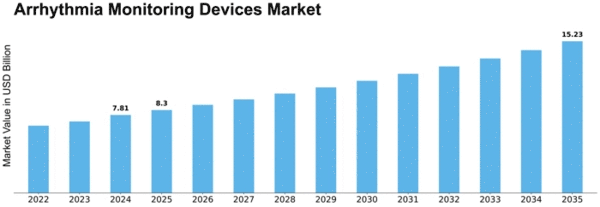

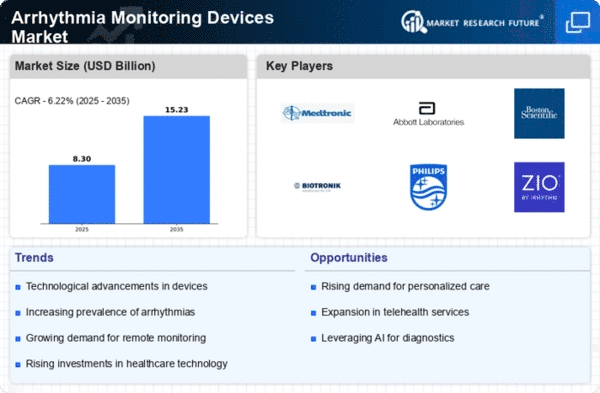

Arrhythmia Monitoring Devices Size

Arrhythmia Monitoring Devices Market Growth Projections and Opportunities

Arrhythmia Monitoring Devices Market is expected to record a CAGR of 6.2% and attain USD 6.12 billion by 2030 in the forecast period. The Arrhythmia Monitoring Devices Market's dynamics and growth path are influenced by a combination of several market factors. The global prevalence of cardiovascular diseases like arrhythmias is an important factor driving the demand for monitoring devices that can identify and manage them as well. Another key market driver is the growing old population, which increases its vulnerability to cardiovascular problems, thus requiring reliable arrhythmia monitors. It has resulted in more emphasis on remote monitoring capabilities so that healthcare practitioners can observe the heart health of their patients without being forced to make frequent visits to hospitals. Additionally, the Arrhythmia Monitoring Devices Market is also significantly influenced by government initiatives and policies. This move towards preventive healthcare and early disease detection at the global level has seen governments invest in healthcare infrastructure, including modern monitoring technologies, which are being integrated into the same systems. There have been significant advancements in awareness and education regarding cardiovascular health for individuals, leading to this market expansion, too. When people understand the importance of checking their heart conditions, it consequently leads to the increased need for personal monitoring devices as well. This explains why there is an increase in demand for home-based monitoring devices that enable early detection of arrhythmias, thereby promoting a preventive care approach rather than the reactive one favored before by physicians. Most importantly, the importance of remote patient monitoring has been brought about by the COVID-19 pandemic, which altered everything we know about our lives today. This shift towards telehealth and virtual care has accelerated the adoption of arrhythmia monitoring devices, ensuring continuous patient monitoring while minimizing the risk of exposure. For instance, large parts of future pandemics will be handled through remote patient surveillance since global health systems acknowledge not only during but even beyond epidemics till efficient long-term medical service delivery. The Arrhythmia Monitoring Devices Market would not be what it currently looks like without its intense competition and healthcare industry mergers. This, in turn, influences product innovation, pricing strategies, and market penetration by the major players.

Leave a Comment