Market Trends and Projections

The Global Aircraft Exhaust System Market Industry is characterized by dynamic trends and projections that reflect its growth trajectory. The market is anticipated to reach 899.9 USD Million in 2024, with expectations of expanding to 2169.9 USD Million by 2035. This growth is underpinned by a compound annual growth rate of 8.33% from 2025 to 2035. Factors such as increasing demand for fuel efficiency, regulatory compliance, and technological advancements are driving this upward trend. The market's evolution is indicative of broader shifts within the aviation industry, as stakeholders adapt to changing consumer preferences and environmental considerations.

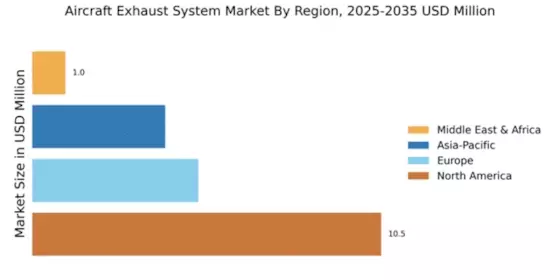

Emerging Markets and Globalization

The Global Aircraft Exhaust System Market Industry is benefiting from the globalization of air travel and the emergence of new markets. Countries in Asia-Pacific and Latin America are witnessing rapid growth in their aviation sectors, driven by rising disposable incomes and increased connectivity. This expansion presents opportunities for manufacturers to tap into these burgeoning markets, thereby driving demand for advanced exhaust systems. As these regions develop their aviation infrastructure, the market is poised for growth, potentially achieving a compound annual growth rate of 8.33% from 2025 to 2035. The globalization of air travel is likely to further enhance the industry's prospects.

Increasing Demand for Fuel Efficiency

The Global Aircraft Exhaust System Market Industry is experiencing a notable surge in demand for fuel-efficient aircraft. Airlines and manufacturers are increasingly prioritizing technologies that enhance fuel economy, as fuel costs represent a substantial portion of operational expenses. The integration of advanced exhaust systems contributes to improved engine performance and reduced emissions, aligning with global sustainability goals. As a result, the market is projected to reach 899.9 USD Million in 2024, reflecting a growing emphasis on environmentally friendly aviation solutions. This trend is likely to continue, with the industry expected to evolve significantly by 2035, when the market could expand to 2169.9 USD Million.

Growth of the Commercial Aviation Sector

The Global Aircraft Exhaust System Market Industry is closely tied to the expansion of the commercial aviation sector. As air travel demand continues to rise globally, airlines are investing in new aircraft and retrofitting existing fleets with modern exhaust systems. This growth is driven by increasing passenger numbers and the need for more efficient aircraft to meet market demands. The commercial aviation sector's expansion is expected to propel the market forward, with projections indicating a market size of 899.9 USD Million in 2024. This trend is likely to persist, as the industry adapts to evolving consumer preferences and technological advancements.

Technological Advancements in Exhaust Systems

Technological innovation plays a pivotal role in shaping the Global Aircraft Exhaust System Market Industry. The development of advanced materials and designs enhances the efficiency and performance of exhaust systems. Innovations such as noise reduction technologies and lightweight materials contribute to overall aircraft performance, thereby attracting manufacturers to invest in these advancements. As the industry embraces cutting-edge technologies, the market is expected to witness substantial growth. The integration of these technologies not only improves operational efficiency but also aligns with the industry's commitment to sustainability, potentially driving the market towards a valuation of 2169.9 USD Million by 2035.

Regulatory Compliance and Environmental Standards

The Global Aircraft Exhaust System Market Industry is significantly influenced by stringent regulatory frameworks aimed at reducing aviation emissions. Governments worldwide are implementing more rigorous environmental standards, compelling manufacturers to innovate and adapt their exhaust systems accordingly. Compliance with these regulations not only ensures operational legitimacy but also enhances the marketability of aircraft. As airlines strive to meet these evolving standards, the demand for advanced exhaust systems is likely to escalate. This regulatory pressure serves as a catalyst for growth, potentially contributing to a compound annual growth rate of 8.33% from 2025 to 2035, as the industry aligns with global sustainability initiatives.