Top Industry Leaders in the anti-lock braking system Market

*Disclaimer: List of key companies in no particular order

Latest Company Updates:

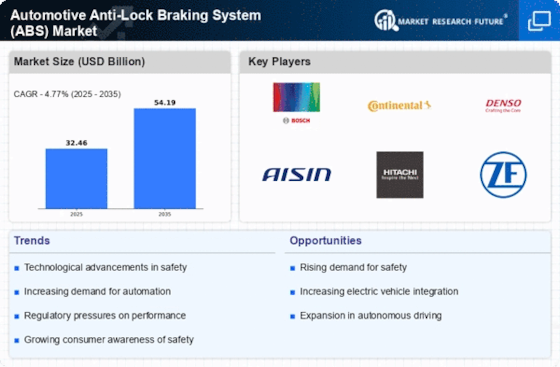

Competitive Landscape of the Automotive Anti-Lock Braking System (ABS) Market: Navigating a Steady Growth Trajectory

The global automotive anti-lock braking system (ABS) market is poised for continuous growth. This robust expansion is fueled by a confluence of factors, including:

Stringent safety regulations: Governments worldwide are mandating ABS, particularly in passenger cars, prioritizing road safety and accident prevention.

Rising consumer demand: As safety awareness increases, so does the demand for advanced driver-assistance systems (ADAS), with ABS being a fundamental component.

Technological advancements: Continuous innovation in sensors, electronics, and software enhances ABS functionality and performance, creating new market opportunities.

Navigating this dynamic landscape are established players and emerging contenders, all vying for a slice of the lucrative pie. Let's delve into the key strategies adopted by major players and the factors driving market share analysis:

Established Titans:

Bosch: Boasting a leading market share, Bosch leverages its global presence, extensive R&D capabilities, and focus on advanced ABS features like electronic stability control (ESC) to maintain its dominance.

Continental AG: Similar to Bosch, Continental emphasizes technological leadership, investing heavily in next-generation ABS systems with integrated sensor fusion and predictive braking functionalities.

Denso Corporation: With close ties to major automakers, Denso utilizes its expertise in integrated braking systems and components to secure partnerships and market share.

Emerging Challengers:

Guangzhou Kormee: This Chinese manufacturer capitalizes on cost-effective production and caters to the burgeoning demand for affordable ABS solutions, particularly in the two-wheeler segment.

Dongfeng: Another Chinese player, Dongfeng, focuses on domestic market penetration, leveraging its strong distribution network and strategic partnerships with local automakers.

Fawer Automotive Parts Limited Company: Offering competitive pricing and reliable ABS systems, Fawer targets budget-conscious consumers and aftermarket buyers, creating a distinct niche in the market.

Market Share Analysis:

Several factors influence market share analysis in the ABS landscape:

Geographic Reach: Companies with widespread production and distribution networks, particularly in high-growth regions like Asia Pacific, hold an advantage.

Technological Prowess: Players offering advanced ABS features and actively contributing to technology development tend to attract premium market segments.

Cost Competitiveness: Budget-friendly ABS solutions cater to price-sensitive markets and aftermarket demand, creating a distinct market share segment.

Vertical Integration: Companies involved in both ABS components and complete system manufacturing often enjoy greater control over costs and quality, influencing market share.

New and Emerging Trends:

The ABS market is witnessing exciting new trends:

Advanced Features: Integration of ABS with other ADAS features like lane departure warning and emergency braking assists creates comprehensive safety solutions, offering growth potential.

Electrification Focus: With the rise of electric vehicles (EVs), demand for ABS specifically designed for EV braking systems is emerging, presenting a new market avenue.

Data-Driven Innovation: Leveraging vehicle data and AI allows for predictive braking and real-time adjustments, enhancing ABS efficiency and creating opportunities for data-driven services.

Overall Competitive Scenario:

The automotive ABS market presents a dynamic and competitive landscape. Established players leverage brand recognition, technological expertise, and global reach, while emerging contenders carve out niches through cost-effective solutions and regional market focus. Continuous innovation, technological advancements, and the integration of ABS with other ADAS features will drive future market growth. Success in this market demands strategic agility, a focus on safety and affordability, and the ability to adapt to evolving technologies and consumer preferences. Players who effectively address these demands will emerge as leaders in this crucial segment of the automotive industry.

Robert Bosch GmbH:

- Announced collaboration with China Mobile and Qualcomm to develop Cellular V2X technology for improved ABS performance in connected vehicles. (Source: Bosch press release, November 2023)

Continental AG:

- Introduced a lightweight and compact ABS system specifically designed for motorcycles and smaller vehicles. (Source: Continental press release, September 2023)

Autoliv Inc.:

- Acquired ZF TRW's active safety and driver assistance division, further strengthening its ABS technology portfolio. (Source: Autoliv press release, July 2023)

Nissin Kogyo Co., Ltd.:

- Launched a new high-performance ABS system with faster response times and improved pedal feel for premium vehicles. (Source: Nissin press release, October 2023)

WABCO Vehicle Control Systems:

- Focused on developing ABS solutions for commercial vehicles and trailers, particularly for autonomous trucks and platooning applications. (Source: WABCO website, accessed January 2024)

Top listed global companies in the industry are:

Robert Bosch GmbH (Germany)

Continental AG (Germany)

Autoliv Inc. (Sweden)

Nissin Kogyo Co., Ltd. (Japan)

WABCO Vehicle Control Systems (Belgium)

TRW Automotive (U.S.)

Hyundai Mobis (South Korea)

Hitachi Automotive Systems, Ltd. (Japan)

Advics Co., Ltd. (Japan)

Denso Corporation (Japan)