, Agilent Technologies, Teradyne Inc, Advantest Corporation, LTX-Credence Corporation, Roos Instrument Inc, National Instruments Corporation, Marvin Test Solutions Inc, and Advance Integration LLC. To stay competitive and excel in the global market, these players employ various growth strategies such as product enhancement, launches, partnerships, agreements, and collaborations.

Notably, the suppliers of ATEs and their technologies encompass manufacturers producing various types and components integral to the final product. The buyers of these sensors span across industries like automotive, aerospace, and medical sectors. The interplay between these stakeholders forms a dynamic ecosystem that propels the growth of the automated test equipment market.

Leave a Comment