Aircraft Mounts Size

Aircraft Mounts Market Growth Projections and Opportunities

The Aircraft Mounts market is witnessing significant growth, driven by key market factors that shape its landscape. One primary driver influencing this market is the continuous expansion of the aviation industry. With the rising demand for air travel and the increasing production of commercial and military aircraft, there is a parallel need for efficient and robust mounting solutions. Aircraft mounts play a crucial role in supporting various components, including avionics, sensors, cameras, and other mission-critical equipment, contributing to the overall functionality and safety of aircraft.

Technological advancements in aerospace engineering are pivotal in defining the trajectory of the Aircraft Mounts market. Continuous innovation in materials, design, and manufacturing processes has led to the development of lightweight yet durable mounts capable of withstanding the rigors of flight. Advanced materials, such as composite alloys and high-strength metals, enhance the structural integrity of mounts while ensuring weight efficiency. Furthermore, innovative design features and precision manufacturing contribute to the overall reliability and performance of aircraft mounts.

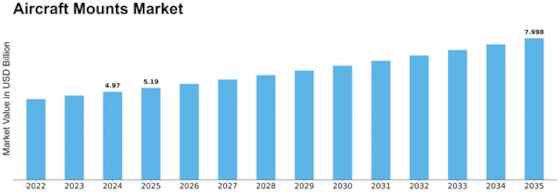

The Aircraft Mounts Market is estimated to achieve a valuation of USD 928.7 Million by the year 2030, showcasing a Compound Annual Growth Rate (CAGR) of 6.8% spanning from 2022 to 2030. This substantial growth in the global aircraft mounts market is attributed to several factors, including rising defense expenditures, a notable surge in passenger traffic, and a significant demand upswing for new aircraft. Additionally, the market has experienced robust growth due to the enforcement of stringent aviation regulations emphasizing safety standards.

Regulatory considerations play a crucial role in shaping the Aircraft Mounts market. Stringent safety standards and airworthiness regulations mandated by aviation authorities globally influence the design, certification, and implementation of aircraft mounts. Compliance with these regulations is imperative for manufacturers, affecting product development and certification processes. Adherence to safety standards ensures that aircraft mounts meet the necessary criteria for installation, contributing to the overall reliability and safety of aviation operations.

The competitive landscape of the Aircraft Mounts market is marked by the presence of major aerospace and defense manufacturers specializing in aviation components. Collaboration, partnerships, and acquisitions are common strategies in this competitive environment, as companies aim to expand their product portfolios and enhance market share. Intense competition fosters continuous innovation, leading to the introduction of cutting-edge technologies and features in aircraft mounting solutions. The competitive dynamics contribute to advancements in mount design, manufacturing efficiency, and overall market growth.

Economic factors, including the growth of the aviation industry, aircraft production rates, and defense budgets, significantly impact the dynamics of the Aircraft Mounts market. Periods of increased aircraft manufacturing and fleet expansion drive higher demand for mounting solutions. Conversely, economic downturns may result in temporary reductions in aircraft orders, affecting the market for aircraft mounts. The cyclic nature of the aviation industry plays a crucial role in determining the overall demand and market conditions for aircraft mounting solutions.

Global geopolitical considerations also influence the Aircraft Mounts market, particularly in the defense sector. As nations focus on enhancing their defense capabilities, investments in military aircraft and associated components, including mounts, increase. Heightened security concerns and evolving geopolitical scenarios drive the demand for advanced mounting solutions that can support the integration of sophisticated avionics and mission-critical equipment on military aircraft.

Leave a Comment