Market Growth Projections

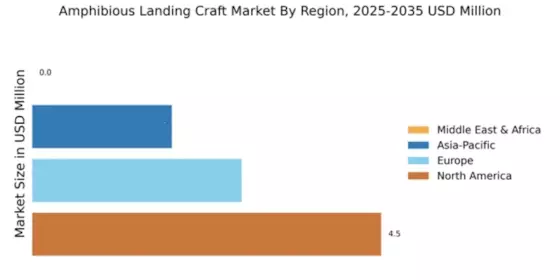

The Global amphibious landing craft Market Industry is projected to experience substantial growth over the next decade. With a market valuation of 3250 USD Million in 2024, it is anticipated to reach 5500 USD Million by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 4.9% from 2025 to 2035. The increasing demand for versatile amphibious capabilities, coupled with advancements in technology and rising military expenditures, suggests a robust market outlook. Stakeholders are likely to focus on innovation and strategic partnerships to capitalize on emerging opportunities within this evolving landscape.

Technological Advancements

Technological innovations play a pivotal role in the Global Amphibious Landing Craft Market Industry. The integration of advanced materials, propulsion systems, and automation technologies enhances the operational efficiency and versatility of these vessels. For example, the development of lightweight composite materials allows for increased payload capacity while maintaining speed and maneuverability. Additionally, advancements in navigation and communication systems improve mission effectiveness. As these technologies continue to evolve, they are likely to attract investments, further driving market growth. The anticipated CAGR of 4.9% from 2025 to 2035 underscores the potential for sustained innovation in amphibious craft design and functionality.

Increasing Military Expenditure

The Global Amphibious Landing Craft Market Industry is experiencing growth due to rising military expenditures across various nations. Countries are prioritizing modernization of their naval capabilities, which includes the acquisition of advanced amphibious landing craft. For instance, the United States has allocated substantial budgets for enhancing its amphibious operations, reflecting a broader trend among NATO allies. This focus on strengthening amphibious capabilities is projected to contribute to the market's expansion, with the industry expected to reach a valuation of 3250 USD Million in 2024. Such investments indicate a strategic shift towards versatile naval assets that can operate in diverse environments.

Strategic Geopolitical Dynamics

Geopolitical tensions and regional conflicts are driving nations to enhance their amphibious capabilities, thus impacting the Global Amphibious Landing Craft Market Industry. Countries situated in strategic locations are increasingly investing in amphibious forces to secure their maritime interests. For instance, nations in the Asia-Pacific region are expanding their naval fleets in response to territorial disputes. This strategic focus on amphibious operations is likely to lead to increased procurement of landing craft, reflecting a broader trend of military readiness. As nations prioritize their defense strategies, the market is poised for growth, aligning with the overall trajectory of military modernization.

Growing Demand for Humanitarian Assistance

The Global Amphibious Landing Craft Market Industry is also influenced by the increasing demand for humanitarian assistance and disaster relief operations. Amphibious landing craft are uniquely suited for delivering aid in coastal and remote areas, where traditional logistics may be hindered. Governments and organizations are recognizing the importance of maintaining a fleet capable of rapid deployment in response to natural disasters. This trend is evident in various countries that have invested in amphibious capabilities to enhance their disaster response frameworks. As the need for effective humanitarian operations grows, the market is expected to benefit, contributing to the projected growth towards 5500 USD Million by 2035.

Environmental Regulations and Sustainability

The Global Amphibious Landing Craft Market Industry is also shaped by the growing emphasis on environmental regulations and sustainability. As governments worldwide adopt stricter environmental standards, manufacturers are compelled to develop amphibious craft that minimize ecological impact. This includes innovations in fuel efficiency and emissions reduction technologies. The shift towards greener naval operations not only aligns with global sustainability goals but also enhances the appeal of amphibious landing craft in procurement processes. As the industry adapts to these regulatory changes, it is likely to witness a transformation that supports both operational effectiveness and environmental stewardship.