Rising Awareness and Education

Increased awareness and education regarding atopic dermatitis are crucial drivers for the Atopic Dermatitis Treatment Market. Healthcare professionals and patients are becoming more informed about the condition, its triggers, and available treatment options. Educational initiatives by dermatology associations and patient advocacy groups are instrumental in disseminating knowledge about effective management strategies. This heightened awareness encourages patients to seek timely medical advice, leading to earlier diagnosis and treatment. As a result, the demand for various therapeutic options is likely to rise, contributing to market expansion. Moreover, the emphasis on patient education fosters adherence to treatment regimens, which may enhance overall treatment efficacy within the Atopic Dermatitis Treatment Market.

Advancements in Treatment Modalities

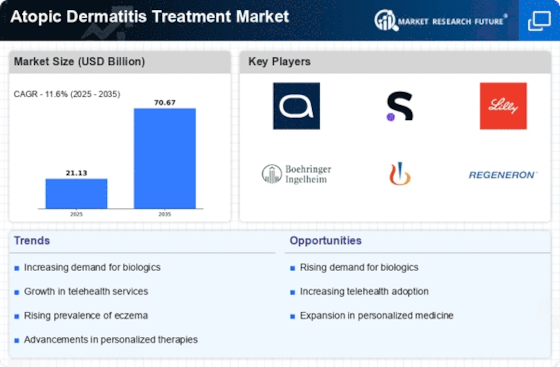

Technological advancements in treatment modalities are transforming the Atopic Dermatitis Treatment Market. The introduction of biologics, such as monoclonal antibodies, has revolutionized the management of moderate to severe atopic dermatitis. These therapies target specific pathways involved in the inflammatory process, offering patients new hope for effective management. Furthermore, the development of topical corticosteroids and non-steroidal anti-inflammatory agents has enhanced treatment options for mild to moderate cases. The market is witnessing a shift towards personalized medicine, where treatments are tailored to individual patient profiles, potentially improving outcomes. As research continues to unveil new therapeutic targets, the Atopic Dermatitis Treatment Market is poised for substantial growth driven by these advancements.

Regulatory Support for New Treatments

Regulatory support for the approval of new treatments is a vital driver for the Atopic Dermatitis Treatment Market. Regulatory agencies are increasingly recognizing the need for effective therapies to address the challenges posed by atopic dermatitis. The expedited approval processes for innovative treatments, particularly biologics, are facilitating quicker access to new options for patients. This supportive regulatory environment encourages pharmaceutical companies to invest in the development of novel therapies, thereby enhancing the overall treatment landscape. As more treatments receive regulatory approval, the Atopic Dermatitis Treatment Market is likely to experience accelerated growth, providing patients with a wider range of effective management solutions.

Increasing Prevalence of Atopic Dermatitis

The rising incidence of atopic dermatitis is a pivotal driver for the Atopic Dermatitis Treatment Market. Recent estimates indicate that approximately 10-20% of children and 1-3% of adults are affected by this chronic skin condition. This growing prevalence necessitates the development and availability of effective treatment options, thereby propelling market growth. As awareness of atopic dermatitis increases, more individuals seek medical intervention, further expanding the patient population. The demand for innovative therapies, including topical treatments and systemic medications, is likely to surge as healthcare providers aim to address the diverse needs of patients. Consequently, the increasing prevalence of atopic dermatitis is expected to significantly influence the trajectory of the Atopic Dermatitis Treatment Market.

Growing Investment in Research and Development

The growing investment in research and development (R&D) is a significant driver for the Atopic Dermatitis Treatment Market. Pharmaceutical companies are increasingly allocating resources to discover and develop novel therapies that address the unmet needs of patients. This focus on R&D is likely to yield innovative treatment options, including new biologics and small molecules that target specific pathways involved in atopic dermatitis. Additionally, collaborations between academia and industry are fostering the development of cutting-edge therapies. As the pipeline for new treatments expands, the Atopic Dermatitis Treatment Market is expected to benefit from a broader array of options, ultimately improving patient outcomes and satisfaction.