Top Industry Leaders in the APAC Lubricants Market

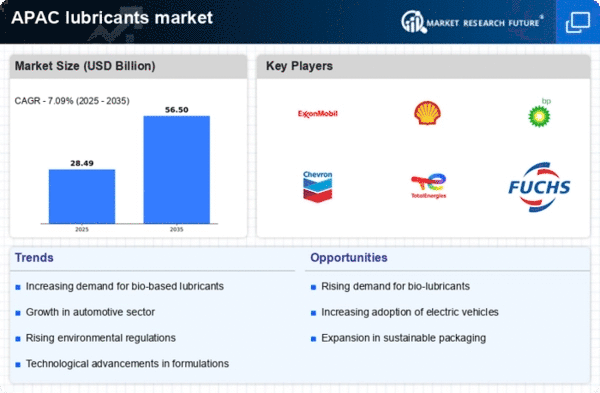

The Asia-Pacific lubricants market, is a churning ocean of opportunity and fierce competition. This vibrant landscape, dominated by automotive (45%) and industrial (38%) segments, presents a captivating spectacle of diverse players, innovative strategies, and evolving trends.

The Asia-Pacific lubricants market, is a churning ocean of opportunity and fierce competition. This vibrant landscape, dominated by automotive (45%) and industrial (38%) segments, presents a captivating spectacle of diverse players, innovative strategies, and evolving trends.

Competitive Landscape and Strategies:

The market is a maelstrom of established giants like ExxonMobil, Shell, BP Castrol, and TotalEnergies battling alongside regional players like Sinopec and GS Caltex. To stay afloat, companies are deploying a range of strategies:

-

Product Diversification: Players are expanding their portfolios beyond standard lubricants, offering specialty fluids for electric vehicles, high-performance engines, and renewable energy applications. Shell's E-fluids series exemplifies this trend. -

Geographical Expansion: Emerging markets like India and Vietnam are fertile grounds for growth. ExxonMobil's recent investment in India's lubricant blending plant illustrates this strategy. -

Brand Building: Building trust and brand loyalty is crucial. BP Castrol's long-standing partnerships with automakers and its focus on technological advancements enhance its brand image. -

Digital Transformation: Embracing e-commerce, AI-powered predictive maintenance solutions, and data analytics helps companies optimize operations and reach new customers. TotalEnergies' digital lubricant platform is a prime example. -

Sustainability Initiatives: Reducing environmental impact through bio-lubricants, energy-efficient formulations, and responsible waste management is becoming a key differentiator. Shell's commitment to carbon neutrality by 2050 sets the bar high.

Factors Influencing Market Share:

In this swirling vortex, securing market share depends on several factors:

-

Cost Competitiveness: Balancing affordability with quality is critical, especially in price-sensitive segments. Sinopec's success in China can be attributed to its cost-effective offerings. -

Supply Chain Agility: Navigating volatile raw material prices and ensuring efficient distribution networks are vital for uninterrupted supply. ExxonMobil's global network of refineries gives them an edge. -

Tech-Savvy Approach: Investing in R&D, developing cutting-edge formulations, and adapting to technological advancements are key to staying ahead. Shell's collaboration with universities and research institutions demonstrates this commitment. -

Regulatory Compliance: Stringent environmental regulations require constant adaptation and innovation. Chevron's proactive approach to regulatory compliance in China strengthens their position. -

Customer-Centric Focus: Building strong relationships with original equipment manufacturers (OEMs) and aftermarket channels is crucial for securing repeat business. TotalEnergies' close collaboration with automakers like PSA Peugeot Citroën is a testament to this.

Key Players

- BP Plc (Castrol)

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation

- ENEOS Corporation

- ExxonMobil Corporation

- GS Caltex

- Idemitsu Kosan Co. Ltd

- Indian Oil Corporation Limited

- Royal Dutch Shell Plc

- TotalEnergies

Recent Developments

-

Oct 2023: BP Castrol announced a partnership with BYD, a leading electric vehicle manufacturer, to develop and supply EV lubricants. -

Nov 2023: TotalEnergies launched its Total Quartz 9000 F ECO lubricants, showcasing their commitment to fuel-efficient formulations. -

Dec 2023: The Indian government introduced stricter emission standards for vehicles, prompting lubricant manufacturers to develop low-emission lubricants.