Antifog Additives Size

Antifog Additives Market Growth Projections and Opportunities

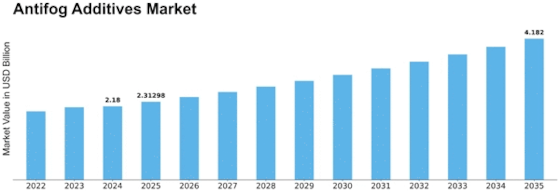

Antifog Additives Market Size was valued at USD 1.9 billion in 2022. The Antifog Additives market industry is projected to grow from USD 2.033 Billion in 2023 to USD 3.493072504 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 7.00%:

Increasing Demand from Food Packaging Industry: One of the primary drivers of the antifog additives market is the rising demand from the food packaging industry. Antifog additives are essential ingredients in packaging films and coatings used for food packaging applications such as fresh produce, refrigerated foods, and ready-to-eat meals. These additives prevent fog formation on the inner surface of packaging materials, maintaining product visibility, freshness, and quality. With the growing demand for convenient and attractive food packaging solutions, the need for antifog additives is increasing to enhance the shelf appeal and consumer experience of packaged food products.

Regulatory Compliance and Food Safety Standards: Regulatory compliance and food safety standards governing packaging materials influence market dynamics in the antifog additives market. Antifog additives need to comply with regulatory requirements such as FDA regulations in the United States and EU regulations in Europe to ensure food safety, consumer health, and environmental sustainability. Manufacturers and suppliers of antifog additives need to adhere to regulatory standards and undergo testing and certification to ensure compliance with food contact regulations and packaging safety requirements.

Sustainability and Eco-Friendly Packaging: The emphasis on sustainability and eco-friendly packaging drives market demand for antifog additives that enable the development of environmentally friendly packaging solutions. Consumers, retailers, and brand owners are increasingly seeking packaging materials and additives that minimize environmental impact, reduce carbon footprint, and promote recyclability and biodegradability. Antifog additives such as bio-based additives, water-based additives, and UV-curable additives offer sustainable alternatives to conventional additives, aligning with sustainability goals and regulatory mandates for eco-friendly packaging.

Technological Advancements and Product Innovation: Technological advancements in antifog additive chemistry and formulation development drive innovation in the market. Manufacturers invest in research and development to develop advanced antifog additives with improved performance attributes such as durability, efficiency, and compatibility with different packaging materials. Innovative additive technologies such as nanotechnology, microencapsulation, and surface modification enable the development of high-performance antifog additives that meet the evolving needs of end-users in the food packaging industry.

Consumer Preferences for High-Quality Packaging: Consumer preferences for high-quality packaging solutions drive market demand for antifog additives that enhance the functionality and performance of packaging materials. Antifog additives play a crucial role in improving the clarity, transparency, and appearance of packaging films, ensuring product visibility and consumer appeal. Consumers value packaging materials that offer features such as fog-free surfaces, clear viewing windows, and attractive presentation, meeting their expectations for quality, freshness, and convenience in packaged food products.

Brand Differentiation and Shelf Appeal: Antifog additives contribute to brand differentiation and shelf appeal in the retail environment, where packaging plays a crucial role in product presentation and consumer perception. Brand owners and retailers leverage antifog additives to create attractive and visually appealing packaging designs that enhance product visibility and brand recognition. Packaging materials with antifog properties offer clear and fog-free surfaces that showcase the freshness and quality of packaged food products, driving consumer engagement and purchase intent in competitive retail markets.

Global Economic Trends and Market Volatility: Global economic trends, market volatility, currency fluctuations, and geopolitical factors impact market dynamics and investment decisions in the antifog additives industry. Market players need to monitor and adapt to changing economic conditions and market uncertainties to mitigate risks and capitalize on emerging opportunities in the antifog additives market.

Raw Material Availability and Pricing: The availability and pricing of raw materials such as resins, additives, and solvents impact market dynamics in the antifog additives market. Fluctuations in raw material prices, supply chain disruptions, and geopolitical factors can influence production costs and pricing strategies, affecting market competitiveness and profitability for antifog additives manufacturers and suppliers.

Market Competition and Industry Consolidation: The antifog additives market is characterized by intense competition among key players, driving innovation, pricing strategies, and market consolidation efforts. Established manufacturers leverage mergers, acquisitions, and strategic partnerships to strengthen their market presence, expand product portfolios, and enhance competitive positioning. Market players differentiate their antifog additives based on performance attributes, formulation expertise, technical support, and customer service to gain a competitive edge in the market.

Leave a Comment