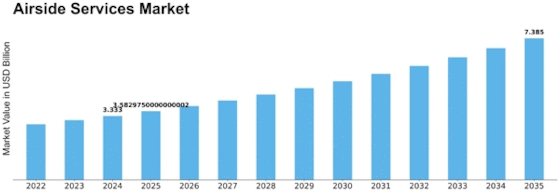

Airside Services Size

Airside Services Market Growth Projections and Opportunities

The airside services market encompasses a wide range of ground handling and support services essential for the efficient operation of airports and aviation infrastructure. This market is influenced by several key factors that shape its growth and evolution. One of the primary drivers of the airside services market is the increasing demand for air travel and the growth of the aviation industry globally. As passenger traffic continues to rise, airports face the challenge of handling larger volumes of aircraft movements, baggage handling, and passenger services. This drives the demand for ground handling services such as aircraft marshalling, baggage loading and unloading, aircraft towing, and aircraft refueling to ensure smooth and timely aircraft turnaround times and efficient airport operations.

Moreover, the increasing trend towards outsourcing of ground handling services by airlines and airport operators is driving growth in the airside services market. Outsourcing allows airlines and airports to focus on their core activities while leveraging the expertise and resources of specialized ground handling service providers. Ground handling companies offer a wide range of services tailored to the specific needs of airlines and airports, including passenger handling, ramp services, cargo handling, and aircraft maintenance, repair, and overhaul (MRO) services. This creates opportunities for ground handling service providers to expand their service offerings, enter new markets, and forge strategic partnerships with airlines and airport operators, driving further growth in the airside services market.

Furthermore, advancements in technology and automation are transforming the airside services market, driving efficiency improvements and cost savings for airlines and airports. Automation technologies such as automated baggage handling systems, robotic baggage loaders, and self-service check-in kiosks enable airports to streamline passenger processing, reduce queuing times, and improve operational efficiency. Similarly, advanced ground support equipment (GSE) such as aircraft pushback tugs, baggage loaders, and de-icing trucks equipped with state-of-the-art technology and digital connectivity features enable ground handlers to perform tasks more efficiently and safely, reducing turnaround times and minimizing delays for airlines.

Additionally, the growing focus on safety and security in aviation operations is driving investment in airside services that enhance safety measures and compliance with regulatory requirements. Ground handling companies are investing in training programs, safety protocols, and equipment upgrades to ensure the highest standards of safety for passengers, crew, and airport personnel. This includes implementing technologies such as surveillance cameras, access control systems, and perimeter security solutions to prevent unauthorized access to restricted areas and mitigate security risks at airports. By prioritizing safety and security, ground handling service providers can build trust and confidence among airlines and passengers, driving further demand for their services in the airside services market.

Moreover, the emergence of environmental sustainability and carbon reduction initiatives is driving innovation and investment in eco-friendly ground handling practices and equipment. Ground handling companies are adopting alternative fuels, electric vehicles, and renewable energy sources to power their operations and reduce their carbon footprint. This includes initiatives such as electrification of ground support equipment, implementation of sustainable aviation fuel (SAF) programs, and adoption of green technologies for waste management and recycling. By embracing sustainable practices, ground handling service providers can not only reduce their environmental impact but also attract environmentally conscious airlines and passengers, driving further growth in the airside services market.

Leave a Comment