Market Share

Introduction: Navigating the Competitive Landscape of Automotive Air Filters

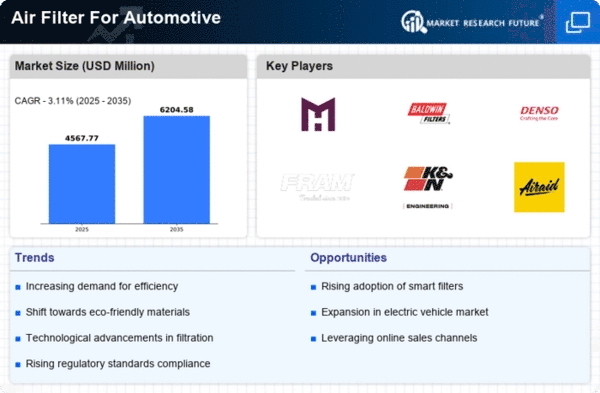

The automobile air-cleaner market is in the throes of a revolution, resulting from the rapid development of technology, from the tightening of regulations and from the increasing demands of consumers for cleaner and more efficient vehicles. In this context, the major players, namely the automobile manufacturers, the aftermarket suppliers and new, disruptive companies, are using new and advanced technologies, such as data analysis and the Internet of Things, to enhance the performance and customer experience of their products. The automobile manufacturers are concentrating on integrating smart filtration systems which optimize the engine’s performance. The aftermarket suppliers are responding to the growing demand for high-performance, sustainable filters. New, disruptive companies are developing biometrics and greener solutions for eco-conscious consumers. The development of these new and advanced technologies will be essential for the companies that wish to be successful in the automobile air-cleaner market, especially in Asia-Pacific and North America.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive solutions across multiple automotive filtration needs, integrating various technologies for enhanced performance.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Mahle | Strong R&D capabilities | Automotive filtration systems | Global |

| Denso Corporation | Advanced technology integration | Automotive components and filters | Asia, North America, Europe |

| Valeo | Innovative product development | Automotive air filters | Global |

| Bosch | Strong brand recognition | Automotive filtration solutions | Global |

Specialized Technology Vendors

These vendors focus on niche technologies and innovative solutions within the automotive air filtration sector.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Mann+Hummel | Expertise in filtration technology | Air and liquid filters | Global |

| Donaldson Company | High-performance filtration solutions | Industrial and automotive filters | North America, Europe |

| Freudenberg Group | Diverse material expertise | Sealing and filtration solutions | Global |

Infrastructure & Equipment Providers

These vendors provide essential components and systems that support the manufacturing and performance of automotive air filters.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Parker Hannifin | Comprehensive fluid management solutions | Filtration and separation technologies | Global |

| Sogefi Group | Focus on sustainable solutions | Automotive filtration systems | Europe, Asia |

| Hengst SEK and N Engineering | Innovative filtration technologies | Air and fluid filtration | Europe, Asia |

| Webasto | Strong automotive partnerships | Heating and cooling systems | Global |

| Cummins Inc. | Robust engine filtration solutions | Engine and filtration systems | Global |

| Filtration Group | Custom filtration solutions | Industrial and automotive filters | North America, Europe |

| H. K. M. S. O. | Specialized automotive solutions | Air filtration products | Regional focus unspecified |

Emerging Players & Regional Champions

- EcoAir Filters, USA, a manufacturer of air filters made of biodegradable materials, has recently won a contract with a major manufacturer of electric vehicles, and is thus challenging the established suppliers by promoting the idea of sustainability in the field of car parts.

- Aeroclean (Germany): This manufacturer of high-efficiency filters for luxury vehicles has recently entered into a partnership with a major automobile manufacturer to improve the air quality in its new models. Its high-end solutions complement those of the established suppliers.

- FilterTech Innovations, India: Provides cost-effective air filters for the growing Indian automobile market, and recently won a government contract for filters for public transport vehicles. By offering inexpensive alternatives to the established suppliers, it is challenging the established companies.

- PureFlow (Canada): Using nanotechnology, this company has developed high-efficiency filtration systems. It has just teamed up with a Canadian automaker to integrate its filters into a new electric car, thereby complementing the work of the established suppliers and pushing the boundaries of filtration.

Regional Trends: In 2024, the tendency towards the sustainable and eco-friendly solutions in the automobile air-filter market, especially in North America and Europe, is evident. The new entrants in the market are concentrating on the new materials and new techniques such as biodegradable filters and nanotechnology to meet the rising demand for the cleaner air inside the vehicles. In Asia-Pacific, the tendency towards the cost-effective solutions is also noticeable, resulting from the rapid growth of the automobile industry and the government initiatives to promote public transport.

Collaborations & M&A Movements

- Mann+Hummel and Toyota partnered to develop advanced air filtration systems aimed at reducing emissions in hybrid vehicles, enhancing their competitive positioning in the eco-friendly automotive segment.

- Donaldson Company acquired the air filtration division of a leading automotive supplier to expand its product offerings and strengthen its market share in the automotive sector.

- Freudenberg Filtration Technologies collaborated with Bosch to integrate smart filtration solutions into automotive HVAC systems, aiming to improve air quality and meet stricter regulatory standards.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Filtration Efficiency | Mann+Hummel, Donaldson Company | A new development of filtration technology, Mann & Hummel has been able to achieve a filtration efficiency of up to 99% in its latest product range. The Donaldson Company is a supplier of high-quality filters that are designed to increase the life of engines. Case studies demonstrate that maintenance costs are reduced and that the engines can be used for longer. |

| Sustainability | K&N Engineering, Bosch | The re-usable air filters from K&N are designed to reduce waste and are said to have a 50% smaller carbon footprint than traditional filters. And the filters from Bosch are made from a high percentage of recycled material, demonstrating the company’s commitment to the circular economy. |

| Smart Technology Integration | Denso, Mahle | In addition, by introducing IoT technology into the air filters, it is possible to monitor the state of the air filters in real time, which can help improve the maintenance of vehicles. Mahle has developed smart filters that communicate with the vehicle’s onboard systems to optimize the quality of the air intake and engine performance. |

| Cost-Effectiveness | Fram, ACDelco | Its cheapest filters are not the cheapest in quality, but are the best for those who are budget-conscious. The ACDelco filters, which combine quality and cost, have earned a reputation for reliability among automobile mechanics. |

| Customization Options | Spectre Performance, Airaid | Customized air filters for specific vehicle models. For the enthusiast. Airaid offers a wide range of filters for different driving styles and needs. The choice is yours. |

Conclusion: Navigating the Competitive Air Filter Landscape

In 2024, the market for automobile air filters is characterized by intense competition and considerable fragmentation, with both established and new players competing for market share. Regional trends are characterized by a growing focus on compliance and on the environment, which are causing the industry to rethink its product offerings. In this process, established companies are able to take advantage of their brand loyalty and distribution network, while newcomers are able to focus on their technological expertise and automation in manufacturing. As the market evolves, the ability to integrate sustainable practices and remain flexible in operations will be crucial for companies aiming to maintain their positions as market leaders. To seize emerging opportunities, companies will have to prioritise these capabilities.

Leave a Comment