Enhanced Quality Control

Quality control remains a critical aspect of manufacturing, and the Artificial Intelligence (AI) in Manufacturing Market is evolving to address this need. AI technologies facilitate advanced quality assurance processes by utilizing computer vision and data analytics to detect defects and anomalies in products. This capability not only minimizes waste but also ensures that products meet stringent quality standards. Recent studies indicate that manufacturers employing AI for quality control have seen defect rates decrease by as much as 25%. The integration of AI into quality management systems allows for continuous monitoring and real-time feedback, which is essential for maintaining high-quality production. As manufacturers strive to enhance their product offerings, the demand for AI-driven quality control solutions is anticipated to rise, further propelling the market.

Data-Driven Decision Making

The shift towards data-driven decision making is a prominent driver in the Artificial Intelligence (AI) in Manufacturing Market. Manufacturers are increasingly leveraging AI to analyze large datasets, enabling them to make informed decisions based on predictive analytics. This approach not only enhances operational efficiency but also aids in identifying market trends and consumer preferences. Reports suggest that organizations utilizing AI for data analysis can improve their forecasting accuracy by up to 20%. As the manufacturing landscape becomes more complex, the ability to harness data effectively is crucial for maintaining a competitive edge. Consequently, the demand for AI solutions that facilitate data-driven insights is expected to grow, influencing the overall trajectory of the market.

Customization and Personalization

The demand for customization and personalization in manufacturing is on the rise, and the Artificial Intelligence (AI) in Manufacturing Market is adapting to meet this need. AI technologies enable manufacturers to produce tailored products that cater to specific customer preferences, enhancing customer satisfaction and loyalty. By utilizing AI algorithms, manufacturers can analyze consumer data to identify trends and preferences, allowing for more targeted production strategies. This shift towards personalized manufacturing is expected to grow, with projections indicating that the market for customized products could expand by over 20% in the coming years. As manufacturers strive to differentiate themselves in a crowded marketplace, the integration of AI for customization and personalization will likely play a pivotal role in shaping the future of the industry.

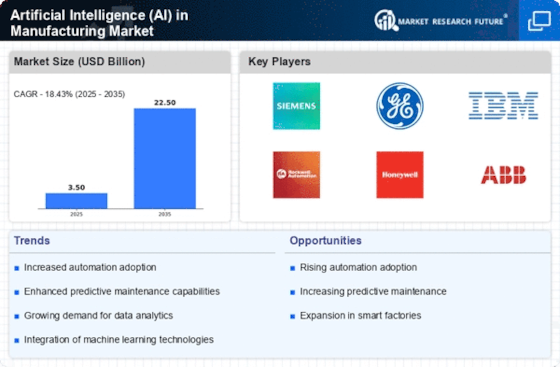

Increased Efficiency and Productivity

The Artificial Intelligence (AI) in Manufacturing Market is witnessing a surge in demand for solutions that enhance operational efficiency and productivity. AI technologies, such as machine learning and robotics, enable manufacturers to automate repetitive tasks, thereby reducing human error and increasing output. According to recent data, companies that have integrated AI into their manufacturing processes report productivity improvements of up to 30%. This trend is likely to continue as more manufacturers recognize the potential of AI to streamline operations and optimize resource allocation. Furthermore, the ability to analyze vast amounts of data in real-time allows for quicker decision-making, which is crucial in a competitive landscape. As a result, the adoption of AI-driven solutions is expected to grow, driving the overall market forward.

Cost Reduction and Resource Optimization

Cost reduction is a primary concern for manufacturers, and the Artificial Intelligence (AI) in Manufacturing Market offers solutions that address this challenge. By automating processes and optimizing resource allocation, AI technologies can significantly lower operational costs. For instance, predictive maintenance powered by AI can reduce equipment downtime, leading to substantial savings. Data indicates that manufacturers implementing AI-driven maintenance strategies can achieve cost reductions of up to 15%. Additionally, AI can enhance supply chain efficiency by predicting demand fluctuations, thereby minimizing excess inventory and associated costs. As manufacturers seek to improve their bottom line, the adoption of AI solutions for cost reduction and resource optimization is likely to accelerate, driving market growth.