Growing Geriatric Population

The increasing geriatric population is a significant driver of the Anticoagulation Market Industry. Older adults are at a higher risk for thromboembolic disorders, necessitating effective anticoagulation management. As life expectancy rises, the number of individuals requiring anticoagulant therapy is expected to grow substantially. This demographic shift is prompting healthcare systems to adapt their strategies to accommodate the needs of older patients, including the development of tailored anticoagulant therapies. Additionally, the prevalence of comorbidities in the elderly population further complicates treatment regimens, creating a demand for anticoagulants that are both effective and safe. Consequently, the Anticoagulation Market Industry is likely to experience robust growth in response to this demographic trend.

Increased Awareness and Education

There is a growing awareness and education regarding the importance of anticoagulation therapy, which serves as a crucial driver for the Anticoagulation Market Industry. Healthcare professionals and patients alike are becoming more informed about the risks associated with thromboembolic events and the benefits of anticoagulant treatments. This heightened awareness is leading to earlier diagnosis and treatment initiation, which is essential for effective management. Educational initiatives and campaigns are being implemented to promote understanding of anticoagulation therapy, thereby increasing patient engagement and adherence. As a result, the demand for anticoagulants is likely to rise, contributing to the overall growth of the Anticoagulation Market Industry.

Advancements in Anticoagulant Therapies

Technological advancements in anticoagulant therapies are reshaping the Anticoagulation Market Industry. The introduction of novel oral anticoagulants (NOACs) has revolutionized treatment protocols, offering patients more convenient options with fewer monitoring requirements. These advancements not only enhance patient compliance but also improve clinical outcomes. The market is witnessing a shift from traditional vitamin K antagonists to these newer agents, which are gaining traction due to their efficacy and safety profiles. As healthcare providers increasingly adopt these innovative therapies, the Anticoagulation Market Industry is expected to expand significantly. Furthermore, ongoing research and development efforts are likely to yield even more effective anticoagulants, further driving market growth.

Regulatory Support and Approval Processes

Regulatory support plays a pivotal role in shaping the Anticoagulation Market Industry. The approval of new anticoagulant medications by regulatory bodies facilitates market entry and encourages innovation. Streamlined approval processes for novel therapies can significantly reduce the time it takes for new products to reach the market, thereby enhancing competition. Regulatory agencies are increasingly recognizing the need for effective anticoagulant therapies, which has led to expedited review pathways for promising candidates. This supportive environment fosters research and development, ultimately benefiting patients and healthcare providers. As more anticoagulants gain regulatory approval, the Anticoagulation Market Industry is poised for continued expansion.

Rising Incidence of Cardiovascular Diseases

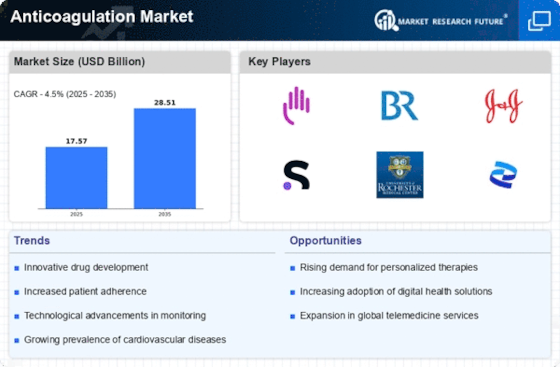

The increasing prevalence of cardiovascular diseases is a primary driver of the Anticoagulation Market Industry. Conditions such as atrial fibrillation and venous thromboembolism are becoming more common, leading to a heightened demand for anticoagulant therapies. According to recent statistics, cardiovascular diseases account for a significant portion of global mortality, prompting healthcare systems to prioritize effective management strategies. This trend is likely to continue, as the aging population and lifestyle factors contribute to the rise in these conditions. Consequently, pharmaceutical companies are focusing on developing innovative anticoagulants to address this growing need, thereby expanding the Anticoagulation Market Industry. The market is projected to witness substantial growth, with estimates suggesting a compound annual growth rate of over 7% in the coming years.