Rising Awareness and Education

The growing awareness and education surrounding atopic dermatitis are crucial factors influencing the Atopic Dermatitis Market. Increased efforts by healthcare organizations and advocacy groups to educate patients and caregivers about the condition are leading to earlier diagnosis and treatment. This heightened awareness is likely to result in a surge in patient consultations and treatment-seeking behavior. Furthermore, educational campaigns are emphasizing the importance of managing atopic dermatitis effectively, which may lead to improved adherence to treatment regimens. As patients become more informed about their condition, they are more likely to explore various treatment options, thereby expanding the market. The emphasis on education is expected to play a significant role in shaping the future landscape of the Atopic Dermatitis Market.

Advancements in Treatment Modalities

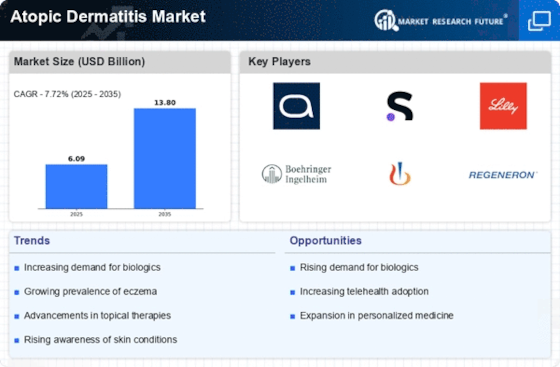

Innovations in treatment modalities are transforming the Atopic Dermatitis Market. The introduction of novel therapies, including biologics and targeted treatments, has revolutionized the management of atopic dermatitis. For instance, biologics such as dupilumab have shown promising results in clinical trials, leading to increased adoption among healthcare providers. The market for these advanced therapies is projected to grow substantially, with estimates suggesting a compound annual growth rate of over 15% in the coming years. Additionally, the development of topical corticosteroids and non-steroidal anti-inflammatory drugs continues to evolve, providing patients with a broader range of options. These advancements not only improve patient outcomes but also drive competition among pharmaceutical companies, further stimulating the Atopic Dermatitis Market.

Growing Investment in Dermatology Research

The surge in investment in dermatology research is a notable driver of the Atopic Dermatitis Market. Pharmaceutical companies and research institutions are increasingly allocating resources to explore new treatment options and understand the underlying mechanisms of atopic dermatitis. This focus on research is likely to yield innovative therapies that address the diverse needs of patients. Recent funding trends indicate a significant increase in clinical trials aimed at developing novel treatments, which could reshape the market landscape. Additionally, collaborations between academia and industry are fostering a more robust research environment, potentially accelerating the development of effective therapies. As investment in dermatological research continues to grow, it is expected to have a lasting impact on the Atopic Dermatitis Market.

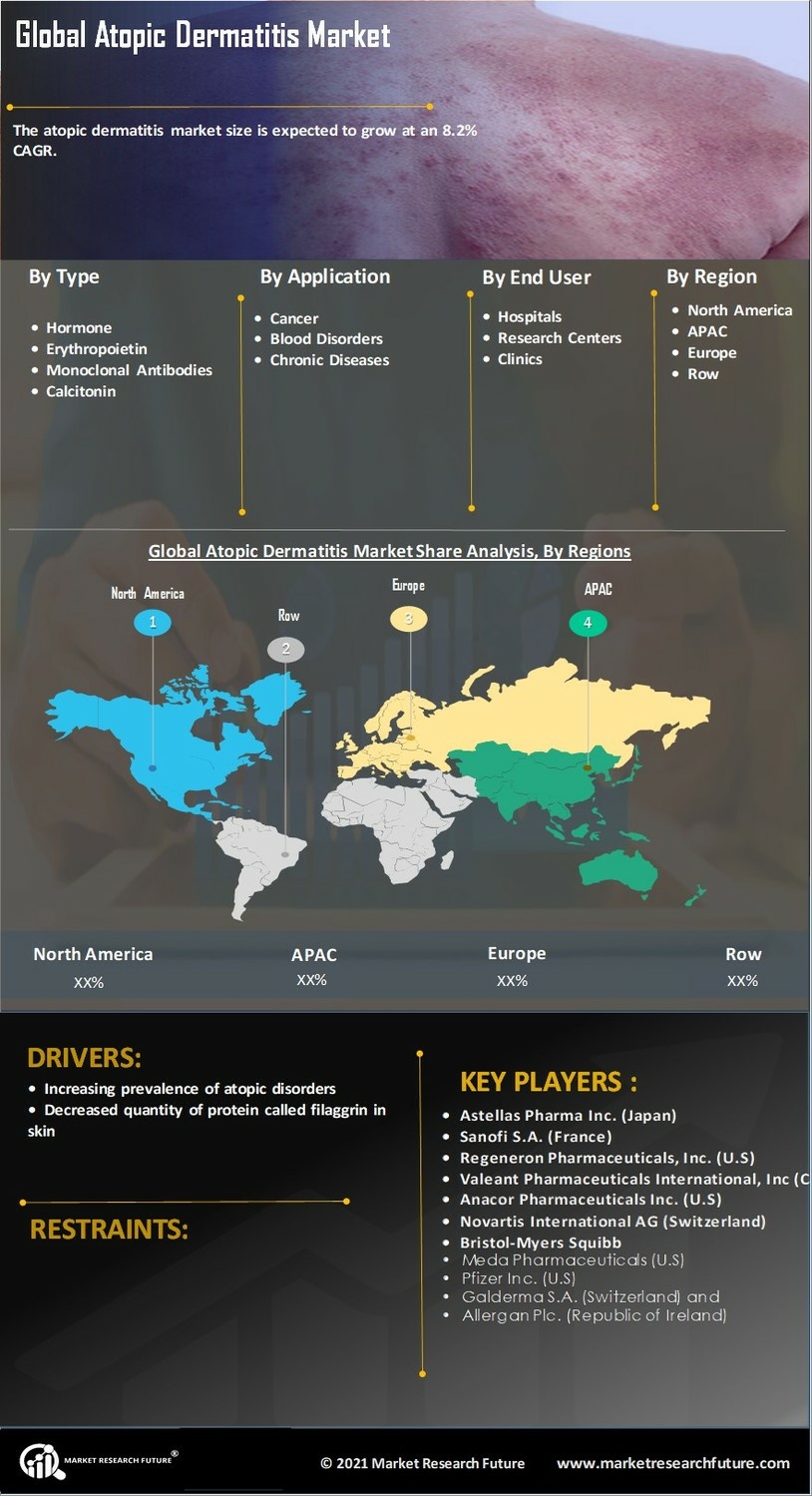

Increasing Prevalence of Atopic Dermatitis

The rising incidence of atopic dermatitis is a pivotal driver in the Atopic Dermatitis Market. Recent estimates indicate that approximately 10-20% of children and 1-3% of adults are affected by this chronic skin condition. This increasing prevalence is likely to escalate the demand for effective treatment options, thereby propelling market growth. As awareness of atopic dermatitis expands, more individuals are seeking medical advice and treatment, which further stimulates the market. The growing recognition of the condition's impact on quality of life is also contributing to heightened demand for innovative therapies. Consequently, pharmaceutical companies are investing in research and development to address this unmet need, which is expected to enhance the Atopic Dermatitis Market significantly.

Telehealth Adoption for Dermatological Care

The integration of telehealth services into dermatological care is emerging as a significant driver in the Atopic Dermatitis Market. Telemedicine offers patients convenient access to healthcare professionals, enabling timely consultations and follow-ups without the need for in-person visits. This trend is particularly beneficial for individuals with atopic dermatitis, as it allows for continuous monitoring and management of their condition. The convenience of telehealth is likely to encourage more patients to seek treatment, thereby increasing the overall market size. Moreover, the ability to provide remote care can enhance patient engagement and satisfaction, which may lead to better treatment outcomes. As telehealth continues to gain traction, its impact on the Atopic Dermatitis Market is expected to be profound.