Technological Advancements in Aviation

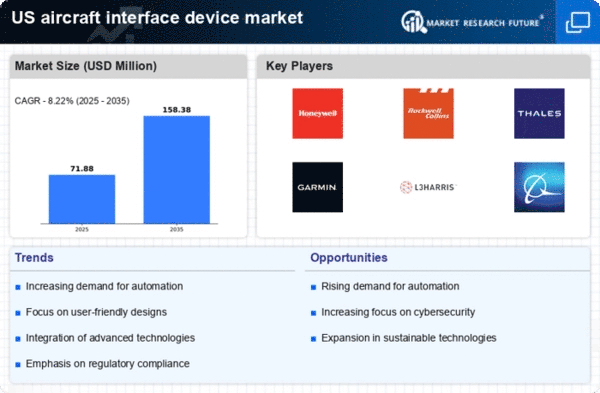

The aircraft interface-device market is experiencing a surge due to rapid technological advancements in aviation. Innovations such as touchscreen displays, voice recognition, and augmented reality interfaces are transforming cockpit operations. These advancements enhance pilot efficiency and safety, leading to increased adoption of modern interface devices. According to recent data, the market is projected to grow at a CAGR of 8.5% from 2025 to 2030, driven by the need for more intuitive and responsive systems. As aircraft manufacturers prioritize integrating these technologies, the aircraft interface-device market is likely to expand significantly, catering to both commercial and military aviation sectors.

Growing Demand for Automation in Cockpits

The push for automation in aviation is significantly influencing the aircraft interface-device market. As airlines seek to enhance operational efficiency and reduce human error, the integration of automated systems is becoming more prevalent. This trend is reflected in the increasing use of advanced interface devices that facilitate automation, such as flight management systems and autopilot interfaces. The market is anticipated to grow by 7% annually as airlines invest in these technologies to streamline operations and improve safety. The aircraft interface-device market is thus positioned to benefit from this growing demand for automation, which is reshaping the future of aviation.

Regulatory Compliance and Safety Standards

Regulatory compliance plays a crucial role in shaping the aircraft interface-device market. The Federal Aviation Administration (FAA) and other regulatory bodies impose stringent safety standards that manufacturers must adhere to. This has led to increased investments in research and development to create devices that not only meet but exceed these requirements. The emphasis on safety and reliability is paramount, as any failure in interface devices can have dire consequences. Consequently, the aircraft interface-device market is witnessing a shift towards more robust and compliant technologies, which is expected to drive market growth by approximately 6% annually over the next five years.

Increased Focus on Pilot Training and Simulation

The aircraft interface-device market is also being driven by an increased focus on pilot training and simulation. As aviation becomes more complex, effective training tools are essential for preparing pilots to operate advanced aircraft systems. Modern interface devices are integral to flight simulators, providing realistic training environments that enhance pilot skills. The market for these training devices is expected to grow by 5% annually, as airlines and training organizations invest in high-fidelity simulation technologies. This trend underscores the importance of interface devices in ensuring that pilots are well-equipped to handle the demands of modern aviation.

Rising Investment in Military Aviation Technologies

The aircraft interface-device market is witnessing a notable increase in investment within the military aviation sector. As defense budgets expand, there is a growing emphasis on upgrading military aircraft with advanced interface technologies. These devices are critical for enhancing situational awareness and operational effectiveness in combat scenarios. The market is projected to grow by 6.5% annually, driven by the need for cutting-edge technologies that improve communication and control in military operations. This trend highlights the strategic importance of interface devices in modernizing military aviation capabilities.