Market Trends

Key Emerging Trends in the Antimicrobial Textile Additive Market

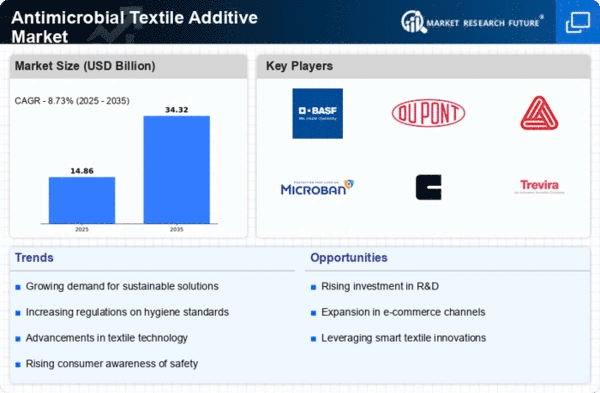

The Antimicrobial Textile Additive market is undergoing significant developments, which reflect a growing awareness of hygiene and health issues across diverse industries. Chemical agents incorporated into textiles during manufacturing to stop the growth of microorganisms such as bacteria, viruses, germs are called antimicrobial textile additives. One of the trends observed in the market is an increase in demand for antimicrobial textiles within healthcare sector. Hospitals, clinics and other medical institutions are adopting the use of textiles with antimicrobial additions in order to enhance infection control measures and maintain clean environment. This trend has been necessitated by increased focus on prevention on healthcare associated infections (HAI) while protecting patients.

The hospitality and travel industry also contribute to trends toward using anti-microbial textile additives. Hotels, airlines or public transport providers have used antibacterial fabrics inside their furnishings or upholstery so as to ensure that customers’ experience safer or healthier environments. The current wave reflects how this sector acknowledges consumer worries around hygiene; hence boosting confidence towards sharing spaces.

Modern textile manufacturing considers environmental sustainability and thus affecting the trends within antimicrobial textile additive market segment. As result there is an increasing demand for eco-friendly anti-microbials that work effectively against microbes yet do no harm to environment when used thereby ensuring ecological safety as well Manufacturers are looking at sustainable solutions for antimicrobials to align with sustainable practices across the broader textile industry.

In addition to this, there has been an increase in the use of antimicrobial textile additives by sportswear and athleisure sectors. This helps to manage the smells that are as a result of bacterial growth during or after exercise; hence such absorption of bacteria causing odor is favored while making garments for sports activities more comfortable. This derives from the need for such garments that help not only in physical performance but also keep them fresh and clean.

Leave a Comment