- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

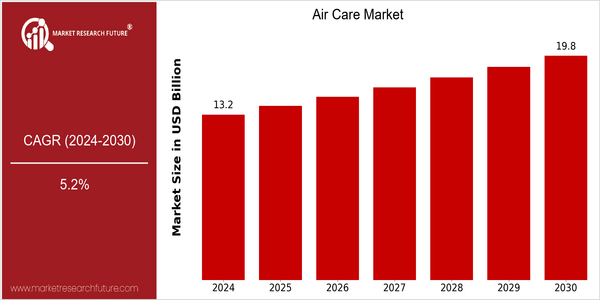

| Year | Value |

|---|---|

| 2024 | USD 13.25 Billion |

| 2030 | USD 19.75 Billion |

| CAGR (2024-2030) | 5.2 % |

Note – Market size depicts the revenue generated over the financial year

In the year 2024 the value of the air-conditioning market will reach $ 13.25 billion and will grow to $ 19.75 billion in the year 2030. This growth represents a compound annual growth rate (CAGR) of 5.2% over the forecast period. This growth is driven by the rising awareness of consumers to the quality of indoor air, and the growing demand for advanced air-care solutions. The development of air purification and odor dispensing systems will also contribute to the growth of the market, as consumers seek to not only improve the comfort of their living space, but also to improve their health and well-being. The leading players in the air-conditioning market, such as Procter & Gamble, SC Johnson and Reckitt Benckiser, are investing heavily in research and development to introduce new and improved products. Strategic initiatives, such as alliances and acquisitions, are also being used to improve the product portfolio and market reach. The development of smart air-conditioning devices that can be connected to home automation systems is a good example of this trend. The factors mentioned above will play a significant role in shaping the future of the market.

Regional Market Size

Regional Deep Dive

Air care market is growing significantly in different regions of the world, mainly driven by the rising consumer awareness of the indoor air quality and the growing demand for new air purification solutions. North America is characterized by a strong preference for technically advanced products, while Europe is characterized by a trend towards eco-friendly and sustainable solutions. The Asia-Pacific region is experiencing rapid urbanization and growing middle class, which will lead to an increase in demand for air care products. The Middle East and Africa are also experiencing increased investment in improving air quality, and Latin America is gradually adopting air care technology as urbanization increases.

Europe

- The European Union's Green Deal is promoting sustainability, leading to increased demand for eco-friendly air care products, with companies like Philips and Unilever investing in sustainable technologies.

- Innovations in smart air care devices, such as those developed by Xiaomi, are gaining traction, as consumers seek integrated solutions that offer real-time air quality monitoring and control.

Asia Pacific

- Rapid urbanization in countries like China and India is driving the demand for air purifiers, with local companies such as Xiaomi and Sharp expanding their product lines to meet consumer needs.

- Government initiatives aimed at improving air quality, such as the National Clean Air Programme in India, are encouraging investments in air care technologies and increasing public awareness about air pollution.

Latin America

- The growing urban population in Brazil and Mexico is driving the demand for air care products, with local brands like Consul and Electrolux expanding their offerings to cater to this market.

- Increased awareness of indoor air quality issues, coupled with government campaigns promoting health and wellness, is encouraging consumers to adopt air care solutions.

North America

- The rise in health consciousness among consumers has led to a surge in demand for air purifiers, with companies like Dyson and Honeywell launching advanced filtration technologies to cater to this trend.

- Regulatory changes, such as the introduction of stricter air quality standards by the Environmental Protection Agency (EPA), are pushing manufacturers to innovate and improve product efficiency, thereby enhancing market growth.

Middle East And Africa

- The UAE's commitment to improving air quality through initiatives like the Abu Dhabi Air Quality Strategy is fostering growth in the air care market, with companies like Daikin and LG actively participating in the region.

- The increasing prevalence of respiratory diseases due to poor air quality is prompting consumers to invest in air purifiers, leading to a rise in demand for advanced filtration systems.

Did You Know?

“Did you know that indoor air can be up to five times more polluted than outdoor air, according to the Environmental Protection Agency (EPA)?” — Environmental Protection Agency (EPA)

Segmental Market Size

Air-cleaning appliances are particularly subject to the growing awareness of the public of the importance of the quality of the air they breathe, and the consequences for their health. Rising pollution and the growing importance of health are putting pressure on the demand for appliances which improve the quality of the air in the living area. Regulations directed at reducing the amount of indoor pollution are also contributing to the growth of this market. The current market for air-cleaning appliances is mature, and the leading companies are Dyson and Honeywell with their innovative products and advanced filtration systems. The appliances are used primarily in homes, commercial buildings and automobiles, where the quality of the air is important. The emergence of the COVID-like influenza pandemic has also put an emphasis on air purification, and the development of sustainable and eco-friendly air-cleaning solutions is a major trend. The HEPA filter and smart air-quality monitoring systems are shaping the development of the industry and ensuring that consumers have access to effective and efficient air-cleaning products.

Future Outlook

From 2024 to 2030, the Air Care Market is projected to reach a significant growth with a CAGR of 5.2%. This growth is based on the increasing consumer awareness of indoor air quality and the health hazards associated with airborne particles. Moreover, the growing trend of urbanization, especially in developing countries, will further increase the demand for air care products, which may reach up to 60% of households by 2030 from about 45% in 2024. The use of air purifiers, aromatherapy, and other air care products is expected to increase, as they are preferred to create a pleasant living environment and improve the quality of life. Also, the integration of smart technology into air care products is expected to further drive the market. The Internet of Things (IoT) has become popular, for example, for air purifiers that can monitor the air quality in real time and adjust themselves automatically. Moreover, the introduction of supportive government policies, such as the implementation of green policies and the improvement of air quality, will create a favorable regulatory environment for market players. Moreover, the emergence of new trends, such as the emergence of eco-friendly and organic air care products, will shape the preferences of consumers and diversify the product offering in the market. In short, the Air Care Market will grow significantly, driven by a combination of growing demand, technological development, and supportive regulations.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 13.25 Billion |

| Growth Rate | 5.20% (2022-2030) |

Air Care Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.