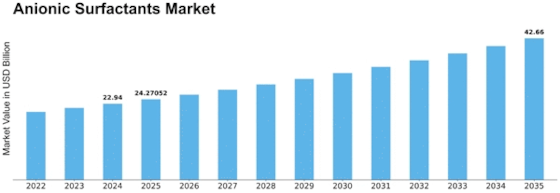

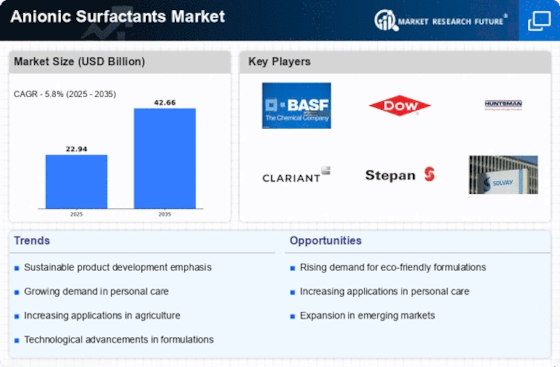

Anionic Surfactants Size

Anionic Surfactants Market Growth Projections and Opportunities

The Anionic Surfactants Market is influenced by a multitude of factors that collectively contribute to its growth and dynamics. A key driver is the widespread use of anionic surfactants across various industries, particularly in the production of cleaning and personal care products. Anionic surfactants, characterized by their ability to reduce surface tension and enhance the wetting and foaming properties of solutions, play a pivotal role in formulations such as detergents, shampoos, and soaps. The demand from the household and personal care sectors significantly contributes to the global anionic surfactants market.

Technological advancements in surfactant formulations and manufacturing processes significantly contribute to market dynamics. Continuous research and development efforts focus on enhancing the performance, biodegradability, and cost-effectiveness of anionic surfactants. Innovations in raw materials, reaction processes, and sustainable production methods aim to address environmental concerns and regulatory requirements, positioning anionic surfactants as versatile and eco-friendly solutions in various applications. Technological advancements drive the adaptation of anionic surfactants in emerging sectors and industries seeking effective surface-active agents.

The cleaning and personal care industries play a crucial role in driving the Anionic Surfactants Market. In cleaning products, anionic surfactants serve as key components in formulations for laundry detergents, dishwashing liquids, and multipurpose cleaners. In personal care products, anionic surfactants contribute to the foaming and cleansing properties of shampoos, body washes, and facial cleansers. The demand from these key consumer-driven industries significantly influences the growth of the anionic surfactants market.

Global economic conditions and trade dynamics impact the Anionic Surfactants Market. As anionic surfactants are essential components in a wide range of consumer and industrial products, factors such as economic stability, trade agreements, and geopolitical events can influence the supply chain and market conditions for these surfactants. The accessibility and cost competitiveness of anionic surfactants are closely tied to global trade dynamics and economic trends.

Environmental considerations and regulatory standards also shape the anionic surfactants market. The industry's commitment to producing environmentally friendly surfactant solutions aligns with stringent regulations governing the use of chemicals in consumer products. Compliance with environmental standards ensures that the production and use of anionic surfactants adhere to eco-friendly practices, making them suitable for applications where sustainability and biodegradability are priorities.

Market competition and industry collaborations are notable factors shaping the Anionic Surfactants Market. The market comprises established surfactant manufacturers, chemical companies, and end-users, fostering a competitive landscape. Collaboration between anionic surfactant producers, formulators, and research institutions facilitates the development of new formulations, applications, and industry standards. Partnerships within the industry supply chain contribute to the overall growth and advancement of anionic surfactant solutions.

Challenges related to cost considerations, regulatory compliance, and the development of alternative formulations are factors that the anionic surfactants industry addresses. While anionic surfactants offer excellent foaming and cleaning properties, the cost of production and raw materials can impact their competitiveness in the market. The industry continuously works on optimizing production processes and exploring cost-effective solutions. Regulatory compliance with evolving standards, particularly related to biodegradability and environmental impact, is a constant consideration. Additionally, the development of alternative surfactant formulations, such as bio-based and non-ionic surfactants, poses challenges and opportunities for the anionic surfactants market.

Leave a Comment