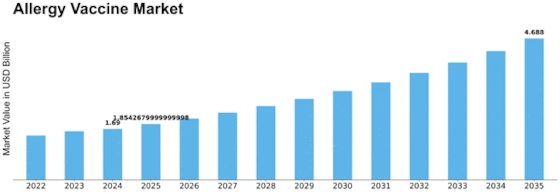

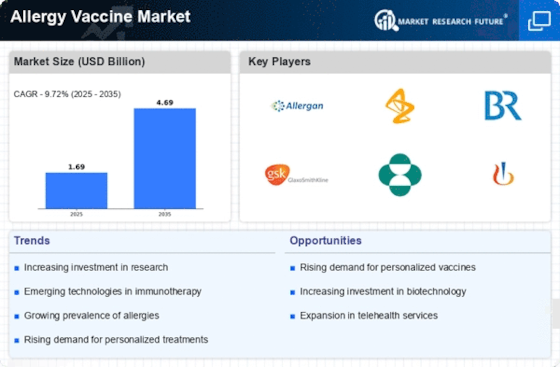

Allergy Vaccine Size

Allergy Vaccine Market Growth Projections and Opportunities

One of the key market factors driving the growth of the allergy vaccine market is the increasing prevalence of allergies worldwide. Allergic conditions, such as hay fever, allergic rhinitis, and asthma, have become more widespread, leading to a rising demand for effective allergy vaccines. The allergy vaccine sector has experienced strong breakthroughs since immunotherapy, more precisely, in the vaccine development, has manifested. Vaccine designers are looking at some new techniques and formulations to ensure their proper implementation, resulting in a higher efficacy level, which is attracting both vaccine recipients and medical care providers. Higher level of education among healthcare professionals and the public at large regarding the advantages of vaccine therapy and their positive impact on market expansion is also realized. Educating consumers about the advantages of vaccinations focusing on their role in helping to manage allergies has been reaping fruits of consumer perception shift for safe preventive healthcare. Public health programs geared towards preventing allergies as well as finding a way of alleviating the huge economic burden that comes with these kind of diseases has fueled the growth of the allergy vaccine industry. Encouraging policies, subsidization, and permits have provided consenting conditions for market champions to invest in research and development. The introduction and development of vaccines has truly revolutionized and dictated the evolution of allergy vaccine market, hereby the introduction of recombinant DNA technology and novel adjuvants is some of the most contributing technological advancements. These innovations improved the safety and efficacy of allergy vaccines; Imraachana yileliwu za dara wa mwaana shini mya. The grow of world healthcare expenditure led to a latest trends in vaccine research and development for allergies. As people and governments continue devoting their resources primarily to healthcare, there is, oftentimes than not, an associated increase in funding for the development of innovative allergy vaccines, hence a faster rate of market expansion. Environmental factors, such as climate change, have been linked to the increased prevalence of allergies. Changes in temperature, pollen seasons, and air quality contribute to the rise in allergic conditions. This correlation has intensified the need for effective allergy vaccines to address the changing dynamics of environmental allergens. Intense competition among market players has led to product differentiation and the introduction of diverse allergy vaccine formulations. This competitive landscape benefits consumers by providing a range of options, spurring innovation, and ensuring the continuous improvement of allergy vaccine offerings.

Leave a Comment