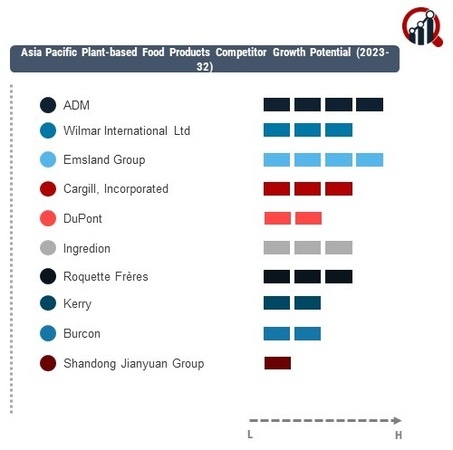

Top Industry Leaders in the Asia Pacific Plant-based Food Products Market

Strategies Adopted by Asia Pacific Plant Based Food Products Key Players

The Asia Pacific plant-based food products market has witnessed a surge in demand driven by increasing consumer awareness of health and environmental concerns. This sector is characterized by a dynamic competitive landscape shaped by key players, their strategies, market share analysis factors, new entrants, industry news, investment trends, the overall competitive scenario, and recent developments, notably in 2023.

List of Key Players

- ADM

- Wilmar International Ltd (2020)

- Emsland Group

- Cargill, Incorporated

- DuPont

- Ingredion

- Roquette Frères

- Kerry

- Burcon

- Shandong Jianyuan Group

- DSM

Key players in the Asia Pacific plant-based food products market are strategically focused on product innovation, marketing, and partnerships to gain a competitive edge. Companies like Beyond Meat and Impossible Foods are actively collaborating with local distributors and retailers to expand their market reach. Oatly, known for its plant-based milk alternatives, has engaged in strategic partnerships with cafes and restaurants to enhance its product visibility.

Factors for Market Share Analysis

Market share analysis in the plant-based food products sector is influenced by brand recognition, product quality, distribution channels, and pricing strategies. Companies that effectively balance these factors tend to secure a larger market share. Additionally, adherence to local tastes and preferences plays a crucial role, as consumers in the Asia Pacific region often have unique dietary habits.

New and Emerging Companies

The Asia Pacific region has seen a surge in the emergence of new plant-based food companies catering to diverse cuisines. Startups like Karana in Singapore, specializing in plant-based alternatives to meat sourced from jackfruit, have gained attention. These emerging players focus on niche segments, providing innovative solutions to address specific dietary needs.

Industry News and Current Company Updates

Recent industry news highlights the growing acceptance of plant-based alternatives in the Asia Pacific region. Local governments are encouraging plant-based initiatives, with Singapore unveiling plans to support alternative protein research. Major fast-food chains are also increasingly incorporating plant-based options into their menus, showcasing a shift in consumer preferences and industry dynamics.

Investment Trends

Investment trends in the Asia Pacific plant-based food market reveal a surge in funding for startups and established companies alike. Investors are attracted to ventures that demonstrate potential for scalability and innovation in plant-based product offerings. The trend aligns with the broader global movement towards sustainable and ethical food choices.

Overall Competitive Scenario

The overall competitive scenario in the Asia Pacific plant-based food products market is marked by a mix of international and local players. Established global brands compete with local startups that have a deep understanding of regional tastes. The competition is intensifying as consumers seek healthier and sustainable alternatives, prompting companies to invest in research and development, marketing, and strategic partnerships.

Recent Development

The Asia Pacific plant-based food market witnessed a significant development with the mainstream integration of plant-based alternatives into traditional diets. One notable trend was the adoption of plant-based proteins in Asian cuisines, where soy, tofu, and innovative ingredients like jackfruit gained prominence. This shift was not only observed in urban centers but also in suburban and rural areas, signifying a widespread acceptance of plant-based options.

Additionally, 2023 saw a surge in plant-based dairy alternatives, with Oatly expanding its market presence in the region. The company's strategic partnerships with local cafes and grocery stores contributed to a notable increase in the availability and awareness of oat milk and other dairy substitutes. This aligns with the growing consumer consciousness regarding health and environmental impact.

Furthermore, major food retailers in the Asia Pacific region began dedicating more shelf space to plant-based products, reflecting the increasing demand. Beyond Meat and Impossible Foods capitalized on this trend by enhancing their distribution networks and forming alliances with supermarkets to ensure a broader reach for their plant-based meat alternatives.

Government initiatives also played a role in shaping the plant-based food landscape in 2023. Several countries in the region introduced incentives and regulations to promote the production and consumption of plant-based foods, fostering a conducive environment for market growth. This support from regulatory bodies signaled a recognition of the environmental and health benefits associated with plant-based diets.