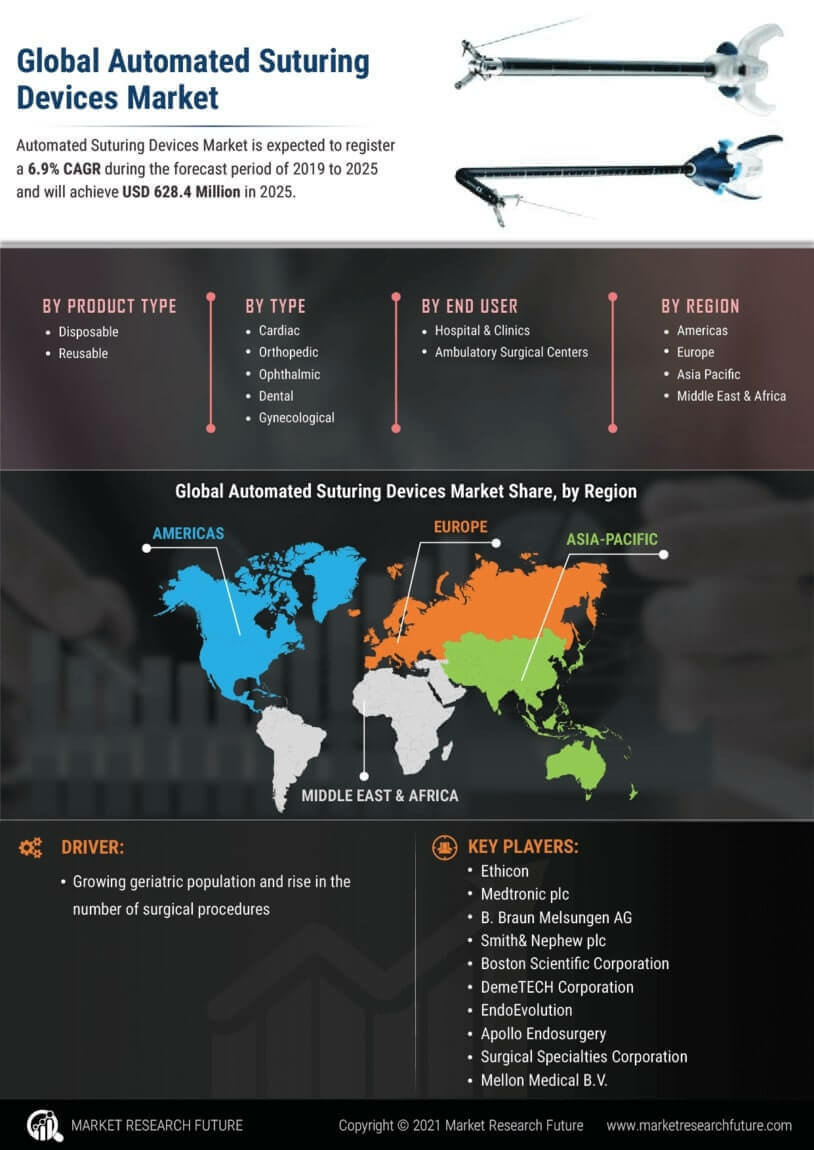

Surge in Surgical Procedures

The Automated Suturing Devices Market is witnessing a surge in the number of surgical procedures performed annually. This increase is attributed to various factors, including an aging population and the rising prevalence of chronic diseases that require surgical intervention. As the volume of surgeries rises, the demand for efficient and reliable suturing solutions grows correspondingly. Market statistics indicate that the number of surgical procedures is expected to increase by approximately 5% annually, further propelling the need for automated suturing devices. This trend underscores the importance of these devices in meeting the demands of modern surgical practices.

Increased Focus on Patient Safety

The Automated Suturing Devices Market is also shaped by an increased focus on patient safety and outcomes. Healthcare providers are prioritizing technologies that enhance surgical precision and reduce the likelihood of complications. Automated suturing devices are designed to minimize human error, thereby improving the overall safety of surgical procedures. Market analysis reveals that hospitals and surgical centers are investing in these devices to ensure better patient outcomes and satisfaction. This trend is likely to drive the adoption of automated suturing devices, as they align with the broader goals of enhancing patient care and safety in surgical environments.

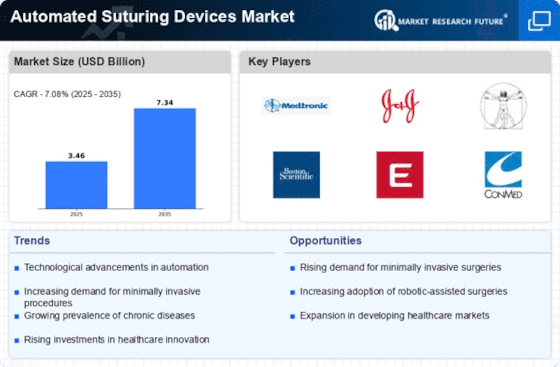

Rising Demand for Minimally Invasive Surgeries

The Automated Suturing Devices Market is significantly influenced by the rising demand for minimally invasive surgeries. These procedures are preferred due to their associated benefits, such as reduced recovery times and lower risk of complications. As healthcare providers increasingly adopt minimally invasive techniques, the need for efficient suturing solutions becomes paramount. The market data indicates that minimally invasive surgeries account for a substantial share of surgical procedures, with projections suggesting that this trend will continue to grow. Consequently, automated suturing devices are becoming essential tools in surgical settings, facilitating quicker and more effective suturing processes.

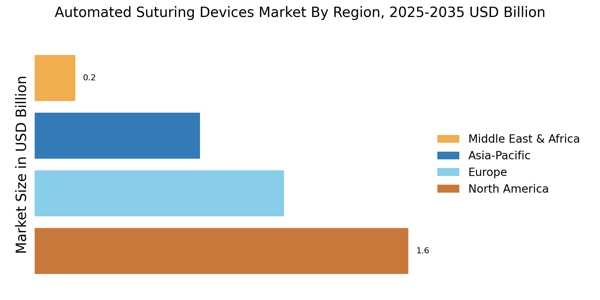

Growing Investment in Healthcare Infrastructure

The Automated Suturing Devices Market is benefiting from growing investments in healthcare infrastructure across various regions. Governments and private entities are allocating substantial resources to enhance surgical facilities and adopt advanced medical technologies. This investment trend is likely to facilitate the integration of automated suturing devices into surgical practices, as healthcare providers seek to improve operational efficiency and patient care. Market data suggests that healthcare expenditure is projected to rise significantly, creating a favorable environment for the growth of automated suturing devices. This influx of capital is expected to drive innovation and expand the market for these essential surgical tools.

Technological Advancements in Automated Suturing Devices

The Automated Suturing Devices Market is experiencing rapid technological advancements that enhance the efficiency and precision of surgical procedures. Innovations such as robotic-assisted suturing systems and smart suturing devices are becoming increasingly prevalent. These technologies not only improve the accuracy of suturing but also reduce the time required for surgical interventions. According to recent data, the market for automated suturing devices is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This growth is driven by the increasing adoption of advanced surgical techniques and the rising demand for minimally invasive surgeries, which require sophisticated suturing solutions.