Regulatory Compliance

Regulatory compliance plays a pivotal role in shaping the Global aircraft interface device Industry. Governments worldwide are increasingly enforcing stringent regulations to enhance aviation safety and efficiency. For example, the Federal Aviation Administration has introduced new guidelines that necessitate the integration of advanced interface devices in aircraft. This regulatory push not only ensures safety but also drives demand for innovative solutions that meet these standards. Consequently, manufacturers are compelled to invest in research and development to comply with evolving regulations, thereby propelling market growth and fostering innovation in the sector.

Technological Advancements

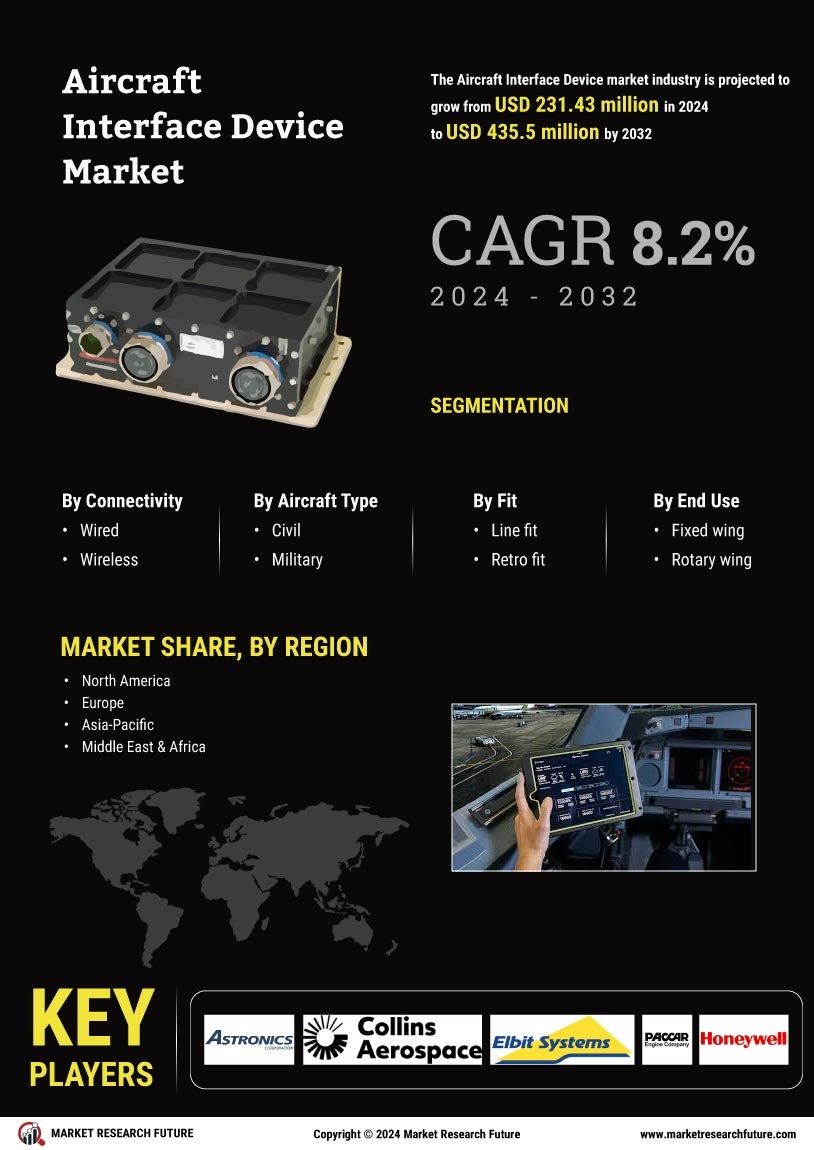

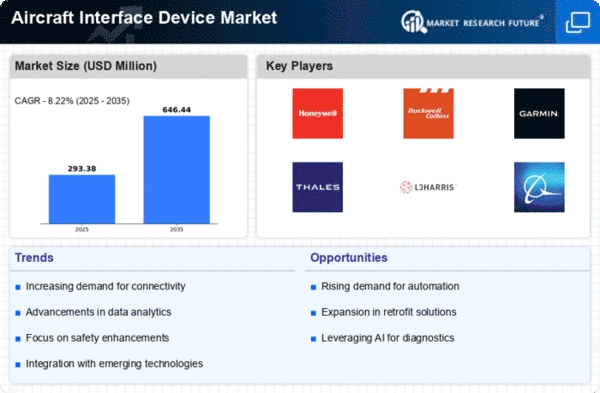

The Global Aircraft Interface Device Industry is experiencing a surge in technological advancements, particularly in the integration of advanced avionics and digital communication systems. These innovations enhance the efficiency and safety of aircraft operations. For instance, the implementation of real-time data transmission capabilities allows for improved decision-making and operational efficiency. As a result, the market is projected to grow from 271.1 USD Million in 2024 to 597.3 USD Million by 2035, reflecting a compound annual growth rate of 7.45% from 2025 to 2035. This trend underscores the importance of adopting cutting-edge technologies in the aviation sector.

Growth of the Aviation Sector

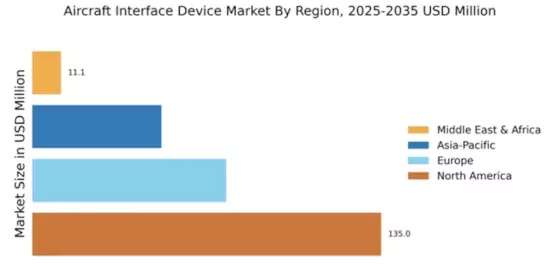

The Global Aircraft Interface Device Industry is closely tied to the overall growth of the aviation sector. As air travel continues to expand globally, the demand for advanced aircraft systems, including interface devices, is expected to rise. Emerging markets, particularly in Asia-Pacific and the Middle East, are witnessing a surge in air travel, prompting airlines to invest in modernizing their fleets. This expansion creates opportunities for manufacturers of aircraft interface devices, as airlines seek to enhance operational efficiency and passenger experience. The growth trajectory of the aviation sector is thus a key driver for the market.

Emerging Markets and Investments

Emerging markets are becoming increasingly influential in the Global Aircraft Interface Device Industry. Countries in Asia, Africa, and Latin America are witnessing a rise in air travel demand, prompting investments in aviation infrastructure. Governments in these regions are prioritizing the development of their aviation sectors, leading to increased procurement of advanced aircraft systems, including interface devices. This influx of investment not only supports market growth but also encourages technological advancements as manufacturers cater to the unique needs of these markets. The potential for growth in emerging economies presents a significant opportunity for stakeholders in the industry.

Increased Demand for Fuel Efficiency

The Global Aircraft Interface Device Industry is significantly influenced by the rising demand for fuel efficiency in aviation. Airlines are under pressure to reduce operational costs and minimize their environmental footprint. Aircraft interface devices that optimize flight operations and enhance fuel management systems are becoming essential. For instance, devices that provide real-time data on fuel consumption can lead to more efficient flight paths and reduced fuel usage. This trend is likely to drive the market as airlines seek to implement technologies that not only comply with regulations but also contribute to sustainability goals.