Aircraft Gearbox Size

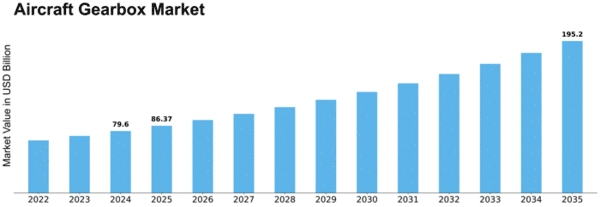

Aircraft Gearbox Market Growth Projections and Opportunities

The Aircraft Gearbox Market is dynamic due to several variables, indicating the importance of gearbox systems in aviation. Technological innovation drives market dynamics. Modern aircraft manufacturers want innovative gearbox systems that improve efficiency, weight, and performance. Market dynamics encourage continual innovation to meet the changing needs of military and commercial aircraft gearbox systems. Geopolitics influence the Aircraft Gearbox Market. Advanced gearbox systems are needed for military aircraft due to national security and strategic requirements. Air forces worldwide have specific operational and regional security concerns. Hence, the industry dynamically provides tailored gearbox solutions. Gearbox designs must adjust to various countries' sociopolitical conditions and mission characteristics. Aviation innovations and air travel trends affect the Aircraft Gearbox Market. Aircraft makers want gearbox systems that transmit power reliably, save maintenance, and improve safety. Market conditions favor gearbox systems with lightweight materials, better durability, and efficiency. The necessity for adaptable gearbox systems that can meet the changing demands of aircraft platforms drives demand. Aircraft Gearbox Market dynamics depend on technological integration. Gearbox solutions must interface with other aircraft components as avionics systems grow increasingly complex. Market dynamics emphasize the development of gearbox systems that can work together in the aviation ecosystem to improve aircraft efficiency and connectivity. The aviation Gearbox Market is driven by aviation system interoperability and cooperation. To ensure aircraft dependability and performance, manufacturers seek gearbox systems that interact smoothly with engines, avionics, and other important components. Market dynamics promote interoperable gearbox systems, which improve cooperation across the complex aircraft system network and simplify and integrate aviation architecture. Aircraft Gearbox Market dynamics depend on material advances. Aviation seeks fuel economy and performance improvement, thus lightweight, robust materials are prioritized. Market dynamics include innovative materials like composites and alloys into gearbox designs to make them durable and reduce airplane weight. The Aircraft Gearbox Market is heavily influenced by global economic and airline industry developments. Air travel demand, aircraft production, and economic circumstances affect market growth. Market dynamics respond to airline fleet changes, reflecting global events, economic upheavals, and regulatory changes on aviation. Gearbox system demand depends on commercial aviation's health and growth. Aircraft Gearbox Market dynamics depend on regulations and safety. Gearbox makers must follow strict aviation, certification, and safety rules. Market dynamics guarantee gearbox systems are rigorously tested and fulfill safety and certification criteria to assure aircraft dependability and airworthiness, keeping with worldwide aviation regulations.

Leave a Comment