Focus on Personalized Medicine

The shift towards personalized medicine is significantly influencing the Automated Cell Culture Market. As healthcare moves towards tailored therapies, the need for precise and reproducible cell culture techniques becomes critical. Automated systems enable researchers to efficiently generate patient-specific cell lines and conduct high-throughput screening of drug responses. This capability is essential for developing personalized treatment plans that are more effective and have fewer side effects. The market for personalized medicine is projected to expand rapidly, with estimates suggesting it could reach USD 2 trillion by 2030. This trend is likely to drive the adoption of automated cell culture technologies, as they provide the necessary tools for researchers to explore and validate personalized therapeutic approaches.

Rising Demand for Biopharmaceuticals

The increasing demand for biopharmaceuticals is a key driver in the Automated Cell Culture Market. As the healthcare sector shifts towards biologics, the need for efficient and scalable cell culture processes becomes paramount. Automated systems facilitate the production of monoclonal antibodies, vaccines, and cell therapies, which are critical in treating various diseases. According to recent estimates, the biopharmaceutical market is anticipated to grow at a compound annual growth rate of over 8% through the next few years. This surge in demand necessitates the adoption of automated cell culture technologies to meet production requirements while ensuring consistency and quality. Consequently, the integration of automation in cell culture is likely to become increasingly prevalent as biopharmaceutical companies seek to enhance their manufacturing capabilities.

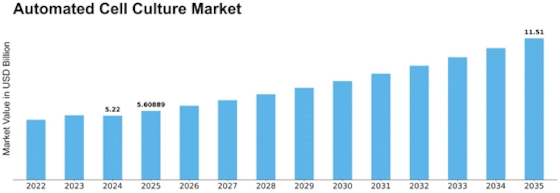

Technological Advancements in Automation

The Automated Cell Culture Market is experiencing rapid technological advancements that enhance efficiency and precision in cell culture processes. Innovations such as robotics, artificial intelligence, and machine learning are being integrated into automated systems, allowing for higher throughput and reduced human error. For instance, automated platforms can now perform complex tasks such as cell monitoring, media changes, and data analysis with minimal intervention. This shift towards automation is projected to drive market growth, with the industry expected to reach a valuation of approximately USD 5 billion by 2026. As these technologies continue to evolve, they are likely to redefine standard practices in cell culture, making automation an essential component in research and production environments.

Increased Investment in Research and Development

Investment in research and development (R&D) is a significant driver of growth in the Automated Cell Culture Market. As pharmaceutical and biotechnology companies allocate more resources to R&D, the demand for advanced cell culture technologies rises. Automation plays a crucial role in streamlining research processes, allowing for faster experimentation and data collection. Recent reports indicate that R&D spending in the life sciences sector is expected to exceed USD 200 billion by 2025. This influx of funding is likely to accelerate the development and adoption of automated cell culture systems, as researchers seek to enhance productivity and innovation in their projects. Consequently, the market for automated cell culture is poised for substantial growth as R&D efforts intensify.

Regulatory Support for Advanced Cell Culture Techniques

Regulatory bodies are increasingly recognizing the importance of advanced cell culture techniques, which is positively impacting the Automated Cell Culture Market. Supportive regulations and guidelines are being established to facilitate the use of automated systems in research and production. These regulations aim to ensure safety, efficacy, and quality in biopharmaceutical manufacturing processes. As regulatory frameworks evolve, they are likely to encourage the adoption of automation in cell culture, as companies seek to comply with stringent standards. This trend is expected to drive market growth, as organizations invest in automated technologies to meet regulatory requirements while enhancing operational efficiency. The alignment of regulatory support with technological advancements may create a favorable environment for the expansion of the automated cell culture market.

Leave a Comment