Growing Awareness of Antibiotic Stewardship

Growing awareness of antibiotic stewardship is becoming a pivotal driver in the Antibiotics Market. Healthcare professionals and organizations are increasingly recognizing the importance of responsible antibiotic use to combat resistance. This awareness is leading to the implementation of stewardship programs aimed at optimizing antibiotic prescribing practices. As a result, there is a shift towards the development of antibiotics that are effective against resistant strains while minimizing the risk of further resistance. The Antibiotics Market is adapting to these changes by focusing on research and development of new classes of antibiotics. Furthermore, educational initiatives aimed at both healthcare providers and the public are likely to enhance understanding of antibiotic use, thereby influencing market dynamics. This trend suggests a more sustainable approach to antibiotic use, which could stabilize the market in the long term.

Increasing Incidence of Infectious Diseases

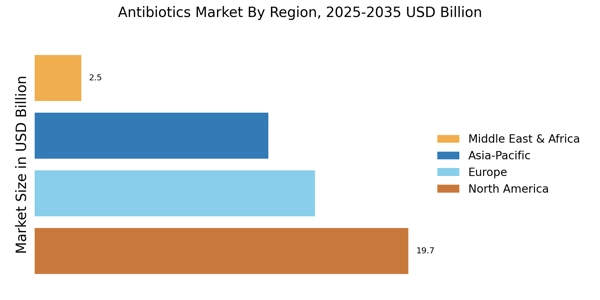

The rising incidence of infectious diseases is a primary driver of the Antibiotics Market. As populations grow and urbanization increases, the spread of infectious diseases becomes more prevalent. According to recent data, the incidence of bacterial infections has surged, leading to a heightened demand for antibiotics. This trend is particularly evident in developing regions, where healthcare infrastructure may be less robust. The Antibiotics Market is responding to this demand by innovating and expanding product lines to address various bacterial infections. Furthermore, the World Health Organization has reported that antibiotic-resistant infections are a growing concern, which further propels the need for effective antibiotics. As healthcare providers seek to combat these infections, the Antibiotics Market is likely to experience sustained growth.

Regulatory Support for Antibiotic Innovation

Regulatory support for antibiotic innovation is a crucial driver of the Antibiotics Market. Governments and regulatory bodies are increasingly recognizing the urgent need for new antibiotics to address the growing threat of antibiotic resistance. Initiatives such as expedited approval processes and financial incentives for research and development are being implemented to encourage pharmaceutical companies to invest in antibiotic innovation. Recent data suggests that these regulatory measures have led to a notable increase in the number of new antibiotics entering the market. The Antibiotics Market is likely to benefit from these supportive policies, as they create a more favorable environment for the development of novel therapies. Furthermore, collaboration between public and private sectors is expected to enhance research efforts, ultimately leading to a more robust pipeline of antibiotics.

Technological Advancements in Drug Development

Technological advancements in drug development are significantly influencing the Antibiotics Market. Innovations such as artificial intelligence and machine learning are streamlining the drug discovery process, allowing for faster identification of potential antibiotic candidates. This has led to a more efficient development pipeline, which is crucial given the urgent need for new antibiotics to combat resistant strains. The Antibiotics Market is witnessing an influx of novel therapies, with research indicating that the introduction of new antibiotics could reach a market value of several billion dollars in the coming years. Additionally, advancements in biotechnology are enabling the development of targeted therapies, which may enhance treatment efficacy and reduce side effects. As these technologies continue to evolve, they are expected to reshape the landscape of the Antibiotics Market.

Rising Demand for Probiotics and Alternative Therapies

The rising demand for probiotics and alternative therapies is impacting the Antibiotics Market. As consumers become more health-conscious, there is a growing interest in natural and alternative treatments for infections. Probiotics, which are known to support gut health, are increasingly being viewed as a complementary approach to antibiotic treatment. This trend may lead to a shift in consumer preferences, prompting the Antibiotics Market to explore synergies between antibiotics and probiotics. Market data indicates that the probiotic segment is experiencing robust growth, which could influence antibiotic prescribing patterns. Additionally, the exploration of alternative therapies, such as phage therapy, is gaining traction as a potential solution to antibiotic resistance. The Antibiotics Market may need to adapt to these evolving consumer preferences to remain competitive.