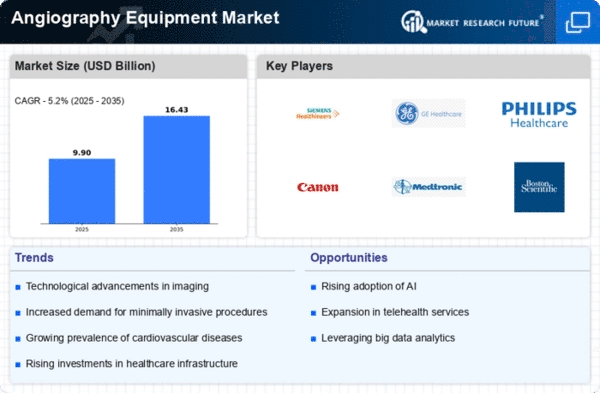

Market Growth Projections

The Global Angiography Equipment Market Industry is projected to experience substantial growth over the next decade. With a market value expected to reach 9.41 USD Billion in 2024 and 16.4 USD Billion by 2035, the industry is poised for a robust expansion. The compound annual growth rate of 5.2% from 2025 to 2035 suggests a steady increase in demand for angiography systems. This growth is likely driven by technological advancements, rising healthcare expenditures, and an increasing prevalence of cardiovascular diseases. As the market evolves, it will be essential for stakeholders to adapt to changing trends and invest in innovative solutions to meet the growing needs of healthcare providers and patients.

Technological Advancements

The Global Angiography Equipment Market Industry is experiencing rapid technological advancements, which are enhancing the efficacy and precision of diagnostic procedures. Innovations such as 3D imaging, real-time visualization, and advanced catheter designs are becoming increasingly prevalent. These developments not only improve patient outcomes but also streamline workflows in healthcare facilities. As a result, the market is projected to reach 9.41 USD Billion in 2024, driven by the demand for more sophisticated imaging solutions. The integration of artificial intelligence and machine learning into angiography systems further indicates a shift towards more automated and accurate diagnostic tools, potentially revolutionizing the industry.

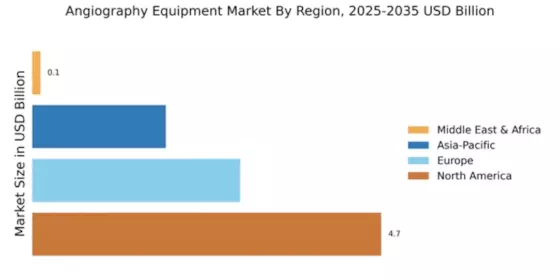

Increasing Healthcare Expenditure

The Global Angiography Equipment Market Industry is benefiting from increasing healthcare expenditure across various regions. Governments and private sectors are investing more in healthcare infrastructure, which includes the procurement of advanced medical equipment. This trend is particularly evident in emerging economies, where improved access to healthcare services is driving demand for angiography systems. The projected compound annual growth rate of 5.2% from 2025 to 2035 indicates a robust market trajectory, fueled by these investments. Enhanced funding for healthcare initiatives is likely to facilitate the adoption of cutting-edge angiography technologies, thereby improving diagnostic capabilities and patient care.

Rising Prevalence of Cardiovascular Diseases

The Global Angiography Equipment Market Industry is significantly influenced by the rising prevalence of cardiovascular diseases, which are among the leading causes of mortality worldwide. As the global population ages, the incidence of conditions such as coronary artery disease and peripheral artery disease is expected to increase. This trend necessitates the use of angiography equipment for accurate diagnosis and treatment planning. The market's growth is further supported by healthcare initiatives aimed at improving cardiovascular health, leading to an anticipated market value of 16.4 USD Billion by 2035. Consequently, the demand for advanced angiography systems is likely to surge, reflecting the urgent need for effective diagnostic tools.

Regulatory Support and Reimbursement Policies

The Global Angiography Equipment Market Industry is positively impacted by supportive regulatory frameworks and reimbursement policies that facilitate the adoption of advanced medical technologies. Governments and health organizations are increasingly recognizing the importance of angiography in diagnosing and treating cardiovascular diseases, leading to favorable reimbursement rates for these procedures. This support encourages healthcare providers to invest in state-of-the-art angiography equipment, thereby driving market growth. As reimbursement policies evolve to cover more advanced technologies, the market is likely to see increased adoption rates, further enhancing the accessibility and affordability of angiography services for patients.

Growing Demand for Minimally Invasive Procedures

The Global Angiography Equipment Market Industry is witnessing a growing demand for minimally invasive procedures, which are preferred by both patients and healthcare providers. These procedures typically result in shorter recovery times, reduced hospital stays, and lower overall costs. Angiography plays a crucial role in facilitating such interventions, as it allows for precise imaging and guidance during procedures. The increasing awareness of the benefits of minimally invasive techniques is likely to drive the adoption of advanced angiography systems. As a result, the market is expected to expand significantly, aligning with the broader trend towards patient-centered care and improved surgical outcomes.