Shift Towards Cloud-Based Solutions

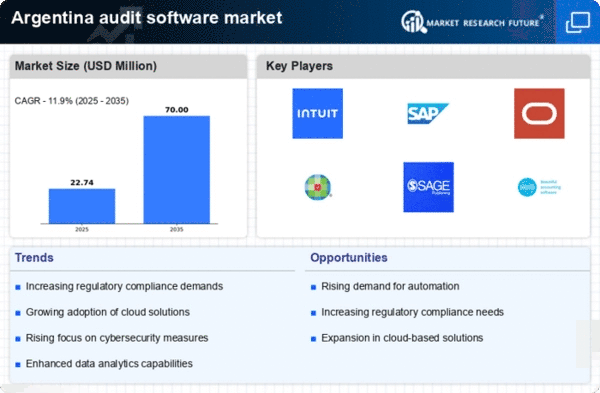

The shift towards cloud-based solutions is transforming the audit software market in Argentina, as organizations seek flexibility and scalability in their operations. Cloud-based audit software offers numerous advantages, including remote access, cost savings, and automatic updates. In 2025, it is estimated that cloud-based solutions will represent over 60% of the total audit software market share. This trend is particularly appealing to businesses looking to reduce IT infrastructure costs while enhancing collaboration among teams. As more organizations embrace digital transformation, the demand for cloud-based audit software is expected to rise, making this shift a crucial driver in the industry.

Rising Need for Financial Transparency

The audit software market in Argentina is experiencing a notable surge in demand driven by the increasing need for financial transparency among organizations. As businesses face heightened scrutiny from stakeholders, the adoption of audit software becomes essential for ensuring accurate financial reporting. In 2025, it is estimated that approximately 70% of companies in Argentina will prioritize transparency in their financial practices, leading to a significant uptick in software utilization. This trend is further supported by regulatory bodies advocating for clearer financial disclosures, thereby propelling the audit software market forward. The emphasis on transparency not only aids in compliance but also enhances trust among investors and clients, making it a critical driver in the industry.

Increased Regulatory Compliance Requirements

The audit software market in Argentina is being propelled by the rising regulatory compliance requirements imposed on businesses. As local and international regulations become more stringent, organizations are compelled to adopt comprehensive audit solutions to ensure adherence. In 2025, it is projected that compliance-related expenditures will increase by approximately 25% across various sectors, driving the demand for audit software. Companies are recognizing that failure to comply can result in severe penalties and reputational damage, thus prioritizing investments in audit software that can facilitate compliance monitoring and reporting. This heightened focus on regulatory compliance is likely to remain a significant driver for the audit software market.

Growth of Small and Medium Enterprises (SMEs)

The proliferation of small and medium enterprises (SMEs) in Argentina is significantly influencing the audit software market. As SMEs increasingly recognize the importance of maintaining robust financial records, the demand for efficient audit solutions is likely to rise. In 2025, SMEs are projected to account for over 50% of the total market share in the audit software sector. This growth is attributed to the need for cost-effective solutions that can streamline auditing processes and ensure compliance with local regulations. Furthermore, as these enterprises expand, their financial complexities increase, necessitating the adoption of sophisticated audit software to manage their financial health effectively. Thus, the growth of SMEs serves as a vital driver for the audit software market.

Technological Advancements in Software Solutions

Technological advancements are reshaping the audit software market in Argentina, as innovative features and functionalities become increasingly available. The integration of artificial intelligence (AI) and machine learning (ML) into audit software is enhancing the efficiency and accuracy of audits. In 2025, it is anticipated that around 40% of audit software solutions will incorporate AI-driven analytics, allowing for real-time data processing and risk assessment. This evolution not only streamlines the auditing process but also provides organizations with deeper insights into their financial operations. As businesses seek to leverage technology for competitive advantage, the demand for advanced audit software solutions is expected to grow, positioning technological advancements as a key driver in the industry.