Rising Healthcare Expenditure

The atrial fibrillation-systems market is benefiting from the rising healthcare expenditure in Japan. As the government and private sectors increase their investments in healthcare infrastructure, the availability of advanced medical technologies is improving. In 2025, Japan's healthcare expenditure is projected to reach ¥50 trillion, reflecting a commitment to enhancing healthcare services. This increase in funding is likely to support the development and deployment of atrial fibrillation systems, making them more accessible to healthcare providers and patients alike. Furthermore, as healthcare budgets expand, there is a greater opportunity for innovation and the introduction of cutting-edge solutions in the atrial fibrillation-systems market.

Government Initiatives and Funding

Government initiatives aimed at improving cardiovascular health are significantly influencing the atrial fibrillation-systems market. In Japan, the Ministry of Health, Labour and Welfare has launched various programs to promote early detection and management of cardiovascular diseases, including atrial fibrillation. These initiatives often come with funding allocations that support research and development in medical technologies. For instance, recent budgets have earmarked over ¥10 billion for cardiovascular health initiatives, which could potentially enhance the availability and accessibility of atrial fibrillation systems. Such government backing not only boosts market confidence but also encourages private sector investment in innovative solutions.

Rising Incidence of Atrial Fibrillation

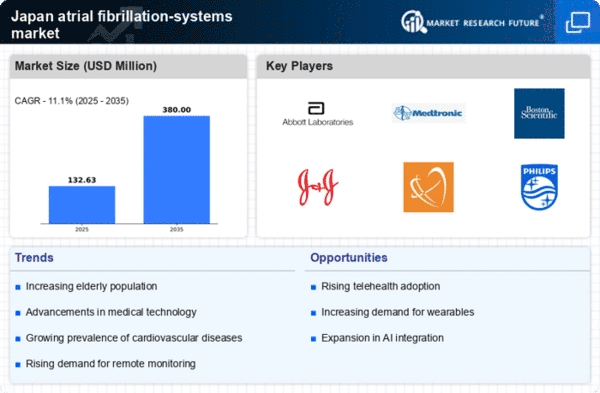

the atrial fibrillation-systems market is experiencing growth due to the increasing incidence of atrial fibrillation in Japan. Recent studies indicate that approximately 1.5 million individuals in Japan are diagnosed with AF, a condition that significantly raises the risk of stroke and other cardiovascular complications. This rising prevalence necessitates advanced monitoring and treatment solutions, thereby driving demand for atrial fibrillation systems. The aging population, which is projected to reach 36% of the total population by 2040, further exacerbates this issue. As healthcare providers seek to manage this growing patient demographic effectively, investments in atrial fibrillation systems are likely to increase, fostering innovation and expansion within the market.

Technological Integration in Healthcare

The integration of advanced technologies into healthcare systems is a pivotal driver for the atrial fibrillation-systems market. Innovations such as telemedicine, wearable devices, and mobile health applications are transforming patient monitoring and management. In Japan, the adoption of these technologies is on the rise, with a reported 30% increase in the use of telehealth services among patients with chronic conditions. This trend not only enhances patient engagement but also facilitates timely interventions, thereby improving outcomes for those with atrial fibrillation. As healthcare providers increasingly leverage technology to streamline operations and enhance patient care, the demand for sophisticated atrial fibrillation systems is expected to grow.

Growing Demand for Remote Patient Monitoring

The demand for remote patient monitoring solutions is a crucial driver for the atrial fibrillation-systems market. With the increasing emphasis on patient-centered care, healthcare providers in Japan are seeking ways to monitor patients outside traditional clinical settings. A recent survey indicated that 65% of healthcare professionals believe remote monitoring can significantly improve patient outcomes for those with atrial fibrillation. This shift towards remote care is likely to spur the development of advanced atrial fibrillation systems that facilitate continuous monitoring and data collection. As patients become more engaged in their health management, the market for these systems is poised for substantial growth.